How the New Federal Budget and Tax Bill Could Lower Your College Costs

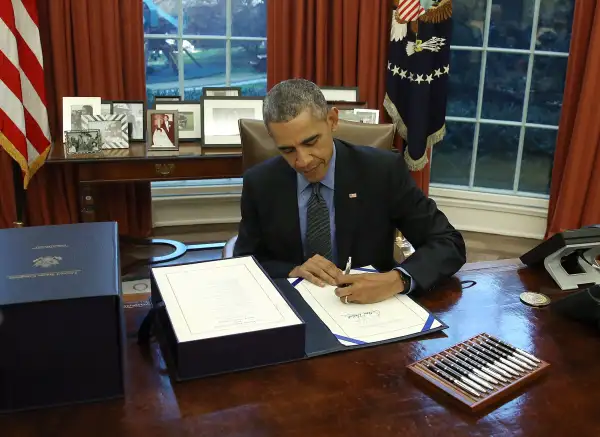

Congress passed a $1.1 trillion spending bill and $700 billion in tax breaks on Friday that may directly affect how you pay, save for, and deduct college expenses. Included in the bill, which covers fiscal year 2016 (starting back in October 2015), is more money for some student aid programs and tuition tax credits. President Obama signed it into law later that day.

Here's a rundown of what it could mean for your college budget:

1. 529 savings plans can be used for more expenses

Before the new law, you could use the money in a 529 college savings plan only to pay for tuition, room and board, and supplies such as books. Now the list of qualified expenses includes computers, software, and Internet costs. Need guidance on why and how to open a 529? Read here and here.

2. The American Opportunity Tax Credit is sticking around

Also known as the AOTC, this credit reimburses families up to $2,500 for tuition, fees, and other educational expenses when they file their taxes. The credit was set to expire in 2017, but the tax bill passed Friday makes it permanent. Want to get an early start on preparing for tax season? Brush up on how to make the most of college tax breaks here.

3. Pell Grant awards grow 2%

Federal Pell Grants are awarded to low- and middle-income students and don't have to be repaid. At a total of $31.4 billion in fiscal year 2015, Pell Grants represent the government’s single largest education program. The spending bill for fiscal year 2016 increases the maximum individual Pell Grant award by $140, to $5,915. Other programs aimed at helping needy students go to and succeed in college (such as TRIO and GEAR UP) also saw budget increases, though that money won't go directly to students.

4. Perkins loans are back from the dead

Congress had let its oldest student loan program expire earlier this fall, but with last week's budget deal, lawmakers extended the program's lifespan by two years. Perkins Loans are reserved for needy students. They have a set 5% interest rate, and interest doesn't start accruing until the repayment period begins nine months after the borrower graduates. Congress hasn’t doled out new money for the program in many years, but instead, colleges have paid for it through a revolving fund, where repayments from previous borrowers finance new loans. If Congress hadn’t restored the program, colleges might have had to repay the initial loan money to the federal government, and no new loans would have been issued. Now the program is back, but with some limitations. For one, new loans are only available to undergraduate students. And colleges will be required to make sure students have used all other available federal direct loans before issuing Perkins Loans. Undergraduate students can receive as much as $5,500 in Perkins funds per year, up to a total of $27,500.

5. Customer service for borrowers might improve

We’ve written about how student loan servicers, the middlemen who process your loan payments, don't always act in borrowers' best interest or provide satisfactory customer service, sometimes resulting in higher interest payments and longer overall repayment periods. Language in the budget deal could improve the loan servicing industry, as the Washington Post explains. That's because the Department of Education would be required to award servicing contracts based on which companies do the best job of keeping borrowers from falling behind on their loan payments.