I Paid Off My Credit Card…and Then the Nightmare Began

Good thing I was desperate that morning to avoid work.

I was reading my junk mail when an invitation to check my credit score for free caught my eye. I hadn’t looked at it since February, when I paid off that massive credit card balance. Anticipating a nice upward bounce, I signed on. And blinked hard. Why had my score gone down, all the way from very good to merely fair?

Heart thumping, I opened the full credit report to find a 60-day delinquent notice – but that couldn’t be right. All my bills were on auto-pay and I’d received no late notices.

The problem, I found with mounting horror, was that Chase credit card I’d paid off to the tune of $22,000. The account was already closed, the online interface showed the balance as zero – what could be wrong? A week after I’d paid off the card, the bank had charged me residual interest, it turned out. And sent the bill to my ex-husband. And called my old disconnected home phone. And, most bizarrely of all, emailed my business partner’s defunct account.

Huge mistakes all around, obviously, most of them not mine. I instantly paid off the interest charges and late fees and called Chase to explain what happened. I imagined we’d share a good laugh about the comedy of errors and they’d agree to reverse the negative credit report.

Read Next: Avoid Making These 6 Mistakes If You Try to Dispute Your Credit Report

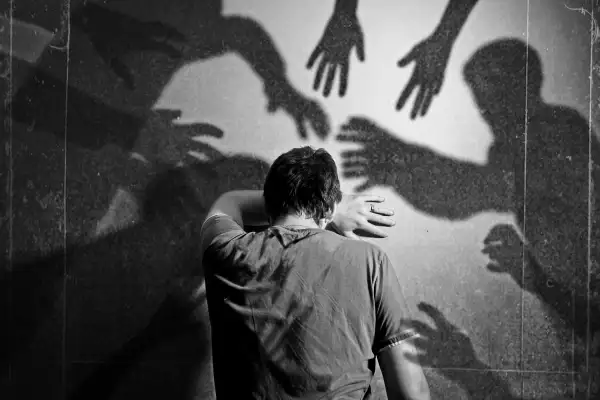

Instead, I found myself in a nightmarish spiral that kept getting darker. The customer service rep bounced me to someone in the credit reporting division who escalated me to her supervisor, and then the press office put me in touch with Ashley Dandridge, senior specialist in Chase’s executive office.

They all refused to reverse the negative report.

“For you personally, I have not seen a way to change the reporting,” said Dandridge. In Chase’s view, they’d sent statements to the address on file, called the phone number on file, sent appropriate email alerts. “For us to update credit reports, it’s not something we can do once the account has been reported as delinquent.”

But….I’d paid off a balance of more than $22,000. The account was already closed. How, a week later, could they assess a new interest charge of $170? And then not notify me, when I’d held this account in good standing for 15 years and also had another credit card and a car loan and a business bank account with Chase? They had all my correct contact information on my other accounts. How had this one gotten so screwed up?

When you pay off a credit card, Dandridge informed me, you can’t trust a zero balance showing up online – you need to call customer service and get an actual payoff number. Otherwise, residual interest – that $170 – can be assessed. And with a joint account, notices are sent to the primary cardholder – in this case my ex.

Read Next: 3 Ways Your Credit Report Could Be Wrong About You

Except my ex hadn’t put his new address on the account; Chase had added it from post office information, Dandridge found. And Chase had mysteriously ported my business partner’s defunct email account to this personal one. And would not let me update addresses or phone numbers on the interface but kept defaulting to the old incorrect ones – though I couldn’t tell that unless I signed back on and double-checked.

Chase representatives kept citing mysterious regulations when refusing to reverse the negative credit reporting on my account.

But what exactly are the laws governing how and when credit card companies report negative information, and whether they reverse it?

The short answer: None.

“Furnishing information to a credit reporting agency is an entirely voluntary act and certainly they can remove an account from the credit reporting system,” says Chi Chi Wu, a staff attorney specializing in consumer credit issues at the National Consumer Law Center. “There’s no prohibition against them fixing the reporting.”

Rod Griffin, the director of education for Experian, one of the big three credit reporting agencies, says that under the Fair Credit Reporting Act and Experian’s own reporting policies, banks and credit card issuers are required to report account status accurately.

“If you’re 30 days late, that has to get reported no matter what. In the vast majority of situations, that late report is going to remain.”

But….but….

“The extenuating circumstances are not specifically laid out,” Griffin admits. “It’s the lender’s decision. The lender can tell the credit reporting company to remove a negative report.”

Read Next: The Best Credit Card for People With Bad Credit (If It Actually Existed)

So how can a consumer with a valid argument get negative credit reporting reversed?

There’s a system for that, laid out by the government’s Consumer Finance Protection Board. You can also submit a complaint to the CFPB or even sue. The measures may not ultimately get the negative reporting reversed, but your explanation of the issue will remain in your file and be sent to anyone looking at your credit report.

My case was complicated by several gray areas: My payments were late, but for reasons that in my view were 90% not my fault. And ultimately, Chase agreed to reverse the negative reporting because they were unable to determine how my business partner’s email address became attached to my personal account.

But what if I hadn’t been a journalist with special access and investigative skills? How can any consumer approach their credit card company with a problem like mine and hope to reverse a negative credit report?

I had hoped to interview an executive at Chase regarding this question, but instead the company issued this written statement on my case:

“We made multiple attempts to reach this customer by calling several phone numbers on file and others given to us, as well as sending written notices to the address on file. It is important that customers keep their account profiles up-to-date so we can contact them with critical account information. Reversing accurate credit bureau reporting is extremely uncommon.”

Read Next: Should You Ever Pay $450 for a Credit Card?

Keep my account profile up-to-date? Chase’s Dandridge had gone over all my contact information with me to make triple sure it was now correct. But given that warning, and because I was once again trying to avoid work, I decided to check again.

And yes, it was still wrong.

What’s more, when I checked my credit report a month later, the late reports had not been reversed as promised. So I had to get back on the phone and email with Chase reminding them of their promise, and then hound them for two more weeks until I received confirmation that it had actually been done.

In early August, six months after I paid off my credit card and three months after I set out to correct the reporting, my credit report was finally clean again. And my credit score was up an astonishing 113 points, from Fair to Very Good, proof of how devastating the negative report had been.

The only problem? Despite formal disputes with supporting documentation, one of the credit bureaus still had my address wrong.

Pamela Redmond Satran is the author of both humor books and novels, including Younger, now a television show created by Darren Star. She is also the coauthor of a groundbreaking series on baby names and the co-creator of Nameberry.