4 Ways Today's Election Could Hit You in the Wallet

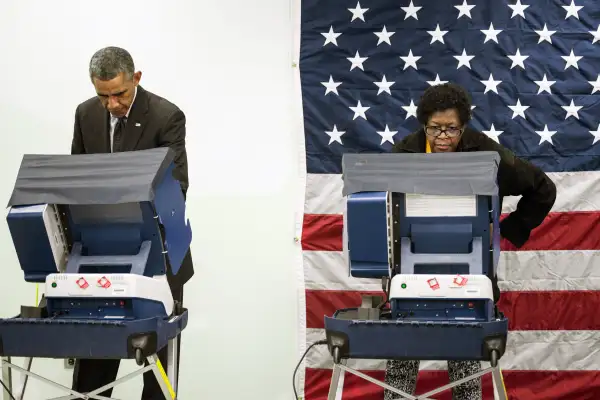

Midterm elections are here, and in times of economic uncertainty Americans tend to vote their wallets.

But good luck with that this year.

"A couple of years ago, people would have predicted that the economy and pocketbook issues would be the big issues everyone is running on, but that's not true" said Howard Gleckman, senior fellow at the Urban Institute.

That's partly because midterm elections are often more a referendum on the president's performance than a driver of significant policy changes. But politicians and voters alike also seem simply resigned to the reality that a gridlocked Congress is unlikely to make much progress on major economic or financial issues at least until after the 2016 election cycle.

But that doesn't mean economic and financial issues are off the table this week. While major policy changes will be few and far between, a handful of pocketbook issues will be in flux on Tuesday -- especially if, as many pundits and pollsters are now projecting, the Republicans take the Senate and end up with majorities in both houses of Congress.

Minimum Wage

The minimum wage has been a hot topic this election cycle. On the state level, Alaska, Arkansas, Nebraska, and South Dakota have minimum wage increases on the ballot this year, and Illinois will vote on a non-binding referendum in favor or raising the minimum wage to $10.

Many conservative economists say a higher minimum wage will slow job growth and price low-skill workers out of the job market. "The guy who gets the job gets more," says Douglas Holtz-Eakin, former head of the Congressional Budget Office and an economic advisor for John McCain's presidential campaign. "But the guy who doesn't is out of work."

Liberals, on the other hand, see little evidence that a higher minimum wage will mean fewer jobs. "We think it shows really immeasurable employment effects," says Josh Bivens, director of research in policy at the left-leaning Economic Policy Institute.

That debate aside, the public appears to have made up its mind. A wage hike is expected to pass in all four states. "It doesn't matter what economists like me say about the negative impacts," admits Holtz-Eakin. "It's always very popular and it's going to pass everywhere it's on the ballot."

Bivens says the policy's broad support -- one Pew study showed 73% of Americans want a $10.10 federal minimum wage -- might even allow for national legislation, especially if Democrats maintain a hold on the Senate. "It’s just a really popular thing, so even federal policy makers who generally wouldn’t be a big fan are always going to be a little pressured," says Bivens.

Obamacare

The Affordable Care Act, known by the popular moniker Obamacare, has been a topic of contention ever since it was first envisioned. But while Republican opposition has been virtually constant throughout the law's history, the GOP's stance appears to have softened in recent months. "The GOP has been fighting over what to do about ACA, but there is no Republican proposal," says Gleckman. "You can't beat something with nothing and it doesn’t work to say to people who got insurance under the ACA, 'We're going to take it away from you and we can't tell you what we're going to replace it with.'"

That said, there is bipartisan support for a handful of Obamacare reforms. Currently, those applying for an insurance subsidy under the program must estimate next year's income to determine how generous their subsidy will be. If you underestimate next year's earnings, you'll have to pay at least some of that amount back when you file taxes. That's a big problem for anyone (and this infographic shows how ridiculously complicated the entire process can be) but it especially affects low-income families.

"People who are getting subsidies go in and out of the work force, and it's therefore really hard for them to predict what they're income really is," Gleckman explains. "It would be nice if we could figure out an easier way." One simple proposal that has received support in both parties is to move the Obamacare open enrollment, which currently takes place from November to February, closer to tax season in April. That way tax preparation firms could help people file their taxes and apply for enrollment simultaneously.

Another possible reform is an elimination of the so-called employer mandate. Currently, businesses with more than 50 employees must provide health care or pay a fine. But this particular ACA provision has begun to lose favor on both sides of the aisle. Dropping the requirement will likely have little effect on national insurance coverage, the Urban Institute has found, and its elimination could help job growth.

Any alteration of the employer mandate would require a significant political battle, of course, but GOP control of the senate would makes this change more likely.

Taxes

The mythical-sounding "grand bargain" over the tax code won't happen in the next two years, if ever, but some tweaks around the edges are a realistic possibility.

For example: Last December, about 80 tax provisions were allowed to expire. Most of them affected businesses, but some will be felt by consumers if they're not approved in time for tax season 2015. Among the provisions in need of renewal are tax incentives for electric cars and energy-efficient appliances, meaning anyone who purchases said items this year will lose money if the provisions aren't reintroduced. Since Dems are typically eco-friendly and Republicans tend to support giving money back to the taxpayer, this one has a good shot under any election outcome.

Banking Regulations

The Dodd-Frank law, which introduced a host of new regulations for financial institutions, is deeply unpopular among Republicans. But as with Obamacare, any major reforms would almost certainly be vetoed by the president.

One provision has at least a chance of change: Under the current law, big and small banks generally have to follow the same rules, which are heavily influenced by international requirements. That's arguably appropriate for large companies that have a global footprint, says Holtz-Eakin, but not so for smaller institutions, which pose far less systemic risk. He believes less burdensome regulations could make it easier for small banks to give loans on things like houses, cars, and small business expenses. Other economists, like Marcus Stanley at Americans for Financial Reform, say the regulations are well-formed and have minimal impact on the cost of credit.

Any change to one of the administration's major policy achievements faces an uphill battle, but a limited compromise is possible if Democrats are weakened on Tuesday.