Thousands of Americans Are Signing Up to Trade Stocks for Free. Here's What to Do Instead

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

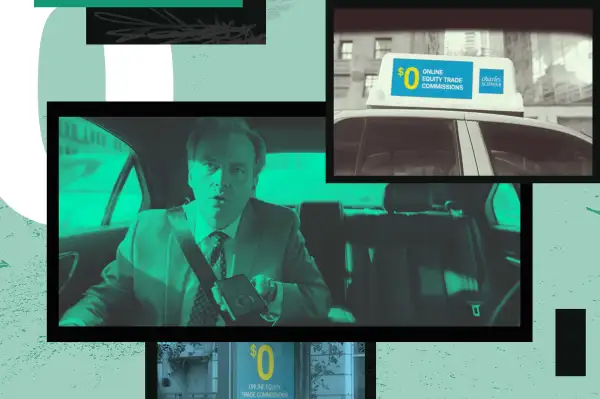

When taxi drivers start offering stock-market tips, it's time for the pros to get out of the market — at least that's what Wall Street lore says.

Maybe Charles Schwab's assumes Main Street investors aren't familiar with that old adage.

In October, the discount brokerage announced a new policy of commission-free stock, ETF and option-trades. Since then, Schwab has been running an ad that shows a middle-aged taxi driver turning around in his cab to address a silver-haired passenger, "You're a broker. What do you charge for online equity trades?" as signs for $0 at Schwab flash by.

As it happens, trade-for-free deals, originally pioneered by upstart apps like Robinhood, have become something of an investing craze. Following Schwab's October announcement, rivals E*Trade, Fidelity and Ameritrade quickly followed suit. And investors appear to be game. Schwab, which agreed to purchase Ameritrade for $26 billion Monday, recently said it signed up 142,000 new customers in October, up 30% from the number it signed up in September.

So are free trades worth it for you?

Maybe. But as with most investing crazes, you should be cautious.

When it comes to investing, costs do matter. And anything that promises to lower investors' costs is worth applauding. But your investment horizon should also be long-term. Making trades free seems to run counter to that, encouraging people to trade more.

(For what it's worth, Schwab doesn't agree. A spokesman says Schwab doesn't expect trading volume to spike as a result of eliminating commissions. He also defended Schwab's ad, arguing a taxi driver chatting about brokerage commissions wasn't the same as one chatting about what stocks to buy.)

Before you jump in to free trades here are some things to consider:

Don't Forget About Mutual Funds

Skipping fees in order to put your money to work sounds like a no-brainer. And it in a way it is. But the truth is, investors have already been able to do this for years.

While brokerages have recently been eliminating commissions they charge to trade stocks, exchange-traded funds and options, investors have always been able to buy shares of traditional mutual funds commission-free, either at brokerages like Schwab or TD Ameritrade (look for the "no load" funds section) or directly from fund companies themselves, on their websites.

The drawback? Well you obviously have to be interested in holding a broad swath of the market— but for most individual investors that's a smart move anyway. Also, unlike exchange-traded funds, which trade like stocks, you can only buy or sell mutual funds only once a day (at the afternoon price that day), and they may limit your ability to repeatedly shift money in and out.

But again, for most individual investors with a long-term time horizon, these restrictions might be seen as healthy guardrails, rather than bugs.

Watch your cash

Brokerages may have made stock trading free. But they aren't becoming charities. So, how do they make money?

One answer, The Wall Street Journal recently pointed out, is your cash. Most stock market investors keep some cash in their accounts — temporarily after selling a stock or earning a dividend that isn't reinvested, or more longer-term as an emergency cushion against market swings.

Even though this money isn't "invested," brokerages pay you interest on your balance. But they don't pay you nearly as much as a money-market mutual fund or as savings account would. Schwab's website says uninvested cash in brokergage accounts (as well as retirement accounts like IRAs) earns 0.06% to 0.3% annual interest. At TD Ameritrade they range from 0.01% to 0.3%, depending on your type of account and how much money you have.

By contrast, Vanguard Prime Money Market fund yields 1.75%. An online savings account at SFGI Direct, Money's pick for Best Banks 2019-2020 in that category, yields 2.27%.

Buy Low and Sell High

Brokerages are lowering trading commissions mainly to better compete with online start-ups. But for their part, investors' desire to trade stocks is probably tied to something else: The stock market, which has been climbing steadily now for more than a decade, and has been hovering near all-time highs.

Indeed, on Nov. 15, the Dow closed above 28,000 for the first time ever. While stocks have slipped back slightly since then, the market remains up about 19% year to date. But while the idea of trading stocks can seem more enticing and exciting when the market soars, the object is ultimately to buy low and sell high.

Right now, stocks are trading at roughly 30 times the 10-year average for company's annual profits — compared to a long-time historical average of just 17 times. In fact, stocks haven't been this expensive since the late-'90s Internet bubble. That was also the last time it became fashionable for individual investors to try to score big by trading individual stocks, in what was then called "day-trading."

Needless to say, it ended badly for many small investors, and for a while they appeared to have learned a lesson. Don't make the same mistake they made.