One-Third of Middle Class Families Could End Up Paying More Under the GOP Tax Plan, Experts Say

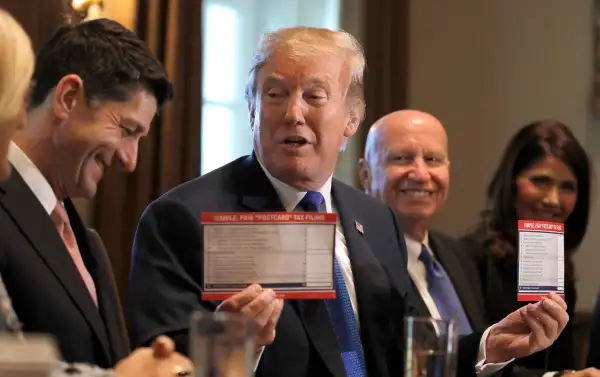

On Thursday, after House Republicans released their tax plan, President Trump touted it as "the biggest cut in the history of our country" and even "a big beautiful Christmas present." But now some tax experts say it could actually raise tax bills for millions of middle-class households by 2027.

The plan, called the Tax Cuts and Jobs Act, overwhelmingly calls for lower taxes for Americans across the income spectrum in the short term, as Money wrote here, thanks largely to the doubling of the standard deduction and an enlarged $1600 Child Tax Credit. But Ernie Tedeschi, a former economist for the Obama Treasury Department, estimates that about one-third of tax filers earning between $50,000 and $100,000 per year -- about 13 million middle-class families -- would see their tax bill increase by 2027.

In a Medium post, David Kamin, a law professor at New York University School of Law, details why, using the same hypothetical family Republicans have been using to sell the plan -- a married couple with two kids earning $59,000 per year.

Under the Republican plan, that hypothetical middle-class family would see a tax cut of $1,182 in 2018 compared to 2017, but a tax increase of $500 in 2027, Kamin estimates. That's because the Family Flexibility Credit ($300 per adult in the household) included in the GOP plan, expires after 2022. In addition, the newly doubled standard deduction is not adjusted for inflation, meaning its value will erode over time, and the Child Tax Credit and the Family Flexibility Credit (which replace personal exemptions) are also tied to a slower rate of inflation, so they become worth less in real dollar amounts as the years go by.

Kamin notes this is in contrast to cuts for the wealthiest families, which remain intact.