The Government Shutdown Is Still Wreaking Havoc on Workers’ Credit Scores

The government shutdown may have ended more than four months ago, but De'von Russell still struggles with it constantly.

The 31-year-old maxed out two credit cards when President Donald Trump partially closed the government for 35 days in December and January. Without roughly $3,000 in wages from his job as a security guard at the Smithsonian National Museum of Natural History in Washington, D.C., Russell had to charge everyday expenses like gas, food and Pull-Ups for his young daughter. He also applied for loans, which led to hard inquiries on his credit report.

As a result, he says, his credit score fell about 15 points.

"It was 'fair'," he adds, referring to a classification on CreditKarma, a service he uses to monitor his score. "Now it's in the 'needs work' category."

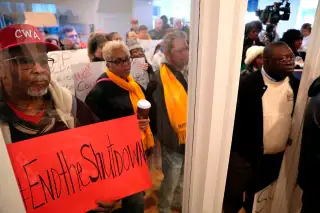

Russell's not alone. The shutdown forced about 800,000 people to go without pay, and several workers Money spoke to say their credit scores have not fully recovered from the desperate measures they took to cope. Because having a low credit score can jeopardize a person's approval for new cards, loans, apartments and more, it means that not everyone can afford to move on.

"It's frustrating knowing that it limits me," Russell says. "They're going to look at my credit and probably be like, 'Well, he's not going to be a reliable source.'"

Using Credit to Get By

Federal workers' financial situations weren't all that rosy going into the shutdown. Though government employees' average pay was $90,794 in 2017, according to the libertarian Cato Institute, staffers at individual agencies take home much lower sums. For example, FederalPay.org shows that the average pay for Transportation Security Administration workers is $17,890, while the average FBI employee makes $37,118.

Whether they were placed on furlough or had to report without pay, government workers and contractors missed two paychecks during the shutdown. And seeing as nearly 40% of Americans don't have the money to cover an unexpected $400 expense, it's not surprising that many of them were caught off guard, says Bruce McClary, the vice president of communications for the National Foundation for Credit Counseling.

"You ran into a situation where a lot of federal workers had very little set aside to get through what turned out to be very lean times," he says.

Organizations did what they could to alleviate financial pain, offering interest-free loans, nixing late fees for missed payments and suggesting ways to negotiate reduced payments. But credit scores posed a major threat.

They're finicky in general because they rely on so many factors. According to Experian, considerations include payment history (how often you pay on time), credit utilization (how much of your credit you're using at one time), credit mix (how varied your portfolio is), hard inquiries (how many times lenders have requested your report) and negative information (whether you have other red flags).

McClary says that a credit bill typically has to be 60 days past due before it shows up as delinquent, so people who missed one payment were likely able to recover swiftly. But for those who had been on the edge already and didn't have much in savings, he says "the adverse effect on their credit materialized rather quickly."

The utilization rate likely had a broader impact. As McClary explains, it can be a warning sign when a person quickly transitions from using a low percentage of their credit to a high one — which is exactly what scores of government workers did earlier this year when they put more expenses than normal on their credit cards.

James DelRae, a Phoenix, Arizona-based TSA uniform coordinator, says he believes running up his cards with daily expenses caused his credit score to fall. The 57-year-old was not furloughed and did receive backpay, but the shutdown hit his wallet hard nonetheless. He used money from a $6,500 zero-interest loan to cover his bills and wipe out existing debt. He currently owes about $1,500 on that loan.

DelRae had a credit score of 740 before the shutdown, and it has just now climbed back to 693. (The average FICO score, a type of credit score, is 704 on a scale from 300 to 850.)

"I've not tried to make any major purchases, but I have no doubt if I needed to I would be denied," he says.

Aftershocks of the Shutdown

It's unclear exactly how many workers' credit scores are still down as as result of the government closing, and to what extent. The federal Office of Personnel Management declined to comment about the lasting impact of the shutdown on employee credit scores.

But it's certainly on people's minds. Anecdotes about the post-shutdown struggle have cropped up on social media and in NBC Washington and Federal News Network articles. Two members of Congress have asked credit reporting companies to ignore missed bill payments when calculating federal workers' scores. Equifax offered a free credit report service to people impacted by the shutdown through late April.

However, it's hard to account for the lingering frustration many government employees feel at having lost control over their finances.

That's something Tamela Worthen, a security guard at the National Museum of African-American History and Culture and other locations, is wrestling with. The 55-year-old says she missed a credit card payment while on furlough, and it's since snowballed because she's a contractor who didn't receive backpay.

Worthen had planned to refinance her house earlier this year in order to cut her mortgage payments, but she says her credit score of 620 is now below the threshold she needs to do it. Given that she's also behind on her car payments and time share bills, she feels like her finances are out of her control.

"I never had bad credit before," she says. "I don't like being in a situation like this because of somebody else's decision."

What to Do if the Shutdown Hurt Your Credit Score

If your score fell because of the shutdown, you have options.

You could consider adding a consumer statement to your credit report — basically, a brief explanation of the factors affecting your finances. McClary says these can give "a little bit of an advantage when it comes to being proactive and telling your side of the story," although they can sometimes get overlooked.

Instead, he says, a better idea is to contact a nonprofit credit counseling agency where experts can "help find an affordable way to get back on track."

The NFCC has a locator here if you prefer an in-person appointment, or you can call 800-388-2227 to speak with someone on the phone. You can also check out the Federal Trade Commission's guide to choosing a credit counselor here.