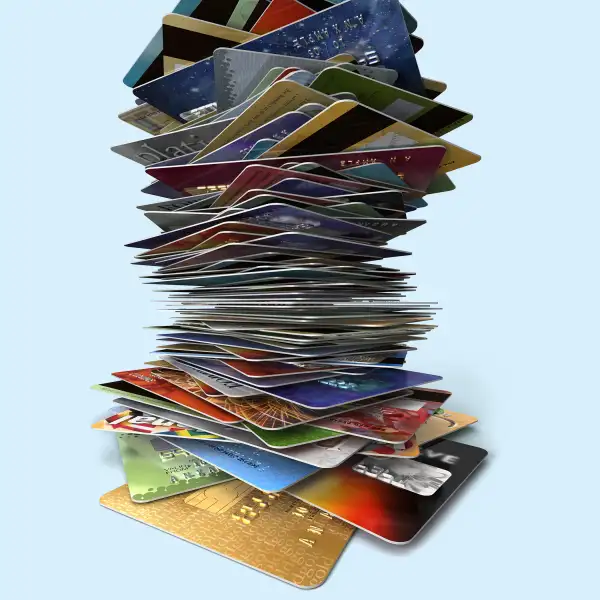

This Man Has 1,497 Credit Cards and Near-Perfect Credit Score

Ever fumble through your wallet at a register, the cashier waiting patiently and people in line behind you less so, as you thumb a few different credit cards looking for the right one to pay for your purchase?

Imagine looking through nearly 1,500 of them.

Walter Cavanagh of Santa Clara, Calif. has earned the Guinness World Record title of "Mr. Plastic Fantastic" by keeping 1,497 credit cards in his name, amounting to a $1.7 million line of credit. Of course, Cavanagh doesn't keep all of those credit cards handy at any given time.

Cavanagh, who was born in 1943, says his credit score is "nearly perfect," and that he only uses one card that he pays off every month. He also says that all of his credit cards have different spending limits, the lowest of which caps at $50.

Need some context? The average American only has about two credit cards, but has more than $15,000 in credit card debt.

Cavanagh's personal finance philosophy might sound loony (he says he started collecting credit cards as part of a bet with a friend) but there are benefits to using credit cards in moderation.

Credit cards are good for building credit and can help you apply for things like mortgages and loans (millennials: it's time to hop on the bandwagon). Too much "new credit" can hurt your credit score, though, so you should avoid applying for several credit cards in a short time.

And if you're using multiple credit cards, you should keep your "utilization ratio" (a comparison between your credit balance and spending limits) low -- only about 10% of your spending limit.

Want one new credit card, but not sure which ones are best? Check out Money's guide to the Best Credit Cards this year.

Don't feel pressured to apply for more credit, though. For most people, a couple credit cards is plenty.