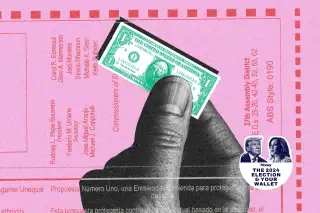

Harris vs. Trump on Inflation: How Each Candidate Plans to Lower Prices

Few issues have gotten as much attention as inflation this election season.

That’s because over the last four years, soaring prices have touched just about every part of Americans’ daily lives, from home prices and rent to food and energy bills. According to the Department of Labor, overall prices have risen over 22% since the start of the COVID-19 emergency, creating one of the worst cost-of-living crises in the U.S. since World War II.

And many major daily expenses have outpaced overall inflation. The price of groceries, for instance, has jumped nearly 26% over that same period of time. Housing costs are up over 24%, and the sticker price of vehicles has increased 25%.

While annual inflation has moderated near the Federal Reserve’s target range of 2% over the long run, Americans are reeling from the cumulative effects of years of price growth. In fact, most still cite inflation as the most important issue facing the country — above even immigration, political extremism and gun violence.

Here’s a look at how former President Donald Trump and Vice President Kamala Harris plan to tackle rising prices.

Trump’s plan to ‘defeat inflation’

Trump recently dedicated a campaign event in Asheville, North Carolina, to talking about the economy and rising prices.

“From the day I take the oath of office, we will rapidly drive prices down,” Trump said in the Aug. 14 speech. “We’re going to make America affordable again.”

He spent much of the event laying the blame for high prices on the Biden-Harris administration, underscoring that inflation took off under current President Joe Biden.

On the campaign trail, Trump often tries to set himself apart from Harris by saying there was “no inflation” while he was in office. (Prices did rise during the Trump presidency, by 7.7% — though much less than under Biden.) He also vows that if he wins the election, inflation will disappear. (According to economists, no inflation whatsoever isn't necessarily a good thing.)

Trump’s platform includes five measures that he says will “defeat inflation.”

- “Unleash” U.S. energy: By lifting domestic oil and gas restrictions, Trump wants to increase energy production in the U.S. as a way to bring energy prices down.

- Slash federal spending: In order to “stabilize the economy,” a Trump administration would work to drastically lower federal spending while “promoting economic growth” — though a growing economy could be a cause of inflation, not a solution.

- End wars abroad: Wars can drive up supply costs, especially for oil. Gas prices skyrocketed after Russia invaded Ukraine, for instance. International conflicts can also hinder shipping routes, which could also hike the price of goods. It’s not clear how Trump would end the latest Israel-Hamas war and the conflict in Ukraine or what direct effect that might have on consumer prices in the U.S.

- Cut regulations: A core promise for a second Trump presidency would be to end a “regulatory onslaught” that the campaign says is costing American households $11,000, though which specific regulations Trump would end are unclear.

- Curb illegal immigration: Trump says that a wave of immigrants who entered the country illegally has driven up the cost of housing, education and health care, and that by securing the border, these services would decrease in cost.

Harris’ plans to lower costs for the middle class

At Univision’s town hall earlier this month, a voter from California expressed frustration to Harris about prices rising on food, utilities, clothes and more.

“I know prices are too high still,” Harris responded. “And we have to deal with it.”

Harris went on to overview her economic plan to build what she calls an “opportunity economy,” but she also highlighted specific ways she hopes to lower prices on groceries, housing and health care — while touting proposals to expand the child tax credit and provide down payment assistance to first-time homebuyers.

Here’s how Harris plans to drive down inflation:

- Ban price gouging on groceries: Part of what’s driving up the price of groceries, Harris says, is that some corporations used the pandemic as cover to “excessively and indefensibly” raise food prices. If elected, Harris says she will call on Congress to federally ban price gouging during emergencies. But given that the pandemic is officially over, this would likely not apply to already-high prices.

- Lower health care expenses: A 2022 law implemented major subsidies for health care coverage through the Affordable Care Act, or Obamacare, in many cases making coverage free for low-income households. These subsidies are slated to expire in 2025, but Harris wants to make them permanent. She also plans to reduce drug prices by building on recent Medicare policies that reduced out-of-pocket drug costs for beneficiaries.

- Reduce energy costs: Harris wants to limit the U.S.’s reliance on foreign energy by making investments in clean energy while also expanding efforts to increase domestic natural gas production by fracking. Much of Harris’ energy plan relies on building on the Inflation Reduction Act, which included consumer tax credits for clean-technology upgrades. Despite the law's name, research found that the law's policies had little to no discernible impact on inflation overall.

- Eliminate junk fees: Harris says she will continue the Biden administration’s war on junk fees. These hidden charges are usually tacked on to everyday bills and services, such as bank overdraft fees, extra charges on cable or phone bills, and mysterious “resort fees” at hotels. The administration’s Council of Economic Advisers estimates these fees add up to $650 annually for the typical household.

- Increase housing supply: The core way Harris says she will rein in housing costs is by increasing the supply of new housing units by 3 million her first year in office. With new homes on the market, she says home prices and rent will come down. She also plans to create a down payment assistance program.

Which candidate’s plans will lower inflation more?

Both candidates have spent a significant amount of time campaigning about inflation.

Trump pins the recent inflation crisis on the Biden-Harris administration and vows to “make America affordable again.” His plan to tackle inflation is largely tied to his other key promises around deregulation and immigration. In terms of policy proposals, though, the details are sparse. The entire Trump-endorsed Republican platform on inflation is about 320 words.

On the other hand, Harris’ proposals on combating prices tops 2,500 words. However, many of those initiatives are extremely specific, such as offering tax credits for home energy upgrades or cracking down on robocall scams.

Experts say both candidates are missing the mark when it comes to keeping inflation in check. Their proposals overall do not directly address the core supply or demand factors that tend to drive consumer prices up across the board.

Underpinning much of Trump's inflation plans are a separate initiative to impose harsh tariffs, which are a form of trade tax, on goods coming into the U.S. from other countries. The idea is to get businesses to make more products in the U.S., but the effects are largely mixed.

According to the conservative-leaning Tax Foundation, the tariffs put in place during Trump's first term and kept in place during the Biden-Harris administration have had mostly negative results for economic growth, consumer prices and employment. Widely expanded tariffs are expected to increase the price of consumer goods, and economists warn that they will negate much of Trump's other potentially inflation-reducing policies.

In a recent survey by the Wall Street Journal, 68% of economists said inflation would be higher if Trump's policies were to go into effect, while only 12% said it would be higher under Harris' plans. The other 20% said there would be no material difference.

Both candidates want to grow the economy and stimulate consumer spending — both of which are counterintuitive when trying to keep prices low.

More from Money:

4 Things to Do With Your Money Before the Election

Elon Musk and Donald Trump Have Been Giving Voters Money. Is That Legal?

Election 2024: How Trump Set Himself Apart From Harris on Crypto