After a Year of High Prices and Cutthroat Competition, Homebuyers Are Burned Out

Alexandra Lashner and her husband have been saving for a home since they got married in 2018. Their plan was to buy in the Philadelphia area this year, close to where they grew up and to their parents.

Like the rest of the country, demand for homes and prices have been through the roof in the Greater Philadelphia area. Knowing that, the couple was wary of going over budget or paying over asking price and didn’t want to waive their right to a home inspection like many buyers have in order to win homes. But after nine months, losing out on two homes and seeing their pre-approval letter expire, the couple is hitting the pause button on their search.

“It's becoming impossible for us to buy a home where we grew up, and in the area where my parents grew up before me,” says Lashner, an account executive with Frank Advertising in New Jersey. “It's downright exhausting and we're burned out.”

The Lashners aren’t alone. In June, just 32% of consumers said it was a good time to buy a home — the lowest percentage in the history of Fannie Mae’s Home Purchase Sentiment Index. (That’s despite super low mortgage rates and a sense in some circles that everyone is buying right now.)

In another recent study, 33% of people who considered purchasing a home this year decided against it, according to ServiceLink, a mortgage services provider.

Of those, 31% said the reason they weren’t buying was because housing options had become too expensive. Home prices have increased by double digits every month since last summer. In May, the median existing home price rose to $350,300, up 24% year-over-year, according to the National Association of Realtors.

The pullback from buyers is reflected in the recent slowdown in home sales. Existing home sales ticked down 0.9% in May, which is not a huge decline, but it does mark the fourth month in a row where sales have decreased, according to NAR.

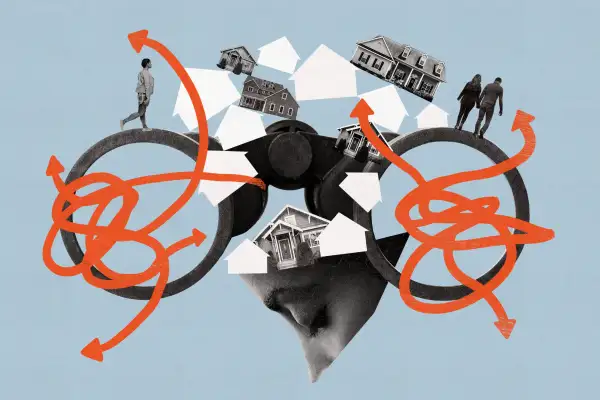

An image circulating on Instagram details the range of emotions people have experienced while trying to purchase a home during a pandemic. They go from a happy smiley face when they finally have enough saved for a down payment to tears of disappointment when their 37th offer is rejected.

More than 40% of first time homebuyers have been searching for over a year, says George Ratiu, senior economist at Realtor.com. “So, it’s not surprising that, for many, fatigue is setting in.”

Take Thomas Jepsen. He has toured 120 homes since the pandemic began. He’s put in offers on several and even come as close as $1,000 from a winning bid. Without a home to show for it, he’s decided to give up on his home search for now.

“It started giving me anxiety and caused sleepless nights,” says Jepsen, founder of home design site PassionPlans. “When I finally slept, I often had nightmares about the homebuying process.”

Buyers are facing a number of challenges

At the heart of this crazy market is a severe shortage of homes. At its lowest point in January of this year, inventory was down to a 1.1 month supply of homes, the lowest level in history. Since then, inventory has improved slightly. Reaching a 2.5 month supply at the current pace of sales in June. Still, a six month supply is considered healthy.

This low inventory is leading to a range of problems for buyers.

Homes are selling at record speed

The pace of home sales has been much faster than usual. In June, the typical home sold after an average of 37 days on the market, 35 days faster than at the same time last year.

“Buyers are stepping away because they’re becoming frustrated with going to see a new property on the market and then finding out that it already has offers,” says Bill Kowalczuk, broker with Warburg Realty in New York City.

That’s what happened to the Lashners. For them, the last straw came when a new home was listed for sale at midnight. They made an appointment to see it the next day, only to find out it already had an over-asking price offer. They decided not to bother with the showing.

“Once you lose you have to be prepared to start the cycle all over again, which is a very unsustainable cycle,” says Lashner.

It’s hard to compete with cash buyers

Many first time home buyers are being pushed out of the market by all cash buyers. In April, the share of all-cash sales increased to 25%, according to the NAR. By contrast, only 15% of all sales in 2020 were all cash. Most of those purchasing homes with cash were non-first time buyers.

Dan Duval, a principal with Elevated Realty, has seen the impact of this with clients in the Boston area. One client recently gave up after eight months of searching because they were having a hard time going up against cash offers.

“The market has been so hot that it’s almost impossible for buyers with conventional financing to compete,” says Duval. “There have been a lot of cash offers well over asking.”

Homes are selling for over asking price

In the Seattle area this year, for example, over 4,500 homes have sold for at least $100,000 above asking price, with 580 homes selling for $300,000 above ask, according to Redfin. There were only 378 such deals last year.

In fact, the market has tilted so much in favor of sellers that one third of those planning on putting their home up for sale plan on pricing their homes above what they think it’s worth.

Bidding wars

Buyers are also having to cope with an ultra-competitive market. Low supply and high demand have led to buyers competing for a limited number of homes, resulting in fierce bidding wars. In May, 70% of all offers written by Redfin agents were involved in a bidding war. Up from 53% in May of last year. Some homes received over 10 offers.

Having a home buying plan can help reduce stress

As difficult as the market has become, there are steps buyers can take to help navigate such a competitive housing market and hopefully avoid burnout.

One of the most important tools you can use is to be prepared. Go over your timing for the home purchase with your broker. With today’s competitive market, be prepared to be flexible in your home search. If you limit yourself to only a certain style of home, you may miss a home that could be perfect for you with a little work.

Set a budget and then determine if you are willing to spend over that budget in case you get into a bidding war. Set a specific percentage you’re willing to go above your ideal price and then stick to it.

You also should be prepared financially. If you need to finance your home purchase, get a pre-approval letter from a mortgage lender. Sellers take offers with pre-approval letters more seriously.

Lastly, don’t feel pressured into a home purchase or overpaying for a home just because you think you have no other option. Some buyers who purchased homes this year for fear of missing out already regret it.

“If you have all your ducks in a row, you can come in strong in your offers and set expectations,” says Kevin Kurland, president of brokerage for Choice NY.

More from Money:

‘Make Me Move’: Sellers Are Listing Their Homes at Ridiculous Prices Just to See What Happens

The Housing Market Shows No Signs of Cooling. 5 Tips For Buying This Summer Anyway

Another Post-COVID Comeback? Homebuyers Are Looking at Cities Again