Old-Fashioned Bartering Is Back. Here's a Guide to Smart Swapping

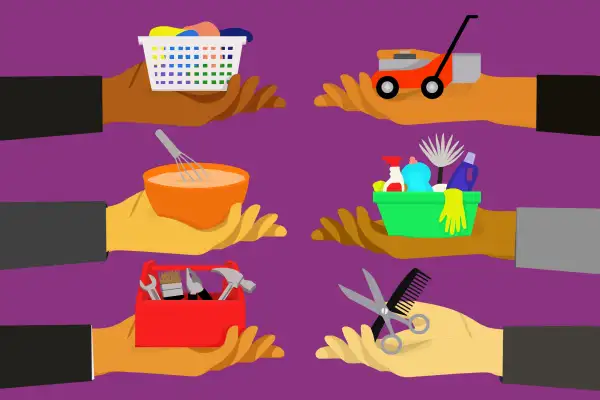

The pandemic has put many households’ finances in jeopardy. While tough times call for creativity, that doesn’t necessarily mean reinventing the wheel. In fact, people are turning to a practice as old as the wheel itself: bartering.

Simply put, bartering is trading. You swap your goods or services with others for the goods and services you need. It’s not just small business owners turning to formal exchanges to keep their businesses afloat. Many average Americans have also adopted the practice, thanks to informal avenues like Facebook and Craigslist, among others. Richard Crone, CEO of Crone Consulting, predicts that the value of person-to-person bartering in the U.S. of “packaged goods,” which includes toilet paper and the like, will grow by 50% this year from its current level of $4.2 million.

Do you want to get in on this? Here’s what you need to know.

Learn the Basics

There are formal barter exchanges that process the barter transactions, acting similar to a financial institution. Your barter dollars are banked for future use, when you can tap them to “purchase” goods or services from members. Prices are set in trade dollars. Members of the network pay in kind through a payment platform, explains John Strabley, CEO of International Monetary System, a barter exchange. Typically, there is a membership fee and a small per transaction fee. With person-to-person bartering, you negotiate and make a deal that suits both parties.

While cash still rules for paying rent and other bills, you’ll be surprised by what’s available for barter, be it car repairs, plumbing, clothing, technology or toys. “You can essentially barter anything,” says Jordan Parker, an entrepreneur and former financial advisor.

Find the magic number

Determine the value of your goods or services. Assess fair market value. What are comparable goods/services going for? If you’re bartering a used item, consider what it would cost if bought new. Then, discount it subjectively, says Parker, based on the condition: a 20% discount if in good condition, for example, or 50% if only in fair condition. For services, think honestly about how much you’d be willing to purchase it for.

Avoid gotchas

Although no money changes hands, bartering income is taxed by the IRS and must be claimed on your taxes. For example, if you're a plumber who received $400 in barter dollars for your plumbing work, it’s considered taxable income by the government. Seek advice from your financial advisor. One advantage of using a formal barter exchange is that they handle the record keeping and will send you a 1099 form at tax time.

Buyer beware. Whenever bartering, particularly services, someone goes first. If you are exchanging five massages for a new water heater, the plumber may be unwilling to install the water heater until receiving all the massages. “Service-for-service bartering carries a higher risk than good-for-good bartering,” warns Anthony Babbitt of Babbitt Consulting, a business consultant with extensive bartering experience.

Draft a contract that details who is responsible for what, when, the value of the exchange and more. Everyone must sign the agreement. If the deal goes awry, consider hiring an attorney.

Mike Arman, a retired mortgage broker in Oak Hill, Fla., once traded a motorcycle for roofing repairs. “They guy did about half the roof and disappeared. When I chased him down, he said he couldn’t finish because he had heart problems. When I asked him where the motorcycle was, he told me he sold it. I sued him.”

But there are wins. Chris Panteli, a restauranteur in Hereford, England, recently bartered for blog related services. “Deriving the value was easy. I was charged an hourly rate and I would simply exchange for the value of any food items on my menu. He was well fed and my website is purring like a kitten.”

More from Money:

Is a Bad Credit Score Driving up Your Car Insurance Costs? New Options Are on the Way