I Ditched My Budget and Created a 'Thrive 'List' — and it Helped Me Tackle My $100,000 Debt

Tara Newman knows how high performers operate.

As an organizational psychology expert and coach, she's helped people change careers and become better leaders, all while fighting 'burnout' and helping them thrive.

But it wasn't always this way.

She learned from her own financial struggles. After the 2008 recession hit, the manufacturing business she owned with her husband went bankrupt, leaving them with over $100,000 in debt (not including their mortgage). "When you go into survival mode, you dig into default behaviors," she says. To raise money and cover living expenses, Newman held garage sales every weekend, while they struggled to pay the mortgage.

"My life looked really good on paper," she told Money. "I was still wearing Ann Taylor suits and driving a Toyota Highlander and pulling up to a really nice house that I couldn't pay for. Friends and neighbors were inviting me to dinners and I couldn't go."

Newman went back to a 9-to-5 job, but years later wanted to take the risk of working for herself — yet couldn't stomach going back into survival mode while sticking to a tiny budget. Suddenly, a life raft of an idea: "The opposite of survival is thriving," she thought.

The problem with a budget, Newman says, is the feeling that you have to sacrifice everything in your life to get out of debt and get back on track. Instead, she says, you should focus on the items and experiences in your life that help you thrive and make you grow.

In order to keep her family's costs down, while ensuring they had enough money to get by, she developed the concept of a "Thrive List."

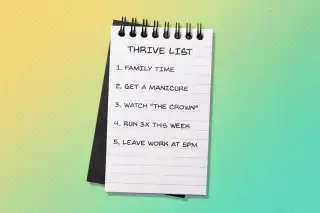

Here's how to create your own thrive list — a universal exercise that works for almost anyone (her 13-year-old son recently wrote his own).

Take an inventory of what you really need — and be specific.

Traditional budgeting usually goes something like this: Assess expenses, then ruthlessly cut them.

This can lead to a scarcity mindset where you're scrimping for pennies. Instead, Newman advises, you should ask yourself: What do I need to grow?

Look at your own life and try to identify the top 5 to 10 items you need to thrive. Consider things you need to get to the next level, whether that's enrolling in classes or maybe even buying an article of clothing that you visualize wearing when leading at your highest level. (Barbara Corcoran says buying this coat helped launch her career.)

So if "exercise" is on your list, get yourself to Lululemon for $98 workout pants!

Just kidding.

The trick is to get as specific as possible with each item. Instead of writing "exercise," which could help you justify buying an entirely new workout wardrobe, two gym memberships, and $10 protein shakes after every spin on the elliptical, get specific enough to say: "go running three times a week."

But don't feel like you have to cut out every expense. "You can't think about it in terms of logic," she says. "Logic will put you back into basic needs—and this is not about basic needs."

A thrive list isn't entirely monetary — while a few items might be tied to cost, more might be linked to emotional needs. Newman recently led a leadership retreat for women and the word "space" and more time for reflection was on all of their lists.

Tara's list includes things like:

- Time with family and husband

- Getting a manicure every week (because it makes her feel good about herself)

- Leather interior in her car (but it doesn't matter if that car is used or not)

- Netflix (main form of entertainment, after realizing she doesn't like going to the movies)

After writing that first thrive list, Newman brought it back to her husband, saying, 'This is how we're going to budget," and "if it's on this list, we are going to spend on it financially, energetically, and time-wise."

Filter every new purchase through your thrive list.

Now that you have your list, say you walk into Target and see some trendy stuff in the impulse-buy bin by the entrance. Why not throw it in your cart?

First, Newman advises, you should ask if that item fits on your thrive list: Will it help you grow?

If the answer is no, forego the retail therapy, knowing that you have an overall mission.

Bonus points: Every time you don't buy something because it's not on your thrive list, tuck that money into your savings account. Newman did this — and had hundreds of dollars in her savings account after one week.

Guess what? A thrive list works for your career, too.

Your career might be guided by a scarcity mindset if you're always planning for the worst, doomsday-ing that you might get laid off, or thinking you need to take on every possible client even if they're difficult or low-paying.

While Newman advises there's a time and place for taking what comes your way, it's beneficial to look at your career through the lens of a thrive list. "When you run a business and think about long-term revenue growth, it allows you to align with what you need to thrive for your business — and what doesn't suck the life out of you," she says.

Ask yourself: What are the clients you need to take on to thrive? What is the job environment you need to thrive? Write a list with 5-10 items and use this to assess any major career moves.

Don't forget about your list during the everyday grind.

"Like anything else, this is a practice and I tell people to practice it every day," says Newman. Ask yourself this question every morning: What do I need to thrive today?

This will help you anchor where you spend your time and energy, and becomes a filter for decision-making.

She also advises you share the list, and rope in a friend, partner, or child to do the exercise, too. "I have my husband's list on my nightstand and I look at it regularly: Is he getting what he needs? Does he need to be reminded of his own list?"

Because, as she says, we don't always see our own behavior — and sometimes we need accountability to truly thrive.