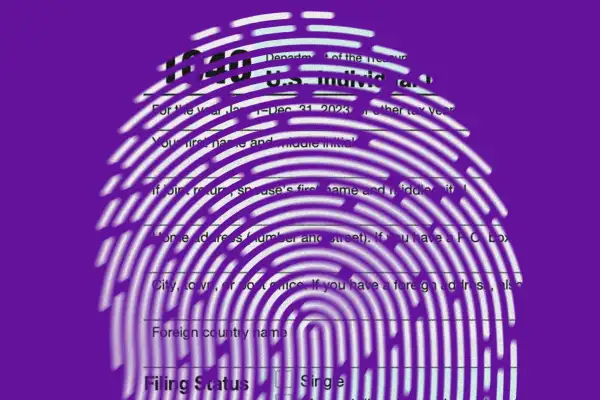

IRS’s Identity Theft Issues Are Leading to ‘Unconscionable’ Tax Refund Delays: Report

The Internal Revenue Service is way behind in dealing with identity theft cases, and it’s causing delays for taxpayers whose refunds are caught up in the bureaucracy.

Identity theft is a growing problem and it’s apparently challenging the IRS’s bandwidth at the expense of taxpayers. The issues stem from scammers filing a high volume of returns in other people's names, trying to steal their tax refunds.

A new report to Congress from the Taxpayer Advocate Service states that the IRS is struggling to help victims in a timely manner, leading to “unconscionable” delays. Hundreds of thousands of taxpayers victimized by identity theft are being forced to wait over a year and a half, on average, to have their issues resolved and get refunds.

“If it weren’t for the significant number of challenges affecting larger groups of taxpayers, this would be headline news, and it should be,” National Taxpayer Advocate Erin Collins wrote in the report. “Many taxpayers depend on their tax refunds to meet their living expenses, particularly low-income taxpayers.”

How IRS identity theft issues affect taxpayers

Two groups of taxpayers are affected by delays related to identity theft that can interfere with their access to tax refunds: 1) victims of identity theft and 2) people whose legitimate tax returns are flagged for possible identity theft.

When the IRS’s systems flag a tax return for possible identity theft, taxpayers’ refunds are delayed until they complete an authentication process. The report says that among taxpayers who authenticate their identities after a flag, the average time to resolve the issue is 46 days.

The other affected taxpayers — people who are actually victims of identity theft — are facing particularly long wait times for their issues to be addressed. Almost half a million people with cases in the IRS’s Identity Theft Victims Assistance (IDTVA) are waiting an average of 19 months for issues to be resolved as of the end of 2023, according to the report. This means the processing of their returns and the issuance of refunds can be long delayed.

The filters the IRS uses for detecting possible identity theft return a sizable number of false positives each year. Millions of returns are flagged each year, and the false positive rate is generally at least 50%, according to the report.

The IRS wants to make sure that criminals aren’t falsely filing returns on someone’s behalf, but this fraud can be hard for the agency to identify.

Taxpayers who are affected by identity theft flags are mailed letters explaining that their refund has been stopped and that they have to go through an authentication process.

The report raises concern that the outreach to these taxpayers is inadequate, contributing to the refund delays. It also says the IRS could work faster to resolve issues for taxpayers with cases under the IDTVA unit.

Right now, “extremely long cycle times plague the IDTVA program,” the report says. Pandemic-era tax changes caused caseloads to surge and led to more criminals attempting tax fraud. The delays have gotten nearly five times longer since 2019.

The report says it’s inexcusable that these issues are ongoing and so severe more than three years after they began. The IRS has faced challenges with staffing qualified employees and properly training some staff members, according to the report. Improving hiring, retention and training, as well as better allocating resources to identity theft victims’ cases, could be solutions to the delays.

Systems also need to be approved so that fewer legitimate returns are flagged for possible identity theft, according to the report. If the IRS can improve in this area, it will reduce the number of taxpayers who experience delays accessing their refunds.

More from Money:

7 Best Identity Theft Protection Services of January 2024

What Should You Do if You Suspect You Are the Victim of Identity Theft?

Scammers Are Getting Smarter. Here's How to Protect Your Identity This Year