Chicken Soup for the Financial Failure

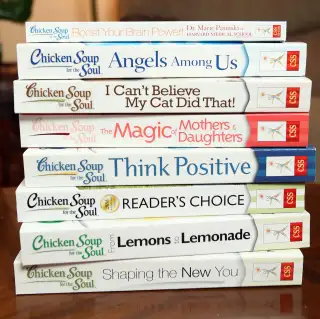

Jack Canfield is best known for his inspirational work as the author of multiple New York Times best-selling books, including the Chicken Soup for the Soul series and The Success Principles, now celebrating its 10th anniversary.

I recently interviewed Canfield on my daily podcast, So Money, about his biggest financial mistake, the principles that helped him bounce back, and how he ultimately went on to build a multimillion-dollar empire. Here’s what he had to say.

His Biggest Financial Failures

“I made some big investments that didn’t work out, when delving off into projects that started with, ‘Hey, Jack, there’s this really cool idea, we can make a lot of money really quick doing this….’

I got involved in some multi-level marketing companies, didn’t realize how much work it was, and lost money because I bought a lot of product and didn’t have any people to sell them to.

The other failure was deciding to create a portal, kind of like AOL. We had no business doing that. We didn’t know enough about it. AOL was cleaning up everywhere. For years, AOL was putting free CDs and DVDs inside of magazines just to build their base. We didn’t have the money to do that. We lost $30,000.

I did another thing where we invested $300,000 in an infomercial. I didn’t know that business well enough to be playing.

What He Did Wrong

I invested in companies I never should have invested in because I didn’t know them.

You know, the richest people in the world tell you, 'Don’t invest in a business that you don’t fully understand.'

And I didn’t do the due diligence I should have done. So, there were lots of $50,000 and $100,000 investments that turned into nothing.

I don’t do that anymore.

What's Different Now

I actually have one person who manages my money with me, and he knows more than I do. He used to work at Deutsche Bank and is an extremely brilliant guy, so I let him do what he knows how to do.

He runs everything by me and I usually say, 'Well, what would you do if it was your money?' We’ve had a great run.

One of the chapters in The Success Principles [says] success is a team sport, and you need to surround yourself with a team of experts— bankers, accountants, investment advisers—people that know what they’re doing, and then work with them on a regular basis. It has to be a consistent touch point.

Don’t try to be an expert in areas you’re not an expert in. Instead, use the experts.

What He's Learned

I think most of my financial failures came when I tried to do something that wasn’t aligned with my purpose.

My purpose is to inspire and empower people to live their highest vision in a context of love and joy. Whenever I was working on that, whether it was writing books to developing audio programs, running seminars, doing coaching programs, I was always making money.

Every day, Money contributing editor Farnoosh Torabi interviews entrepreneurs, authors, and financial luminaries about their money philosophies, successes, failures, and habits for her podcast, So Money, which is a “New and Noteworthy” podcast on iTunes.