Why Mutual Fund Costs Are a Lot Bigger Than They Seem

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Sometimes the best way to grasp a complex concept is with a simple picture. The videos in “Big Ideas in Simple Sketches” offer illustrated insights from some of the best minds in money. The drawings may look pretty basic, but the thinking behind them will ultimately make you a better investor.

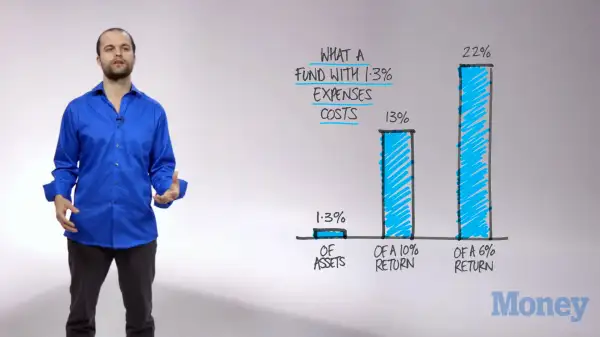

The average actively managed fund doesn't look expensive—what's 1.3% per year? A lot, says Charley Ellis, founder of financial consulting firm Greenwich Associates.

Read next: Why Stock Market Losses Feel More Extreme Than Gains

Think of expenses as a share of your expected returns. If long-run history repeats and stocks grow 10% a year, then 1.3% is 13% of that. And if stocks falter, you would give up an even bigger percentage of any gains to the fund manager.