‘Income Dream Come True’: Savers Have Several Risk-Free Ways to Beat Inflation

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Beating inflation may not be as hard as you think. Many savings products and fixed-income investments are offering positive real yields — meaning that their annual percentage yield (APY) is higher than the rate of inflation. This is actually a fairly rare occurrence in the grand scheme, allowing savers to beat inflation with a risk-free investment.

Even though rates on some savings products have dipped slightly since the end of last year, safe investments are highly attractive right now because real yields are still very strong, experts say.

The U.S. aggregate bond index, a compilation of high-quality investment grade bonds, is yielding 5.28%, and the highest 12-month certificate of deposit (CD) annual percentage yields (APYs) are just a hair lower at 5.25%. Those yields are much stronger than the annual inflation rate of 3.5%, according to the latest consumer price index (CPI) reading.

“It's the first time in a long time that investors have been able to earn risk-free income above that forecasted inflation,” says Matthew Miskin, co-chief investment strategist at John Hancock Investment Management in Boston. “This is a retirement income dream come true."

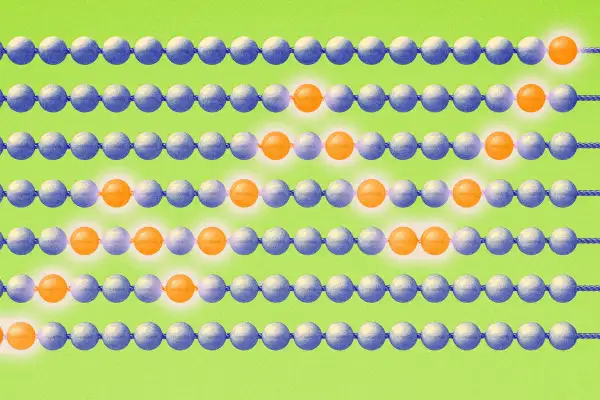

Savings products offer high real yields in 2024

Real yields are a better indicator of the value of a savings product compared to the unadjusted APY.

If inflation is higher than the advertised yield, you’re not actually getting ahead. When the U.S. inflation rate peaked in June 2022 at 9.1% per the CPI, the highest APYs were hardly cracking 4%. But rates on savings products kept climbing through late 2023 as inflation cooled, which caused real yields to improve.

In the current landscape, you can gain purchasing power with CDs, high-yield savings accounts, money market accounts, bonds and Treasury Bills.

Miskin cautions that savings account rates are subject to change. He advocates for locking in fixed rates over variable ones to secure long-term returns.

"Longer-term interest rates, if it's a longer-term CD or a bond, those are ways to lock in these rates and in our view, they're going to provide real returns," Miskin says.

High-yield savings accounts vs. stocks

Bruce Primeau, financial planning consultant at Avantax, says higher APYs make it easier for savers to preserve their capital.

For high-yield savings accounts, he advises looking at the the offerings of credit unions and online banks to find the best rates.

He notes that some of the highest APY offers from credit unions have restrictive eligibility requirements to become a member and qualify, but you won't have trouble finding one yielding above 4%.

When there are positive real yields on savings products like there are now, Primeau recommends shifting to a higher split of safe investments compared to stocks — though each person's circumstances are different.

Interest income and taxes

Taylor Kovar, a certified financial planner in Lufkin, Texas, notes that federal and state taxes chip away at how much a CD or a savings account actually produces for investors. In his view, this should be a factor in how you think of the real yield.

Savings interest is taxed based on the year when it's generated, whereas long-term stock investments are taxed only via capital gains after they're sold.

“Let's say you buy a CD that says it yields 5%, but if you're in a 35% combined tax bracket you're really only keeping two-thirds of that," Kovar says. “It may sound good or really attractive at 5%, but if you're only getting 3.3% after you pay all the taxes on it, it may not look as attractive because that's maybe barely ahead of inflation.”

While savings yields are better than they’ve been in the past, the risk that comes with investing in stocks, in most situations, is still worth the likelihood of higher returns in the long run, he argues.

“I think people get enamored by the 4% or 5% rate,” Kovar says. “Stocks, although I know they're much more volatile than CDs or savings accounts, you can bet on a 9% or 10% return if you were invested in a 100% stock portfolio.”

More from Money:

11 Best High-Yield Savings Accounts of 2024

The Surprising Way Inflation Can Be Good for People With Debt

Why Keeping Your 401(k) After Retiring Could Be a Smart Savings Decision