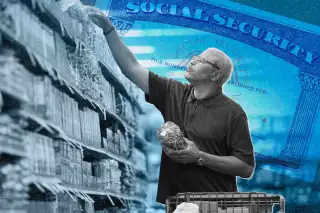

80% of Retirees Say Social Security Benefits Need Better Protection From Inflation

Retirees will receive an above average cost-of-living-adjustment (or COLA) to their Social Security benefits in 2024 — but the vast majority feel the federal government needs to do more to protect their monthly payments from being eaten up by inflation.

A recent survey from advocacy group The Senior Citizens League found that 80% of retirees think Congress should provide an annual COLA that more accurately measures price increases affecting older Americans. The group claims that calculating the yearly Social Security COLA with a specialized index would provide greater inflation protection and higher benefits growth over time.

The Social Security Administration announced last week that the 2024 COLA will be 3.2% — much lower than 2023’s 8.7% historic increase, but still higher than the average COLA of 2.6%.

Even so, data gathered by The Senior Citizens League indicates more than half of retirees are worried their income won’t cover the cost of essentials in the coming months. An analysis from the group shows that using an alternative index to calculate the COLA would result in bigger benefits for retirees on average.

Each October, the COLA is calculated for the upcoming year using the average inflation rate for the third quarter of the year (July through September), as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures the monthly changes in the prices of goods and services for a broad swath of the U.S. population, representing about 32% of Americans.

According to The Senior Citizens League, retirees spend more of their income on housing and medical costs, and these expenses typically increase faster than overall inflation. The group says benefits have not kept up with inflation as it pertains to retirees, and previous analysis from the group found that Social Security benefits have lost a significant amount of buying power in the last two decades — roughly 36%.

That’s why some retiree advocates and progressive legislators are pushing for the adoption of an alternate index known as the CPI-E. The CPI-E specifically measures inflation on the goods and services most used by adults 62 and older. Proponents of using this index for updating the Social Security COLA say it would help retirees keep up with inflation better by providing a bigger benefit on average than the CPI-W.

Impact of Social Security COLA changes

Analysis published Oct. 13 by Mary Johnson, policy analyst for The Senior Citizens League, found that the CPI-E would provide greater inflation protection and benefits growth over time.

Going back 10 years, Johnson calculated what the COLA would have been using the CPI-E and compared the results to the official COLA. The average Social Security monthly benefit of $1,294 in 2014 will have grown to about $1,692 in 2024 using the CPI-W. Using the CPI-E, however, the average benefit would have grown to about $1,750 in 2024, about $58 more per month on average.

If the CPI-E had been used to calculate COLAs from 2014 to through the end of 2024, the average beneficiary would have received $3,787 more in Social Security income, according to Johnson's estimates.

“If that were the law today, the COLA in 2024 would be almost a percentage point higher — 4%, versus the 3.2% just announced by the Social Security Administration,” Johnson said in the news release.

While a switch to the CPI-E would increase benefits for retirees in the short term, critics of the index say that it’s flawed. For one, calculating the COLA using the CPI-E for 2022 and 2023 would have resulted in lower increases for those years. Johnson’s analysis shows that even though benefits would have been higher most years using the CPI-E over the last decade, the COLA for 2022 would have been 4.8% instead of the official 5.9% COLA calculated using the CPI-W. In 2023, the COLA would have been 8% instead of 8.7% if the CPI-E had been used.

Marc Goldwein, senior vice president and policy director for the nonprofit Committee for Responsible Federal Budget, previously told Money that the CPI-E is also problematic because it doesn’t reflect retirees’ true housing costs.

“The vast majority of seniors are not facing any rent, and half of seniors aren't facing any ongoing housing costs related to [their properties],” he told Money in September.

Finally, the Old Age and Survivors Insurance (OASI) Trust Fund used to fund Social Security has been barreling toward depletion for years. While a COLA calculated using the CPI-E would raise Social Security benefits by about .2% per year on average, the increase could push the OASI toward insolvency faster without comprehensive program reform.

An analysis released earlier in the year by the Committee for a Responsible Federal Budget found that in the absence of a solution to the looming funding shortfall from lawmakers, the OASI’s reserves will run out by the end of 2033. This would result in an benefits reduction of $17,400 for the average newly retired, dual-income household.

Congress managed to pass last-minute reforms the last time the OASI faced depletion in 1983 — that said, it's difficult to gauge the current likelihood of insolvency. Lawmakers are nowhere near reaching an agreement to secure the long-term viability of Social Security, but benefits have never been been cut, suspended or delayed before as a result of inaction.

More from Money:

The Government Is Coming After Social Security Overpayments

Millennials vs. Boomers: Who’s Doing a Better Job Saving for Retirement?