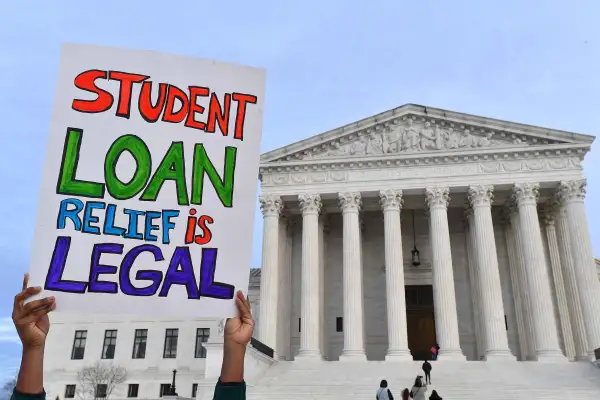

Student Loan Forgiveness: What to Know About Supreme Court Oral Arguments Today

Student loan forgiveness gets its ultimate day in court today, with the Biden administration defending its plan to cancel debt for millions of borrowers before the Supreme Court.

Attorneys will present their positions for and against the legality of loan forgiveness — and the justices will grill them — in back-to-back arguments for the two legal challenges that have made their way to the top court. Many borrowers, meanwhile, will be looking for hints about what may end up happening with their debts.

When the justices eventually rule on the challenges later in the term, they’ll answer if the administration can move forward with canceling up to $20,000 of federal student loan debt for millions of borrowers.

The ruling, and its timing, will likely also determine when student loan payments will resume after they’ve been paused for nearly three years at this point.

Legal experts say there's a limit to how much you can garner from an oral argument, but it’ll nonetheless be interesting to see how justices frame their questions about the challengers’ standing to sue and the executive branch’s authority to cancel debt, among other issues. Here’s what to watch.

Are the justices skeptical that the challengers have standing?

For student loan borrowers hoping that their debt gets canceled, the best case scenario might be one in which justices, including some of those who are more conservative, give suggestions that they're not fully convinced the challengers have standing to sue.

After the loan forgiveness program was initially announced, conservative groups were always expected to mount some legal challenges, but the problem they had to first solve was finding a party that could show they would be harmed by the program. This step — officially known as standing — is a requirement to successfully stop a government action in court.

Legal experts say the question of standing is the biggest challenge the plaintiffs have to overcome; if the justices find there isn't any, they can throw out the cases without considering the actual arguments against loan forgiveness.

In the first case on the Supreme Court's calendar, the challengers are six GOP-led states. The first judge to hear the case threw it out for lack of standing, but an appeals court overruled that decision, saying the lawsuit had standing because a nonprofit loan servicer in Missouri has financial ties to the state, and that loan servicer would lose money as a result of the debt cancellation program.

With the second case, the challengers are two individuals who took out student loan debt, but say they wouldn’t fully benefit from the Biden program and didn't have the opportunity to comment on the eligibility cutoffs.

Even though Perry Dane, a law professor at Rutgers Law School, suspects the Supreme Court will strike down the loan forgiveness plan, he says there’s a chance they won’t find that these challengers have standing. That would mean the administration could go ahead and cancel borrowers' debt.

“It's entirely possible that the court will decide that whatever anyone may think of the loan forgiveness program, nobody can challenge it,” Dane says. “This is one of those instances where, at least on its face, the loan forgiveness program helps a lot of people; it's not clear who it hurts.”

In both cases, he says the theories of standing are a stretch, and adds that ideological conservatives have traditionally taken a narrow view of standing. But the oral arguments could shed light on where justices are at on the standing question in this particular case.

Which justices question Biden’s authority to cancel student debt

If the justices think that the parties do have standing, the question then becomes whether the executive branch has the authority to cancel student debt in this manner.

The Biden administration’s loan forgiveness program is grounded in the HEROES Act, a bill that expanded the Secretary of Education’s ability to change the federal student loan system during emergencies.

In the case of loan forgiveness, COVID-19 was the emergency used to justify the relief for borrowers. Before President Joe Biden took office, the Trump administration used the HEROES Act to pause student loan payments amid the COVID-19 emergency.

Hofstra University law professor James Sample says the merits question in this case is whether the HEROES Act gives the administration the ability to permanently cancel debt on this scale, which is undoubtedly a different type of move than previous emergency actions on student loans that were temporary or specific to particular groups of borrowers.

Given the court’s 6-3 conservative majority, many borrowers are doubtful that the court will side with the administration here, but the justices’ questioning in oral arguments could provide a sense of the directions they’re leaning.

Sample says justices who think the program should be struck down may cite the “major questions doctrine,” which conservative justices have used in recent years to limit executive authority and say explicit congressional approval is necessary for programs with significant economic or political consequences. During the oral arguments, experts following the case will be looking out for questions about this doctrine, he says.

Timing on next steps may remain unclear

When will the Supreme Court rule on student loan forgiveness? The only thing we know with certainty is that a ruling will come before the term ends, which typically happens in late June.

Dane says the justices usually behave “like a bunch of college students” in that big, complicated and contentious rulings often come out at the last minute.

In these major cases, “it's going to take longer to draft an opinion. If there's a dissent, the dissent has to be circulated. There have to be changes to the opinion to respond to the dissent. There might be other concurring opinions, other dissents,” he says. “That can drag out the process.”

However, if the justices are able to quickly come to a consensus, a ruling could come out sooner. If there’s consensus that the challengers don’t have standing, for example, there's a possibility, though perhaps an unlikely one, that a decision could come out soon, Dane says.

For borrowers waiting for forgiveness, the bottom line is that the holding pattern they've been in will likely continue for several more months after the oral arguments.

As Sample puts it, borrowers won’t have a “roadmap for what happens next” with debt cancellation or repayment until a decision comes out.

More from Money:

8 Key Student Loan Dates to Put on Your Calendar

'Too Good to Be True': Student Loan Borrowers Start to Doubt Forgiveness Plan

Many Student Loan Payments Could Be Cut in Half Under Latest Biden Plan