Will Paying Off Our Daughter's Student Loans Trigger a Gift Tax?

Q: My wife and I want to help our daughter pay off her student loans. Will that trigger the gift tax? If so, is there any way to avoid it?

A: You should be able to avoid the gift tax if you help your daughter pay off her student loans, but you need to keep some IRS rules in mind.

Any gifts that stay within the annual gift tax exclusion—which is $14,000 in 2016—are not taxable. As a married couple, you and your spouse may each give your daughter up to $14,000 a year, for a total of $28,000, without triggering taxes. And you don't even have to tell the IRS.

"You can give away up to $14,000 in 2016 to as many people as you would like without having to pay any tax on your gift or having to file a gift return," says certified financial planner Kathryn Hauer.

According to the most recent data from the Institute for College Access and Success, college grads who've borrowed leave school with an average of nearly $29,000 in student loan debt. That's high, but as a married couple you are not likely to exceed your annual gift tax exclusion if you're helping your child pay off her loans.

"If you do give a gift of more than $14,000, or $28,000 if married," adds Hauer, "you’d then need to file Form 709 with the IRS, but it is still unlikely that you would owe any tax on that gift."

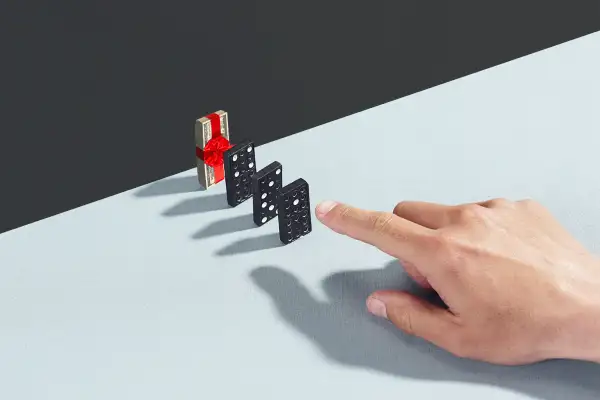

That's because while you must report any gifts over $14,000, your generosity will ultimately produce a tax bill only if the the total amount of such gifts over your lifetime, combined with any assets you leave behind, exceed your lifetime exclusion, which is currently $5.45 million. Plus, your estate would owe taxes on any amount above that.

While this is probably too late for you, there are other strategies available for parents who are willing to help their children pay for school but worried about taxes.

For one thing, if you co-sign your student's loan and then wind up making the payments, that money won't count as a gift.

You can also pay your child's school bills directly. Tuition payments qualify for a gift tax exclusion no matter the amount—though this rule doesn't apply to non-tuition expenses like books.