Your Insurer Wants to Snoop on Your Driving. Is It Worth It?

Are you ready to have your car insurance priced through continuous monitoring of how far — and how well — you drive? As this technology goes mainstream, it may time to decide if the potential savings are worth the privacy tradeoffs.

Interest in usage-based car insurance, sometimes referred to as “telematics,” is rising as people realize that they've been driving fewer miles while enjoying only modest givebacks in their insurance premiums. As many as 50% of drivers say now they'd be comfortable having their insurance costs based partly on their driving activity, according to a recent survey by data analytics firm Arity. That's up from just 38% last year. (Many other factors, from your age to the car you drive, also affect your premium, as they do for traditional policies.)

At the same time, cars themselves are becoming more telematics-friendly. This month, GM announced its own insurance offering through the OnStar technology that's built into its vehicles. OnStar gathers driving data as well as using location technology to provide navigation and roadside help. Tesla has launched its own insurance product, too, also using the vehicle’s on-board technology, although for now it is offered only in California. Ford has made deals with insurers including Metromile, a telematics-only insurance provider, and Allstate to share driving data from the modems in new vehicles.

Here are three steps to help you better understand telematics and what it may mean for you.

Shop around and try telematics to see if you'll really save

While insurers promise savings from telematics — and many even offer discounts merely for trying the technology — it isn’t yet clear what long-term savings such policies might deliver to the typical driver.

In a November 2020 survey of premiums, online insurance broker The Zebra reported average savings of just 3% on usage-based policies compared with regular ones, resulting in a financial break for using telematics of less than $100 a year in most states. Such savings are well below the double-digit discounts that respondents to a Deloitte & Touche study said they’d expect from agreeing to have their driving monitored.

That said, many mainstream insurers even give you an upfront discount for simply doing so, and some drivers (such as those whose annual mileage is very low) may indeed save significant amounts with such plans. Your best bet: Shop around for car insurance, considering both telematics-based and regular policies, to see if the savings are worth it for you.

Don't automatically commit to using your car's on-board telematics

Automakers see increasingly sophisticated vehicles as an opportunity to sell you another extra, in this case insurance. Until now, telematics insurance has required the use of either portable sensors (or “dongles”) inside the car or of a smartphone app. Now that technology is being built into many cars, which could make signing up for a policy something a car salesman could take care of, like getting plates or satellite radio service.

But that convenience comes at a cost, since these built-in systems may be tied to a particular underwriter that the car maker has decided to partner with, and which may not offer you the best deal. If your new vehicle doesn't allow sharing of your data with multiple providers, to allow comparison shopping, consider getting estimates from other options, both telematics-based and traditional. Even if you're committed to trying telematics, then, consider trying it out with a few insurers to see how it pans out for price and convenience.

Make sure your privacy is protected

Advocacy groups including Consumer Reports have already raised concerns about how and to whom driving data from telematics will be used and shared. And the Deloitte survey found that nearly half of respondents would not want to share data on their driving behavior with insurers, with older drivers the most resistant to that sharing. Consumer advocates worry about such scenarios as location-based telematics data being used as evidence of adultery in divorce cases or driving behavior records as evidence of fault in criminal proceedings involving accidents.

Telematics insurers say the necessary safeguards are in place. Nonetheless, check policy language around data use and protection, to be sure you're comfortable with them. The Deloitte study recommended usage-based insurance agreements include “full disclosure of the cyber-security measures, privacy policies, and end-user license agreements put in place by the insurer.”

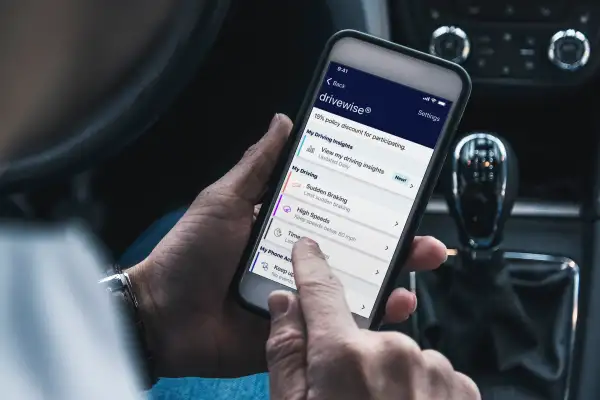

Insurers also point out that drivers can themselves check the data generated on their driving, and even receive tips or alerts on how it might be improved, both for safety and further savings on premiums. Many of the interfaces for monitored driving, such as the one shown above for Allstate's Drivewise program, include a dashboard that allows you to track how well you're performing at the wheel. A study in the journal Marketing Science found that drivers using these programs reduced hard braking by 21%, on average, after six months. Younger drivers improved more than older drivers, and women improved more than men.

More on Car Insurance

Money’s Top Picks

Car Insurance Reviews Learn More |