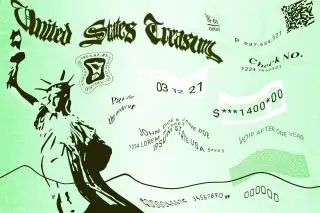

Can the IRS Take Back Your $1,400 Payment? 7 Stimulus Check Myths, Debunked

President Joe Biden only just approved a third round of coronavirus stimulus checks in the American Rescue Plan, but there's already a lot of confusion around the $1,400 payments.

Partially because it's tax time, one of the biggest misconceptions is that the funds will get added to Americans' tax refunds in the next few weeks. That's not true. The third Economic Impact Payment (EIP) is an advance on a tax credit for 2021, and the taxes you're filing this spring — as well as the refund you're probably getting — are for 2020.

So while it's possible your coming refund may be larger because you claimed the Recovery Rebate Credit, it's not related to this new law. Any extra stimulus money you get in your 2020 refund is from the CARES Act and the Consolidated Appropriations Act (which created the first and second stimulus payments last March and December, respectively).

At this point, the $1,400 stimulus check is separate. It will either be direct deposited into your bank account or show up in the mail as a paper check or debit card.

This isn't the only myth spreading on the internet right now. Here are six other commonly misunderstood aspects of the third stimulus check, along with explanations of what you truly need to know.

Myth: The $1,400 stimulus is based on your 2019 salary.

The facts: The IRS is basing the size of your stimulus check on the information provided in your 2019 tax return — or your 2020 one if you've already filed this season. (Reminder: The deadline is April 15.)

The data point it's using is adjusted gross income, or AGI. AGI isn't your salary. It's your wages plus capital gains and such, minus expenses like student loan interest and retirement contributions. If you're curious, you can use a calculator to determine your AGI.

Myth: People who make over $75,000 don't get a stimulus check.

The facts: Single filers who earn $75,000 or less and married couples who earn $150,000 or less are eligible for the full amount. Once your AGI exceeds that level, the $1,400 payment begins phasing out — but it doesn't drop to zero all at once.

The amount you'll get decreases by 5% for every $100 you earn over the threshold. That means single filers who make $80,000 or more and couples who make $160,000 or more won't receive a stimulus check.

Myth: Debt collectors can't take your third stimulus check.

The facts: When the first round of stimulus checks went out last year, many people in debt, on the hook for child support or behind on bank fees worried that their EIPs would be seized to cover them. After some states stepped in to prevent this, the federal government specifically shielded the second, $600 stimulus check from garnishment.

Due to the way the American Rescue Plan was passed, the $1,400 checks don't have that protection built in. Several consumer groups have demanded Congress rectify this by passing stand-alone legislation, writing in a letter that allowing the payments to be garnished "could impose significant burdens on some families, especially those in communities of color, facing unprecedented circumstances." But no dice so far.

Myth: If you got your previous stimulus payments via debit card, the IRS will just reload it this time.

The facts: Like with the first two stimulus checks, the fastest way to get your stimulus check is to have direct deposit information on file with the IRS. Otherwise, the agency will have to mail you a paper check or prepaid debit card containing your funds.

It won't, however, top up those old debit cards with your new $1,400. The law prohibits that. So there's no need to panic if you've already thrown away the original debit card.

Myth: The IRS will take back your stimulus check if you get too much.

The facts: Say if you made $80,000 in 2020 and $70,000 in 2019, but you haven't filed your taxes this year yet. You would get a $1,400 stimulus check even though your current income disqualifies you. Once you file your taxes, effectively telling the IRS that you now make $80,000 and should not have received a stimulus check, you may be afraid the government will try to take its money back.

But you're in luck. Unless the money was sent to a dead person, the IRS is generally not clawing back EIPs. Keep the cash.

Myth: There's no way to fix stimulus check mistakes because this is a one-time deal.

The facts: If the IRS sends your check based on your 2019 return, and your 2020 return ends up qualifying you for more money, you're in luck. The law specifically outlines an "additional payment determination date" that'll fall either 90 days after Tax Day or Sept. 1, whichever comes first. If you file your 2020 taxes before that date and end up eligible for extra relief funds, the IRS will send them to you.

Even that's not your last chance. If you or the IRS somehow screw up the math, or if your family size changes this year, you'll have an opportunity to claim your stimulus money when you file your 2021 taxes next spring.

More from Money:

Third Stimulus Check: What We Know About Amount, Eligibility and Timing

Who Qualifies for a $1,400 Stimulus Check? Eligibility Rules Explained