To Invest for Retirement Safely, Know When to Get Out of Stocks

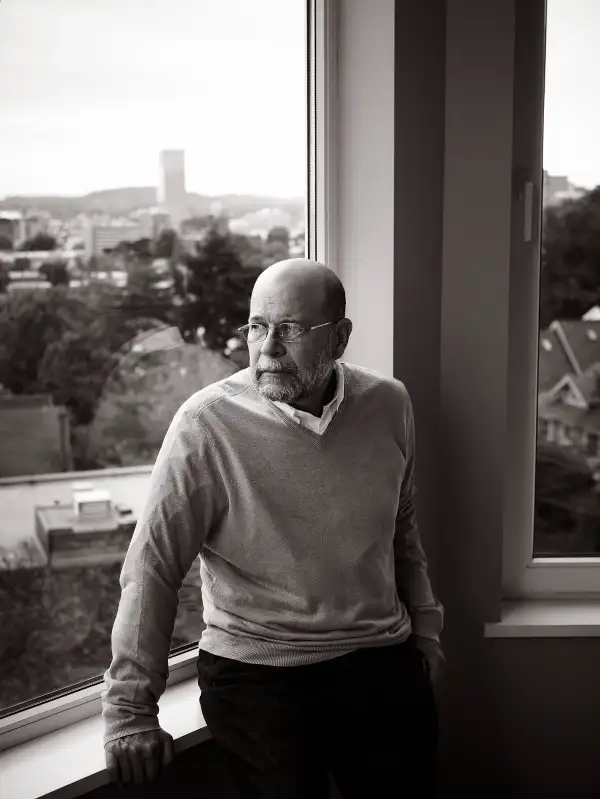

A former neurologist turned investment adviser turned writer, William Bernstein has won respect for his ability to distill complex topics into accessible ideas. After launching a journal at his website, EfficientFrontier.com, he began writing numerous books, including "The Four Pillars of Investing" and "If You Can: How Millennials Can Get Rich Slowly." ("If You Can," normally $0.99 on Kindle, is free to Money.com readers on June 16.) His latest, "Rational Expectations: Asset Allocation for Investing Adults," is written for advanced investors. But Bernstein, who manages money from his office in Portland, Oregon, is happy to break down the basics.

Q. Retirement investors have traditionally aimed to build the biggest nest egg possible by age 65. You recommend a different approach: figuring out how much you'll need to spend in retirement, then choosing investments that will deliver that income. Why is this strategy a better one than the famous rule of withdrawing 4% of your portfolio?

There’s really nothing wrong with the 4% rule. But given the lower expected portfolio returns ahead, starting out with a 3.5% withdrawal, or even 3.0%, might be more appropriate.

It also makes a big difference whether you start out withdrawing 4% of your nest egg and increasing that amount by inflation annually, or withdrawing 4% of whatever you've got in your portfolio each year. The 4%-of-current-portfolio-value strategy may mean lower income in some years. But it is a lot safer than automatically increasing the initial withdrawal amount with inflation.

I also think that it makes sense to divide your portfolio into two separate buckets. The first one should be designed to safely meet your living expenses, above and beyond your Social Security and pension checks. In the second portfolio you can take investing risk in stocks. This approach is certainly a more psychologically sound way of doing things. Investing is first and foremost a game of psychology and discipline. If you lose that game, you’re toast.

Q. What are the best investments for a safe portfolio?

There are two ways to do it: a TIPS (Treasury Inflation-Protected Securities) bond ladder or by buying an inflation-adjusted immediate annuity. Neither is perfect. You might outlive your TIPS ladder, and/or your insurer could go bankrupt. But they are among the most reliable sources of income right now.

One other income source to consider: Social Security. Unless both you and your spouse have a low life expectancy, the best version of an inflation-adjusted annuity out there is bought by spending down your nest egg before age 70 so you can defer Social Security until then. That way, you, or your spouse, will receive the maximum benefit.

Q. Fixed-income returns are hard to live on these days.

Yes, the yields on both TIPS and annuities are low. The good news is that those yields are the result of central bank policy, and that policy has caused the value of a balanced portfolio of stocks and bonds to grow larger than it would have in a normal economic cycle—so you have more money to buy those annuities and TIPS. That said, there’s nothing wrong with delaying those purchases for now and sticking with short-term bonds or intermediate bonds.

Q. How much do people need to save to ensure success?

Your target should be to save 25 years of residual living expenses, which is the amount that isn't covered by Social Security and a pension, if you get one. Say you need $70,000 to live on, and your Social Security and pension amount to $30,000. You'll have to come up with $40,000 to pay your remaining expenses. To produce that income, you'll need a safe portfolio of $1 million, assuming a 4% withdrawal rate.

Q. Given today’s high market valuations, should older investors move money out of stocks now for safety? How about Millennial or Gen X investors?

Younger investors should hold the largest stock allocations, since they have time to recover from market downturns—and a bear market would give them the opportunity to buy at bargain prices. Millennials should try to save 15% of their income, as I recommend in my book, "If You Can."

But if you're in or near retirement, it all depends on how close you are to having the right-sized safe portfolio and how much stock you hold. If you don’t have enough in safe assets, then your stock allocation should be well below 50% of your portfolio. If you have more than that in stocks, bad market returns at the start of your retirement, combined with withdrawals, could wipe you out within a decade. If you have enough saved in safe assets, then everything else can be invested in stocks.

If you’re somewhere in between, it’s tricky. You need to make the transition between the aggressive portfolio of your early years and the conservative portfolio of your later years, when stocks are potentially toxic. You should start lightening up on stocks and building up your safe assets five to 10 years before retirement. And if you haven’t saved enough, think about working another couple of years—if you can.