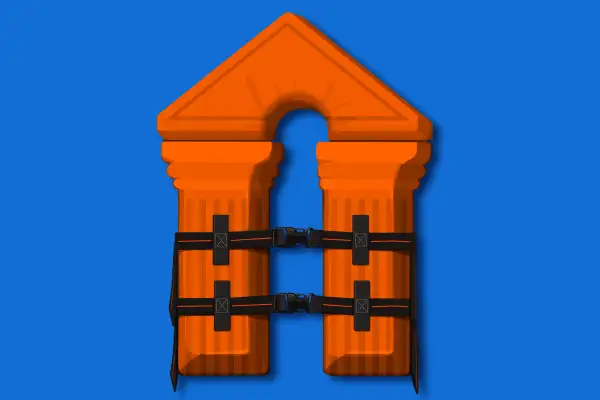

Tuition Insurance and Coronavirus: What to Know Before You Buy it for Your College Student's Fall Semester

College may be the biggest purchase outside of a mortgage you make in your lifetime. Last year, students paid on average $15,000 at public universities and $27,000 at private universities. So it’s no surprise that more families are wondering whether they should buy tuition insurance to safeguard their college payments this year as the fast-spreading delta variant is driving a rise in COVID-19 cases.

Here’s what you need to know about how tuition refund insurance works and how much it costs.

How does tuition insurance work?

Tuition insurance reimburses tuition, room and board, and academic fees if your student withdraws from school for a qualifying medical event and won’t be able to earn academic credit for that term. It also covers mental health conditions, such as depression or anxiety, as well as the untimely death of a student or tuition payer.

Say your student develops a debilitating case of mononucleosis or is badly injured in a car accident and has to withdraw in the middle of the term. Tuition insurance would typically reimburse 75% to 100% of the fees you paid. The amount depends on the specifics of the policy you choose. If your student withdraws during the first 4 to 5 weeks, when schools often refund a partial percentage of tuition, insurance would cover the remaining balance. Withdraw after that partial refund period, and tuition insurance would cover up to the full amount, minus grants or scholarships.

To be eligible to collect, students must be assessed by a licensed medical practitioner and obtain a written recommendation to withdraw. They can’t simply decide they need to go home.

Like any insurance, tuition insurance comes with exclusions. And that fine print is critical.

What isn't covered by tuition insurance?

The most common reasons college students withdraw aren’t medical and won’t be covered, says Shannon Vasconcelos, director of college finance at Bright Horizons College Coach. Instead, the common reasons include emotional, academic, financial, and disciplinary reasons.

“A family needs to understand tuition insurance is for limited conditions,” she says.

Other exclusions include injury during amateur sports competition (that means NCAA athletes aren’t covered), participating in a “riot,” or pursuing extreme sports such as mountain climbing, caving, bungee jumping, scuba diving, or skiing and snowboarding outside marked trails.

Pre-existing physical or mental health conditions might be covered — with caveats. Policies include statements outlining how students cannot have received treatment or experienced symptoms within 60, 120, or 180 days prior to the policy purchase date or between the purchase date and the first day of classes. But the language on what qualifies as symptoms can be vague, so plan to ask about pre-existing conditions’ exclusion details. Some policies might cover withdrawal due to substance abuse, and some might cover a suicide attempt or suicide. Check for those in the exclusion details as well.

If a student has a pre-existing medical condition, “the single-most important thing they should do is obtain a doctor’s statement saying they’re well enough to start college,” says John Fees, co-founder of GradGuard. That way, if their condition worsens and they do need to take a leave of absence, you may still qualify for insurance coverage.

Can tuition insurance help protect against uncertainties caused by the coronavirus pandemic?

Pandemics are often excluded from tuition insurance policies. But the two major tuition insurance companies, Dewar and GradGuard, have said they will cover some disruptions caused by COVID-19. Here's the catch: If campuses send students home again and offer remote instruction, tuition and housing fees won’t be reimbursed by tuition insurance. Nor would you receive a refund because your student is afraid to move to campus or doesn’t like the online instruction delivery.

However, if a student must withdraw due to being sick after contracting COVID-19, that might be eligible. Keep in mind, conditions like mono, a concussion, or depression may be more likely to cause a serious disruption than COVID-19, particularly for vaccinated students.

How much does tuition insurance cost?

Costs vary based on the amount you buy. Many colleges partner with tuition insurance companies — including Dewar, GradGuard, and Liberty Mutual — to offer plans through the school. School plans are generally less expensive, often averaging 1% of your term’s fees, and offer broader coverage (up to 100%) than independent policies, experts say. Independent policies average 2% or more of fees. Covering a $35,000 semester at a private college could run $350 to $700 per term, while $8,000 of coverage might cost as little as $69, depending on the policy.

The question is, what is the likelihood of a qualifying event? “You have to weigh the numbers,” Vasconcelos says. “How much does the policy reimburse? How much does it cost? How likely it is an event occurs during the term? How bad would it be for you financially if it did occur?”

Tuition insurance isn’t like car insurance or health insurance that guards against million-dollar events. But if your student has a chronic condition or an unexpected illness worries you, tuition insurance might make sense. Policies must be purchased prior to the start of the term.

Can you get reimbursed in other ways?

Many schools offer a partial refund up to the fourth or fifth week and don’t limit refunds to medical events. Trinity College offers a sliding scale percentage up to the fifth week and then $0 after that. Boston University’s policy is similar. Or, if your student fell ill near the end of term after most coursework was completed, they might negotiate taking an incomplete and making up coursework without formally withdrawing.

The death of a student or parent is worth consideration, especially if you’ve co-signed private student loans, which often aren’t canceled upon death. However, term life insurance policies — which would cover those loan obligations — are inexpensive for young people, as little as $120 per year. Life insurance wouldn’t cover a medical leave of absence, of course.

The bottom line: experts say most families won’t need tuition insurance, but you’ve got to weigh your family’s variables and do the math. Peace of mind in the event of the unexpected might be worth it.

“The biggest mistake families make is not reading the fine print,” Vasconcelos says. That out-of-bounds snowboarding accident will leave you out of luck.

More from Money:

A Six-Step Guide to Asking Your College for More Financial Aid This Year

Your College Classes May Be Online This Fall. But Don't Expect Cheaper Tuition