The Dangers of Using Trendy Online Installment Programs to Buy Stuff You Can't Afford

Welcome to Dollar Scholar, a personal finance newsletter written by a 27-year-old who’s still figuring it out: me.

Every week, I talk to experts about a money question I have, whether that’s “What if I don't have a 401(k)? or “How many credit cards do I need?” As I learn, I share simple ways to improve your financial life… and post cute dog photos.

This is (part of) the 30th issue. Check it out below, then subscribe to get future editions of Dollar Scholar every Wednesday.

Break out the balloons and confetti! This is the 30th Dollar Scholar, the newsletter I write every week that you should sign up for.

So here’s a confession: Although I’m frugal at heart, I love looking at stuff I know I can’t afford.

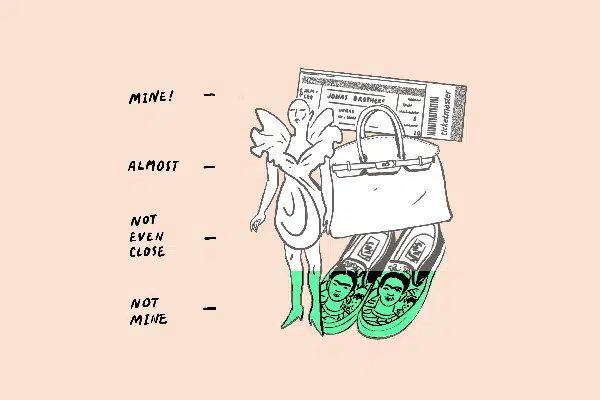

I can’t stop checking the prices on plane tickets to Las Vegas for the upcoming Jonas Brothers residency. I’m constantly browsing fancy menus on Yelp or taking virtual tours of mansions on Zillow. Sometimes I even go wild and sort by “Price: High to Low” on Anthropologie’s website.

It’s a nice, fun thought experiment. I imagine I could be the kind of person who eats a $90 steak, wears a $500 dress, drops $1,000 on a cross-country trip to see a concert.

The part where it gets dicey is when those dreams feel within reach.

I’ve recently seen ads everywhere for Klarna, Affirm and Afterpay, which seem designed to make me believe I could actually afford those expensive items if I just spread the payments out over time. But as a trained Dollar Scholar with a full 30 issues under her (Target) belt, my instinct tells me to be wary. Should I use a hip new installment program to buy stuff?

I called Stephanie Yates, Regions Bank endowed professor of finance at the University of Alabama at Birmingham, to get the 411. She told me that although virtual payment plans are definitely in vogue, their terms and conditions can be risky.

“It makes making large purchases very easy and convenient, so a lot of retailers — particularly bigger-ticket item retailers — are using these now,” she says. “But consumers really have to be careful.”

Yates is right that these services are everywhere on the internet these days. Brands like J. Crew, Madewell and Ulta use Afterpay, whereas H&M, Timberland and Overstock offer Klarna. Expedia, Walmart.com and even StubHub accept Affirm.

The reach makes sense: Over a third of shoppers say they’re more likely to make a purchase if the business offers a payment plan.

As for the programs themselves, they all have gorgeous, clean websites designed to please my millennial eye. Clicking around, it’s easy to get dazzled by the buzzwords. “Shop stress-free,” they promise, with “nothing extra to pay.” Select “manageable installments” and “start enjoying what you’ve ordered right away.” Choose “a better way to buy.”

Sounds wonderful, right?

But a more accurate way to refer to them might be “fixed-rate loans,” according to Yates. Affirm, for example, offers an annual percentage rate (APR) between 10% and 30%.

“People have to pay attention to the details on these,” she adds. “You’re potentially paying more for the item than you expected, especially if you could have afforded to pay cash for it.”

The fine print varies by company. Afterpay’s installments don’t charge service fees or interest, but if I don’t pay on time, I could face late fees up to $8.

Klarna is a little more complicated. It has several payment options, including “4 interest-free installments” (which, as the name might suggest, don't involve interest or late fees), “pay later in 30 days” (also no fees) and “monthly financing” (which has an APR of 19.99% AND late fees of up to $35).

There’s a real possibility that customers — especially young ones — don’t totally know what they’re getting into when they sign up for these services. Aside from the potential for hidden fees, I could dig myself into debt without realizing. My credit score could take a hit if I miss payments or borrow a lot, according to smart shopping expert Trae Bodge.

And then, of course, there’s just the basic risk that financing things I can’t afford is probably not a good spending habit to form.

“The danger is, as you’re checking out it looks great,” Bodge says. “If that customer is looking at a $500 pair of boots they know is out of their price range, [they] might jump because this option is being offered to them.”

Bottom line: If I’m considering a purchase, I should take stock of all the payment options I have available to me before choosing to buy now/pay later. Can I pay outright? Could I put it on an existing credit card? Do I truly understand what I’m agreeing to?

Yates told me to weigh cost and convenience before I decide to break the cost of, say, a $345 pair of Frida Kahlo Vans into multiple payments. And I should reeeally try to be candid with myself about whether I truly need the item that’s in my cart.

“If you’re opting for one of these programs, it’s possible that you shouldn’t be making the purchase to begin with,” Bodge says.

More from Money:

Help! I Can't Stop Spending Money on Dumb Stuff