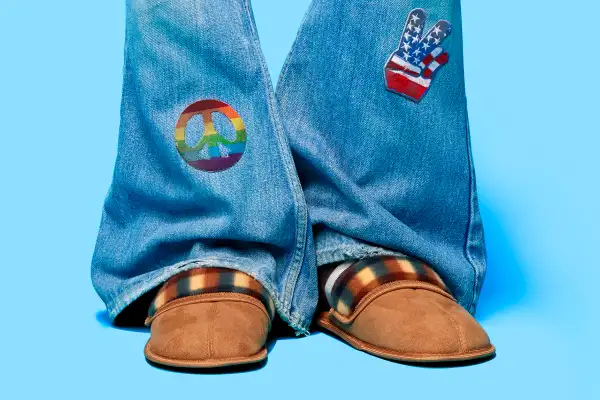

Happy 70th Birthday, Boomers!

If you're on the leading edge of baby boomers—Americans born from 1946 through 1964—you're probably not feeling old. And your instincts are right: When researchers are talking about your g-g-generation, which came of age in the 1960s, they say you're healthier and more mentally agile than previous cohorts were at your age.

That good fortune carries some financial implications for you. The oldest boomers, who are turning 70 this year, will more likely than not be able to celebrate their 85th birthdays, according to the Centers for Disease Control and Prevention; their grandparents at 70 had only a 28% chance. And more than one in 10 of the oldest boomers will reach age 95, compared with fewer than three in 100 of their grandparents.

You have plenty of time left, then, to invest your money, protect it—and enjoy it. So now that the generation that grew up on 45s and 33s has hit its seventies, here's a financial to-do list that rocks.

BILLION-DOLLAR BABIES

A milestone birthday is a good opportunity to take stock of your life, both figuratively and, when it comes to your investments, literally. That's especially important given that we're now in a bull market that may be on its last legs.

So that you won't have to pull money out of a declining market for living expenses, be sure to have at least 12 months of cash on hand to cover day-to-day costs. Since you should definitely be taking Social Security now—there's no advantage to not collecting once you hit 70—include those checks in the total.

But don't assume you need less risk in the rest of your portfolio, says Evelyn Zohlen, a certified financial planner in Huntington Beach, Calif. If most of your everyday costs are covered by Social Security and other guaranteed income, you can stay largely in stocks, particularly if you hope to leave an inheritance, says Zohlen. If you need your portfolio for living expenses, dial back, but don't bow out. A reasonable stock allocation for most people 70 and over ranges from 40% to 60%, says Dan Keady, senior director of financial planning for TIAA-CREF.

TAKE THE Money AND RUN

Coming soon after you turn 70 are your first mandatory withdrawals, formally known as required minimum distributions, from certain retirement accounts, like 401(k)s and traditional IRAs. (You don't have to take RMDs from Roth IRAs, or from your current 401(k) if you're still working.) The clock starts ticking on these annual withdrawals the year you turn 70½.

You must take each distribution by Dec. 31, except for the RMD for the year you turn 70½, which can wait until April 1 of the next year. Miss a deadline and you'll pay a painful 50% of the money you were supposed to pull. (See chart.)

Don't procrastinate, says Maura Cassidy, Fidelity Investments' director of retirement products. Instead, have your brokerage or 401(k) plan automate your RMDs.

I FEEL FINE

A couple, both age 65, will spend $245,000 on health care in retirement, estimates Fidelity. Try to beat that average by staying active. A 2014 study of 229 healthy seniors linked better cardio health to lower costs for medication. And after studying 51,000 adults of all ages, researchers at Emory University and the CDC reported that annual health care costs for inactive people averaged 30% more than for those engaging in 2½ hours of moderate physical activity per week.

"It doesn't take a lot," says Jacksonville physician and financial planner Carolyn McClanahan. "Lifting weights for 10 to 20 minutes in the morning and just staying active is enough."

YOU'LL NEVER WALK ALONE

This is tough to face, but vital: If you haven't already, prepare for the possibility that you become incapacitated, advises elder-law attorney Carolyn Rosenblatt of San Rafael, Calif. Have a lawyer draw up durable powers of attorney letting someone you trust make financial and medical decisions for you. (Your cost: roughly $100 to $200.) Your spouse could become disabled when you do, Rosenblatt says, so look for someone younger, and put "trigger points" in writing for making the handoff, like a doctor's finding of eroded mental abilities.

And now that you have all those bases covered? It's time to relax and let the sun shine in.