What's the Right Mix of Stocks and Bonds for My 401(k)?

There are two things to focus on when you're selecting investments for your IRA or 401(k).

First, you want to look for funds that have broad diversification, meaning they're exposed to the world's markets. Don't just consider how the funds have done in the past.

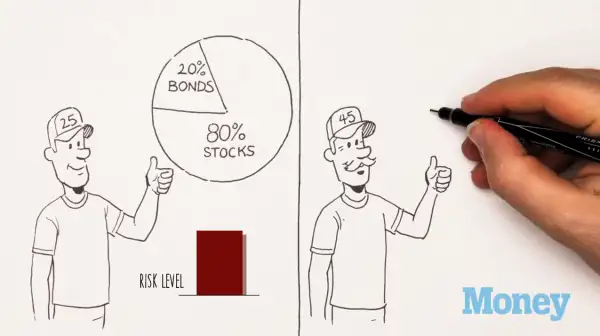

Second, you need to determine how much risk you're willing to take. Stocks are more aggressive investments, while bonds are more conservative. The younger you are, the larger the percentage of your portfolio you should have in stocks. In fact, these financial experts recommend as much as 80% to 90% of your portfolio when you're 25. As you get older, you can reallocate your funds.

Don't want to figure out your distribution on your own? Use a target date fund. With a target date fund, you select the expected year of your retirement, and the fund naturally becomes more conservative the closer you get to that date. All you have to do is sit back and enjoy the spoils.

Read Next: The Simple Reason Why You Need to Invest