Here's Why it Pays to Have a Good Credit Score (Even if You're Not Buying a House)

One of the first items on any homebuyer's to-do list is to improve their credit score. It's a crucial part of the process — your credit score affects what kind of mortgage you can get, which companies will approve your loan and how high the interest rates will be. And if the fall housing market ends up being as competitive as experts predict, you'll need to take advantage of every opportunity to save money.

But what if you're not planning on buying a house anytime soon? Is there any reason to still care about your credit score?

Nirit Rubenstein, CEO and cofounder of credit repair startup Dovly, says yes. There are tons of other benefits to having a high score.

“It absolutely is something you should start thinking about early on,” she tells me. “It’s in everything that we do in our lives, and it really touches almost every aspect of our financial future.”

Rubenstein explained that credit histories and scores are widely used to determine whether a person is a good risk for something. Most scoring models use a range of 300 to 850, and there’s a correlation between the number and my perceived reliability.

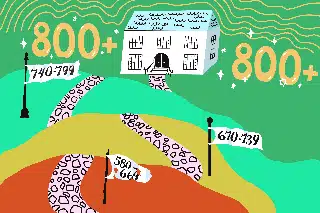

According to Equifax, one of the three major credit bureaus, 580 to 669 is a “fair” score. From 670 to 739 is “good,” while 740 to 799 is “very good” and over 800 is “excellent.”

If your score is high, then a lender can safely assume that you will generally pay your bills on time — and so they’ll want you as a customer. If your score is low, they’ll assume the opposite.

It’s not just real estate. Credit scores get used by a lot of different entities. Landlords often ask about applicants’ scores to see whether they’ll pay rent on time. Utility companies will check residents’ credit scores to determine whether or not to require a security deposit. Even cell phone providers inquire about credit scores before approving a contract for the new iPhone XYZ 100 (or whatever iteration we’re on now).

Credit scores don’t only impact whether you qualify to get the apartment or flashy phone — they can also affect what the terms of that agreement are, according to Rod Griffin, senior director of public education and advocacy for Experian. A high credit score can unlock better interest rates or a lower car insurance premium.

“If you’re using credit well, having a good credit score can help you be more financially successful up until the point you buy that house,” Griffin adds.

Sounds like a lot of pressure — especially when you consider that building up to a good credit score takes a lot of time. We’re talking years.

The silver lining is that you control your credit. You can get started by opening a credit card and making on-time payments regularly; you’ll want to keep the balance low so my utilization rate doesn’t exceed 30%. Rubenstein said you can also piggyback off people who do have established credit by asking to become an authorized user on their account.

Building my credit is a slow and steady process, but luckily there are a couple of shortcuts. Experian Boost is a feature that adds positive cell phone, utility and even Netflix payments to your credit file (and, theoretically, raises your FICO score). You can ask your landlord to report your rent payments to the credit bureaus, as well.

You can also pull your credit report to see what’s on it and determine whether you're making progress.

Normally, people can only request reports from each of the three major credit bureaus for free once a year, but the coronavirus crisis has changed the rules. Now you can get a free copy of your credit report every week.

The bottom line: Your credit score can affect what apartments you qualify for, how nice a phone you get, what your car insurance premiums are and a bunch of other, non-house things. Because it takes a long time to build up my history, you need to take care of your credit now. That way, when you are ready to buy a home, your affairs are in order.

“Lenders want to loan you money. That’s how they make money — they don’t want to say no,” Griffin says. “If you have good credit scores, it’s going to create greater opportunities for you in a lot of different ways.”

More on Credit & Credit Repair

Money’s Top Selection Guides for Improving Your Credit

Money’s Credit Repair Companies Reviews |