Gen Z Is Rewriting the Rules for Personal Finance in Real Time. That's Good, Right?

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

In the summer of 2020, Matt Choon sat in his Brooklyn apartment surrounded by piles of boxes of CBD gummies and bags of designer clothing. He spent years trying to turn his e-commerce business Potion from a passion project into a sustainable revenue source, trekking through snow to beg bodegas to sell his products and throwing house parties just to get photos of guests with his brand’s logo. But collaborators had come and gone, and now it was just 24-year-old Choon, his roommate and a recently laid-off neighbor he hired to help with shipping Potion orders.

In an effort to really ramp up the business, Choon turned to TikTok.

Suddenly, a few videos of the gummies and clothing at pop up shops and street fairs with captions like “secret vintage designer pop up in NYC” changed everything. He watched as videos racked up thousands of views and lines formed down the streets.

Choon funded Potion, which is described as a hemp and cannabis brand, with his cryptocurrency investments — and just a few months after those first TikToks, he had a full-fledged retail space in Manhattan’s Lower East Side. The Bowery Showroom is a CBD dispensary selling Potion products and clothing boutique featuring up-and-coming designers that pitch Choon their brands; it’s also a cultural hub for Gen Z creatives to host workshops and art installations. The walls are covered with art visitors can use to create backgrounds for their own social media posts, including a movable, puzzle-like display made out of carpet and a mirror you can write directly on with markers. Gen Zers waste no time pulling out their phones, filming videos of themselves exploring the shop and posing with friends. Choon and his team have made well over six figures since the store opened in late April.

“We just needed something that could show people beyond our immediate network what we were doing, and that ended up being TikTok,” says Choon, who was raised in downtown Manhattan. “An app for kids and cringey dance moves ended up being so much more than that.”

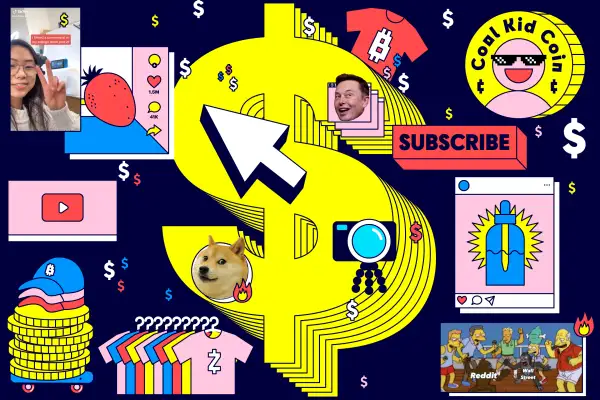

You’re probably thinking: a 24-year old who built his success off of cryptocurrency, CBD and TikTok? That’s one in a million. A lucky guy who took advantage of a fad. But Choon is on the older cusp of Gen Z, a generation of those born after 1996 that are completely rewriting what it means to make money and invest in their futures. Gone are the days of taking jobs at summer camp or as a babysitter, squirreling away cash in a piggy bank and waiting until someday a company offers you a 401(k). This extremely online generation learned to manipulate Instagram and YouTube algorithms to get side gigs and start their own businesses. They’re at the forefront of an investing landscape dominated by day trading and meme stocks. Words like non-fungible token and Ethereum are just a natural part of their vocabulary.

It makes sense that a population which grew up in the shadow of the 2007 financial crisis and has now survived the COVID-19 recession would want to write their own money rules, all while showing that they care about the environment and companies’ ethics.

They’re working really hard to build wealth in new ways that feel ultra necessary for these post-pandemic times. The hard thing? Figuring out if it will last.

‘These strangers have become my mentors’

Growing up in a two-bedroom apartment with her parents and younger brother, Diana Guardado was aware that her family didn’t have a lot of money. As a kid, she wanted a Barbie that all her friends had. Her mother made it clear that wasn’t in the cards.

“I adopted this very weak relationship with money because I never had it,” Guardado says.

That didn’t stop the 19-year-old from setting the goal of buying a house and retiring before age 30.

Guardado didn’t have anyone to teach her about investing, so when she turned 18 she opened a brokerage account and got to work. She pored over videos of YouTubers like Our Rich Journey and Wealth Nation and spent hours on Public.com — a trading and social media platform that allows investors to post commentary about their trades, follow other investors and talk in group chats — to learn about dollar-cost averaging, indexes, exchange-traded funds and more.

“These strangers online have become my mentors,” Guardado says. “Investing wouldn’t have been possible without social media.”

Much of Gen Z’s view of building wealth can be understood through their obsession with authenticity. To Guardado, investing didn’t equate to rich men in buildings towering over Wall Street. She was able to learn it from young and diverse influencers who broke down complicated financial terms in T-shirts from their homes. She saw herself in them.

And the authentic online public sphere is dictating real money moves at a dizzying pace. This year, investing apps like Robinhood and Webull have exploded in popularity with young people, giving them the option to trade stocks, funds and even cryptocurrencies at lightning speeds with no fees. Reddit fueled one of the biggest, oddest stock comebacks in years with the rise of Gamestop. Elon Musk tweets something and crypto prices plunge. The number of Gen Z account openings on Apex Clearing, a platform that facilitates trades for brokerage companies, increased almost 10 times over the last two years as of May. And for this generation, investing means socializing. A Public.com survey found that 64% of 18- to 29-year-olds discuss investments with friends and 41% of Gen Z respondents to a Fidelity survey said that they turn to social media influencers to educate themselves on investing.

“People have always talked about investing, they’ve always shared stock tips with each other,” says Leif Abraham, co-CEO of Public.com. “But social media has just brought this more into the mainstream.”

For 17-year-old Matt While, Twitter and YouTube exposed him to the crypto world before he was even old enough to have his own trading account. The New Jersey-based high school student asked his parents to open a Webull account for him during the pandemic. After watching Bitcoin’s price for several months, devouring hundreds of YouTube videos and following Twitter chatter about cryptocurrency, he bought about $7,000 worth of Bitcoin, Ethereum, Litecoin and Dogecoin with saved up gift money.

Thanks to crypto's volatility, he's now in the negative, but hasn't given up hope he can turn it around. He still spends about an hour a day researching crypto and other investments, but also wants to be one of those YouTubers he spent so much time admiring. In just 5 months, he has over 1,000 subscribers on his own channel where he shares tips on everything from how to build credit if you’re under 18 to the cheapest auto insurance for young drivers. It’s just While in his room, often wearing a sweatshirt, casually sharing what he’s learned.

When the world first embraced Instagram over a decade ago, posters fell into the same pattern that plagued them on Facebook: they wanted elaborately crafted, beautifully filtered pages that attempted to prove their lives were perfect. Gen Z just doesn’t seem to care that much. Instead of getting dolled up and finding the ideal photoshoot spot, they’re filming dances from their bedrooms, going viral with reaction videos or just making fun of themselves and pranking their friends. Even the ads are low-key (cue TikTok star Dixie D'Amelio advertising Beyond Meat to her 53 million followers from her kitchen in a baseball hat). And the sentiment has reverberated across the internet — the one of the highest-paid YouTube stars is a 9-year-old who reviews toys with his dad.

“Authenticity is huge with this generation,” says Michael Pankowski, 21, who founded Crimson Connection, a marketing firm that works with companies who want to connect with Gen Z. “It isn’t about showing the perfect self or anything — it's about showing your true self and if people like it, great.”

It’s a privilege to be able to spend your time posting on social media, and plenty of kids are still going to need to take low-wage jobs. But as authenticity beats out the need for high production value on social media, this generation has seriously lowered the barrier of entry.

Ashley Xu, a 19-year-old student at Northwestern University, turned TikToks of her making advertisements in her college dorm room into a business. She wasn’t trying to make money. She wasn’t even trying to get attention. She was just having fun and now, five months and a viral Sprite commercial later, she has clients like Verizon and Sabra pay her to film 30-second ads for their companies, a management team and more than 450,000 followers on TikTok. Young people can now connect with big-name companies and market themselves for new opportunities from their bedrooms.

On the other side of the spectrum, Jai Bhavnani has already sold one cryptocurrency company — a mobile wallet for crypto called Ambo — and started another. He’s 19.

The Los Angeles-based college student is the co-founder of Rari Capital, a platform that enables the lending and borrowing of crypto assets. In 2018, he saw decentralized finance (DeFi) — a form of finance that doesn’t depend on third-parties like banks or governments — as the future, and he wanted to go all-in on it before it exploded. It wasn’t easy.

“It’s very anti what you’re taught in school,” he says about DeFi. “It’s very anti what you’re taught to think is right.”

Bhavnani is aware that plenty of people with decades more of financial experience aren’t as psyched about cryptocurrency — and he’s not at all oblivious to its risks. He doesn’t think anyone should go all in on Bitcoin and other digital currencies instead of having a diversified investment portfolio. But he also says that assuming people who are making money off of cryptocurrency just got lucky is a dumb way to look at it.

Rari Capital wouldn’t be anything without Twitter, he says. That’s where Bhavnani finds users and new hires, and does nearly all of his networking. Like Xu, Bhavnani is carving out a future by embracing the changing norms of the internet, how authenticity is communicated and how you can build wealth around these new norms.

“There’s a fundamental reason these winnings are happening,” Bhavnani says. “You can either reject it and say that it’s unfair or you can embrace the change.”

'They’re not buying into a lot of the capitalist hype'

If all of this seems a little far-fetched, consider this: The COVID-19 pandemic caused millions of people to lose their jobs just as college graduates were hoping to enter the workforce. Instead of entry-level jobs, young people got cancelled internships and unemployment insurance, and there’s no saying exactly how much this will impact their future. Plus, as Social Security faces serious funding challenges, Gen Z might not be able to rely on the government to help them in retirement in the same way generations before them did. Even stocks and bonds may not provide the same promises to Gen Z as they did to millennials, Gen X and baby boomers: Gen Z can expect lower average annual real returns on their investment portfolios than older generations enjoyed, according to a report by Credit Suisse. The authors analyzed decades of stocks returns and bond yields, taking inflation into account, to estimate this gloomy, low-return future, that, if it comes to pass, will hit the younger generation harder.

Meanwhile, Gen Z, the most racially and ethnically diverse generation, may also face a similar fate as millennials when it comes to debt. The generation faces the biggest increases in student loan debt, personal loans and mortgage balances year after year, according to a report by EducationData.org.

But they’re aware that the advice to take out tons of debt to go to school in the hopes you’ll eventually be able to buy a house and settle down may not make sense for them.

“They’re not buying into a lot of the capitalist hype that millennials bought into,” says Delyanne Barros, an attorney and money coach. They’re seeing that this did not work out for millennials, so they need to do something different.

A typical paycheck — broken down into rent, discretionary spending and savings — might not cut it anymore. Chloe Tan, a 20-year-old University of Chicago student from Shanghai, for example, has built her emergency fund with money she makes tutoring high school students virtually as well as a portfolio of digital collectibles (NFTs). She covers her everyday expenses with the earnings from her YouTube channel, where she posts videos about everything from being an amateur photographer to her dorm room move-in to her 85,000 subscribers. Tan was making between $100 and $400 per month in 2021 until a viral video bumped that up to nearly $5,800 in May and more than $13,000 in June.

It’s fair to wonder how something like expensive digital art will create a sustainable income source for someone in their twenties — but the change may be necessary. Legacy financial systems, like traditional banks and brokerage houses, aren’t friendly for young people, says Craig Russo, director of innovation at Polyient, an investment group that focuses on virtual economies. (The idea that you might actually have to walk into a bank’s building to get the help you need is, for people in their teens and early twenties, absurd.) So they’re looking at assets like crypto as freedom to do what they want, when they want with their money, Russo adds.

Gen Z doesn’t want a world that was created by their parents and grandparents. Everything from government programs to how world leaders have handled sustainability to brands like Victoria’s Secret have let them down.

“We’ve seen how our system is flawed,” Guardado says. “We’re trying to change that.”

Any optimist can get behind these ideals. But with anything so new, there’s a world of risk involved that this generation doesn’t seem to mind. Or, they’re clueless about the risks associated with different kinds of investments, says Steve Hanke, a professor of applied economics at Johns Hopkins University.

“They just think you play the game and it’s an automatic win kind of thing,” he says.

And it’s worked so far. But that’s only because of the Federal Reserve’s recent huge injection of money and liquidity into the market, Hanke adds. A rising tide lifts all boats.

Risky moves might not pay off over time. A survey by E*TRADE from July of 2020 found that 51% of investors under the age of 34 said they’re trading stocks more frequently since the pandemic, and experts say it's very hard to be good at day trading over the long term.

“Things aren’t always as easy as what you’ve grown accustomed to over this last year,” says Douglas Boneparth, an advisor at Bone Fide Wealth based in New York City.

Boneparth, who considers himself fairly pro-crypto, says those looking to fund their future with digital coins like Bitcoin and Ethereum need to recognize that the asset is still new, and there’s a tremendous amount of risk. It might not look the same when Gen Zers are buying homes or retiring.

A good investment all comes down to return of cash flow and predictability, says Clark Kendall, president and CEO of Kendall Capital, a wealth management firm. But cryptocurrency is anything but predictable.

“Bitcoin might be like the AOL of 30 years ago,” Kendall says, referring to how AOL took over the internet in the 1990s, similar to how Bitcoin dominates the cryptocurrency space as the first to its market. “It’s very unusual for me to even see an AOL email address anymore."

Another pitfall? The internet is just full of suspect information. Anderson Lafontant, a financial advisor at Miracle Mile Advisors in Los Angeles, was shocked when her 20-year-old vegan and environmentally conscious sister told Lafontant she wanted to invest in an oil ETF via Robinhood because she heard it was a good buy.

“It’s the opposite of what I would expect,” Lafontant says. “It shows you that she doesn’t necessarily understand the implications of investing money into things.”

There’s bad personal finance advice all over the internet and if that’s the be all, end all of how young people learn about money, it could backfire on them, Lafontant adds.

Still, whether or not Gen Z’s approach to money is a long term strategy — that may be moot at this point. A DIY ethos centered around trusting authentic, youthful sources instead of the establishment has always been at the center of the new generation. Now, building wealth seems possible for just about anyone with a phone — as long as you believe you can.

Choon’s mother is always telling him he needs a 401(k) or Roth IRA. His future depends on it, she says.

“For what? So I can get penalized when I need to take it out before I’m 60?,” he says. “I’m not doing that.”

More from Money:

Robinhood for Beginners: A Complete Guide

How to Get Items Removed From Your Credit Report

Here's Why Financial Advisors Won't Recommend Cryptocurrencies — Even if They'd Like to