People Can’t Pay Their Medical Bills Because of the Government Shutdown

Jo Ann Goodlow's 17-year-old son's wisdom teeth are growing in sideways. The dentist says he needs oral surgery, and she has insurance — but she's too afraid to make the appointment. As a federal employee who's been on furlough for three weeks, Goodlow can't afford it.

"He came to me [saying] 'Mom, my gums are splitting, I need help with this,'" she says. "I don't know when I'm going to have the next check."

The guilt is crushing, but so are the bills. Goodlow is already struggling to cover her $605 car payment and $1,652 mortgage. She's working a part-time job and donating plasma, but it's barely generating enough cash for gas and groceries.

So on Wednesday night, hours after President Donald Trump walked out of a meeting in Washington with Democratic leaders over their refusal to finance a border wall, Goodlow headed to the store in Arizona. She bought her son an Orajel medicated mouth rinse in hopes it will make his pain manageable until the government shutdown ends.

"Because I don't want to incur the copayment, I spent $8 on this mouthwash," the 48-year-old single mother tells Money. "It's just a bad situation right now."

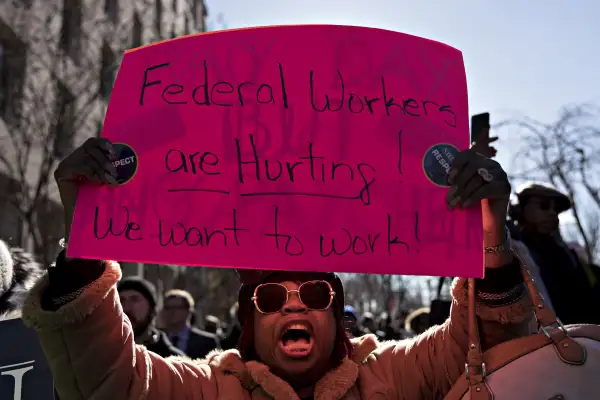

About 800,000 government workers like Goodlow are affected by the partial shutdown, which began Dec. 21 due to a lapse in funding. Since then, about half of those employees haven't been working at all; the rest have been working without pay. And with no end in sight, some people are growing desperate — starting GoFundMes for medical bills, letting prescriptions lapse, postponing doctors' appointments and more.

"I shouldn't have to feel that way," Goodlow, who has worked for the Bureau of Land Management for 19 years, tells Money. "I should be able to take my kids to the doctor when they get sick."

Missing Paychecks and Postponed Procedures

The government shutdown is forcing families to fight through red tape and make potentially dangerous decisions about their health, along with how to spread out their dwindling cash.

Ted Geier, a Forest Service employee in Wisconsin, had knee surgery last month to deal with complications from an on-the-job fall in 2017. He was then put on furlough. That means not only is Geier not working due to the shutdown, but neither is the HR person who would normally help get his workman's comp approved.

He's racing to navigate the system on his own before the invoices arrive in the mail.

"If I don't get this corrected soon, I'm going to get billed several thousand dollars," Geier says. "I am worried I could end up paying this."

Geier, 64, is also covering bills for his son, who is working without pay now for the Transportation Security Administration in Washington state. He says the family has a small savings account, "but it ain't gonna last that long."

The financial strain has led Geier's wife, Cathy, to de-prioritize her health. A close relative got diagnosed with ovarian cancer in December, and now Cathy needs to get an internal ultrasound to make sure she isn't having symptoms, as well. But she's hesitant to book the appointment until the shutdown is over and Ted's knee bills are settled.

"I have put off having this done because I don't know where the money's going to come from," she says.

She's not alone. The Federal Reserve Board found that, even before the shutdown, 40% of Americans couldn't immediately afford an unexpected $400 expense. A quarter of adults were avoiding necessary medical care because of the cost.

That could spike now that thousands of government workers have missed Friday's paycheck, which the left-leaning Center for American Progress says adds up to more than $2 billion.

GoFunding the Furlough

Now, furloughed employees are flooding social media and crowdfunding sites with pleas for cash. A GoFundMe search for "government shutdown" returns more than 1,600 campaigns, including ones for a breast cancer patient, a woman who just gave birth and someone who can't afford glasses.

Katherine Ogilvie, a 46-year-old in California, created a post of her own on Monday. She's not a government worker, but the shutdown is hitting her finances hard all the same. Ogilvie owns a craft kit business that gives people supplies to weave their own baskets and other items. It derives 60% of its income from national park stores, so she's losing hundreds of dollars every day the government — and the shops — stay closed.

"I'm an anxious wreck right now," she says.

She's particularly worried about the state of her bank account because two of her children had to go to the emergency room in December. Ogilvie's son impaled his thigh on a piece of rebar while playing outside, and her daughter suffered a setback from her anemia while on a field trip. Both kids are now fine, but she's worried about how she's going to pay for the hour-long ambulance ride her daughter had to take through the mountains.

"I buy my own insurance. They're not great plans; they have high deductibles," Ogilvie says. "It's going to max me out."

Ogilvie says she's already begun calling creditors to see whether they'll accept late payments. Luckily, several banks are offering assistance: On its website, Wells Fargo promises to "work with individuals and business banking customers whose income is disrupted as a result of the shutdown." Bank of America launched a shutdown-specific webpage vowing to "help you in any way we can."

While she waits for the shutdown to end, Ogilvie says she's saving money where she can. She canceled her son's KiwiCo subscription and is actively trying to find new business opportunities in private museums, but she feels like she's hit "rock bottom" due to Trump's standoff over border security.

"This whole issue is about protecting, but it's hurting people," Ogilvie adds. "That's the irony of it."