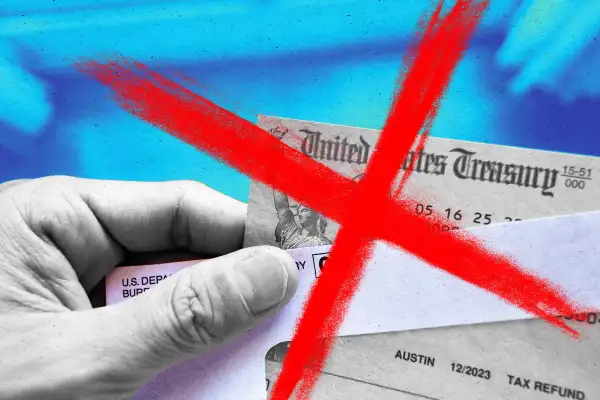

The IRS Is Ending Paper Checks for Tax Refunds

The Internal Revenue Service has announced that it will no longer send tax refunds as physical checks (with a few exceptions).

For decades, tax refunds arrived as paper checks. And every spring, some lucky households would open their mailboxes to find a refund large enough to splurge on something big, like a car. But starting next week, a paper check won't even be an option for most people.

This year, direct deposit was (by far) the preferred method for tax refunds, used by 93% of people, according to the Internal Revenue Service. That's about 87 million refunds.

While it may not be as exciting as opening up a letter with a physical check, the IRS says direct deposit is much quicker, among other benefits. There's also no paper waste, no postage cost and no theft risk.

The IRS naturally wants to downplay the potential for disruption of this change. However, even if only 7% of refund recipients receive their checks in the mail, that's still a huge number of people — over 6 million, by our math. Getting that many people set up with a new payment method will not be a seamless process.

IRS eliminates paper check option for tax refunds

According to a Tuesday IRS release, paper checks will be "phased out" starting Sept. 30 "to the extent permitted by law." It's a "first step of the broader transition to electronic payments," the IRS said. The release notes that more guidance will be published before the 2026 tax filing season begins.

The change is part of a larger, controversial government transition away from physical checks for payments. President Donald Trump signed an executive order on March 25 requiring all federal payments to be made electronically.

The impact of this policy on Social Security recipients has been the main flashpoint, with critics of the change stating that the 400,000 people who receive paper benefit checks can't afford to experience any disruptions.

But the tax refund implications could soon come into the spotlight, with tax season a few months away. For more information on setting up direct deposit for your next refund, the IRS maintains a guide with all the steps.

The IRS will provide options for people without bank accounts. "Prepaid debit cards, digital wallets or limited exceptions will be available," the release said. In addition to direct deposit, the IRS says "other secure electronic methods" may be used for refunds.

One more thing to watch: Trump's executive order could affect checks sent to the IRS. For now, the IRS release said you can still pay taxes with checks, but restrictions are possible in the future. "Taxpayers should continue to use existing payment options until further notice," this week's IRS release said.

More from Money:

7 Best Tax Relief Companies of September 2025

Here's How to Track Your Tax Refund This Year

When Social Security Recipients Will Get Their Checks in September