This 100-Year-Old Has Been Retired for 40 Years, Has a Healthy Savings Account, and Is a Track Champion. Here's His Impressive Path to a Rich Retirement

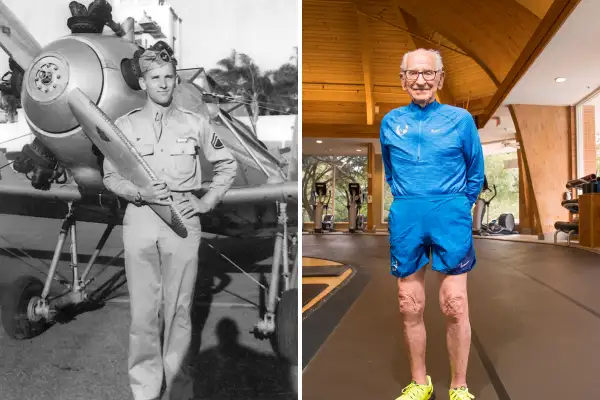

Orville Rogers was forced into mandatory retirement from his pilot job at age 60. Refusing to let company policy keep him grounded, he flew his own planes until age 79.

“I owned three different airplanes, and I enjoyed every one of them,” says Rogers, now 100, of Dallas. While he hasn’t manned the cockpit for a couple decades, Rogers still logs plenty of miles in the air. These days, he takes vacations with his extended family and travels around the country to master’s track meets, where he's a champion.

Rogers “slaughtered the world record in the mile" a few years ago, he recalls. He shaved more than two minutes off the record in his age group, for a winning time of 9:57. And while his pace has slowed since then, Rogers remains a model of endurance in his fourth decade of retirement.

Here are his secrets for success.

Start Saving Early

Orville began saving for retirement in 1952, a quarter century before the creation of the 401(k). Back then, workers weren’t prodded to save for their own retirements. You either had a pension or you lived off Social Security alone, and either way you probably didn’t live for that long. The average life expectancy of a man born in 1917, as Rogers was, was just 48.4 years, according to the University of California, Berkeley. (Rogers turns 101 on Nov. 28.)

So opening up a retirement savings account was a prescient move for the 35-year-old Rogers. His job took him away from his family often, and he spent his down time in hotels reading The Wall Street Journal and Forbes to learn about investing. Eventually, he felt confident enough to up a Merrill Lynch account that he says is worth about $5 million today.

Rogers didn’t scrimp and save for this impressive nest egg. He says his lifestyle wasn’t particularly frugal. What’s more, he's given generously to his church and to other Christian causes throughout his life.

But Rogers had time on his side. Long before personal finance was even a discipline, Rogers taught himself one of its key tenets: “The key to success in any investment is periodic investments over a long time,” he says.

Begin an Exercise Routine

Look on the Sunny Side

Like most centenarians, Rogers has outlived many friends and loved ones. He lost one son in the Vietnam War when the helicopter he was flying crashed. His wife died in 2008, and Rogers moved into a retirement community two years later. “I’m making new friends, because if I don’t I’d have none left,” he says.

Rogers enjoys traveling with his three surviving children, 14 grandchildren, and 11 great-grandchildren. He makes long-term plans: the extended family recently put down a deposit on their vacation for next summer.

His faith sustains him. “My Christianity has been a strong force in my life,” he says.