How President Trump Could Actually Fix America's Finances

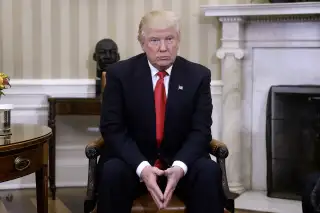

President-elect Donald Trump looks on in the Oval Office of the White House during a meeting with U.S. President Barack Obama on November 10, 2016. Douliery Olivier/Sipa USA via AP

As the nation's leaders have gotten down to work this month, sweeping financial reforms could be on the table: an overhaul of the tax code, the repeal of Obamacare, Medicare privatization, and more.

The debates may be contentious after such a bruising election season, with any results slow to take effect. But right out of the gate—and potentially with less fanfare and drama—the executive and legislative branches could pull off more modest reforms that we believe would help Money readers save, spend, and invest in the smartest ways possible.

What follows is our to-do list for the new Trump administration: nine sensible fixes to our financial laws and regulations that both sides of the aisle could embrace (and in some cases already have).

1. Make Auto-Enroll IRAs a Nationwide Program

- Why it's needed: More than 30 million full-time employees don't have access to a retirement account at work. Typically, no 401(k) or IRA means no savings: Just 20% of workers without one of those accounts save for retirement, while 90% of workers with a plan sock money away, the Employee Benefit Research Institute reports—a troubling gap.

- How Washington can help: California and a handful of other states will soon require employers without plans to enroll workers in one administered by a third party, with contributions made automatically via payroll deductions. (Employees can opt out if they wish.) A nationwide standard would be easier on both employers and workers. Republicans never warmed to President Obama's proposals for an automatic IRA, but there's support from some in financial services for a system that would minimize regulatory and implementation hurdles, says Melissa Kahn, head of retirement policy for the defined-contribution team at State Street Global Advisors: "The time is right to do this."

2. Let the Federal Government Negotiate Drug Prices

- Why it's needed: In recent years drug costs have been the fastest-growing segment of U.S. health care spending. Medicare isn't immune to the trend: Medications provided under Part D made up 14% of Medicare spending in 2014, up from 11% in 2006. For beneficiaries, that means rising coinsurance, co-payments, and deductibles for prescriptions. According to a recent Kaiser Family Foundation poll, 77% of Americans consider prescription drug costs unreasonable.

- How Washington can help: Most developed countries have a national health system, with governments using their purchasing power to negotiate with pharmaceutical companies. The upshot: lower drug prices. Yet federal law prohibits the U.S. government from dealing directly with drugmakers on behalf of Medicare recipients. Opening that door would give pharma an incentive to price products more competitively, experts say. On the campaign trail, candidate Donald Trump backed this longtime Democratic proposal. Already some lawmakers on both sides of the aisle support a smaller step that could still mean big savings: Allow Medicare to negotiate with companies that make pricey specialty drugs that don't have therapeutic alternatives, says Jack Hoadley, research professor at the Health Policy Institute at Georgetown University.

3. Keep the Fiduciary Rule on Track

- Why it's needed: The one-third of Americans with individual retirement accounts are vulnerable to conflicted advice from the financial pros who manage their money. The Labor Department estimates that brokers who put IRA investors in high-commission, low-performing funds are costing savers more than $20 billion annually, cutting their returns by an average of one percentage point a year. Under new Labor Department rules, scheduled to take effect on April 10, 2017, advisers who manage retirement funds will be required to adhere to the fiduciary standard, which means they must put a client's interests ahead of their own and recommend the best investments for the investor's needs, not just a suitable one that may pay them a hefty commission.

- How Washington can help: Opponents have long argued that the commission model makes investing more affordable for those with small portfolios who can't pay big management fees, and financial firms and trade organizations have filed lawsuits to stop the rule, citing high costs to implement it. Now the anti-fiduciary forces are urging the new Trump administration to delay or defang the regulation by, say, declining to enforce it. But officials should listen to a surprising alliance of investor groups and firms—including Vanguard and Merrill Lynch—who say to stay the course. Yes, some investors may pay more in fees, but over the long run it's a more transparent way to pay for advice. And once all advisers are charging the same way, competition should drive fees down.

4. Make It Easier for Families to Manage College Costs

- Why it's needed: College has gotten so expensive that almost three-quarters of parents say that it's their No. 1 financial worry. While tackling the high cost of tuition may be too ambitious a goal for D.C., simplifying access to aid and making it easier to repay loans should be easy wins. The 105-question Free Application for Federal Student Aid (FAFSA)—the main financial aid application—can be so daunting that it scares off at least 400,000 students a year, federal data show. And those who don't fill out the form typically miss out on at least $2,000 a year in grants and $5,500 in low-rate federal loans, according to a study by Michael Kofoed, an economics professor at West Point. Postgraduation, more than 40 million Americans are facing a total of $1.3 trillion in education loans, a burden that gets in the way of home buying, entrepreneurship, and retirement savings.

- How Washington can help: Simplify the FAFSA and allow students to automatically import more information from federal tax filings and other government programs into the form. For that to happen, Congress would need to act, says Justin Draeger, president of the National Association of Student Financial Aid Administrators (NASFAA). The prospects for that appear good. Sen. Lamar Alexander (R-Tenn.), a longtime simplification advocate, will head the Senate Committee on Health, Education, Labor & Pensions in 2017. Once you're through school, the government offers eight federal loan repayment choices, including five flexible plans that peg payments to borrowers' income. The Consumer Financial Protection Bureau has found that the applications are so complicated that thousands of eligible students miss out. Trump has come out in favor of automatically enrolling grads in one simple plan: Pay 12.5% of your income for 15 years and then have any remaining debt forgiven. While details need to be worked out, the general idea has won support from college student-body presidents and nonpartisan groups like NASFAA.

5. Enable Small Businesses to Thrive

- Why it's needed: Americans are an entrepreneurial bunch, launching nearly 680,000 businesses in 2015, according to the Bureau of Labor Statistics. Unfortunately, with the recovery still sluggish, that's about 35,000 fewer than were started in 2006.

- How Washington can help: President-elect Trump has proposed allowing anyone reporting business profits on an individual tax return to pay a flat 15% rate. But that measure, sure to incense Democrats, may be painting with too broad a brush, giving tax breaks to everyone who's self-employed rather than targeting the minority of small businesses that create jobs. Less controversial proposals to cut down on paperwork might have a better shot. One is to change the threshold for so-called accrual accounting, recognizing sales when they are booked rather than when the money arrives. Because it's a more precise way of tracking business, the IRS requires it for firms with more than $5 million in revenues. But it's a big headache for owners who don't have an accounting department. Raising that floor—Hillary Clinton had proposed $25 million—could help. The IRS estimates that businesses spend nearly half a billion hours each year complying with depreciation tables in order to write off new equipment and other investments. Many small businesses can deduct investments up to $500,000 immediately. There's bipartisan support for allowing more businesses to take advantage of that perk.

6. Mandate Paid Family Leave

- Why it's needed: The U.S. is the only developed nation that doesn't guarantee paid family leave. Yet such policies can be a win-win. For companies, studies show, paid leave may boost overall productivity. For women, the ability to take a paid break can make the difference between staying in the workforce and leaving, a major factor in future earnings. A 2015 PayScale study found that, controlling for industry and education, single women earned 0.6% less each year than their male colleagues, but when women married and had children, the pay gap jumped to 4.2%.

- How Washington can help: Trump has already proposed ways for new parents to get time off. The Trump plan, administered as part of unemployment insurance, would guarantee six weeks of paid leave to new mothers. The idea has flaws: For one thing, it doesn't include fathers. And the benefits—expected to average about $300 a week—could be more generous. "It's a much smaller-scale solution," says Elise Gould, senior economist at the Economic Policy Institute, a left-leaning Washington think tank. "But as long as you don't say, 'We've solved the problem,' you are moving the ball in the right direction."

7. Keep the Consumer Watchdog in Business

- Why it's needed: The Consumer Financial Protection Bureau, created as part of the 2010 Dodd-Frank financial overhaul, has had great success, from bringing attention to 2 million phony Wells Fargo accounts and adding fraud protections to payment apps to opening a consumer-complaint database that has logged nearly 700,000 entries to date. In 2016 alone the bureau delivered more than $95 million in relief to consumers. Yet the CFPB has also been hobbled by partisan infighting. One sticking point: Opponents consider it unaccountable to Congress or the president. In fact, in October, a federal appeals court struck down the CFPB's leadership structure, giving the president the right to fire the director—currently Richard Cordray—at will. (Before the ruling, the president appointed the director but could only fire him or her for cause during the five-year term.)

- How Washington can help: Install a panel rather than a single director to lead the agency, something that Republicans proposed in a House bill last September. That could slow down the CFPB's policing efforts, but it would give both parties a stake in its efforts, raising the chances for long-term success. "You will see more back-and-forth," says Mark Calabria, director of financial regulation studies at the right-leaning Cato Institute. "That will give CFPB more legitimacy."

8. Help Retirees Get the Most From Social Security

- Why it's needed: Choosing the wrong Social Security claiming strategy can prove costly. Advisory firm Financial Engines estimates that the average single retiree could lose more than $100,000 in lifetime benefits by not picking the best option; the average married couple could miss out on $200,000 or more. Despite these high stakes, the Social Security Administration fails to consistently provide the information you need to make an informed decision, according to a report last fall by the Government Accountability Office (GAO), based on observations at Social Security field offices. Specialists, for example, often failed to tell retirees that waiting to claim would result in higher benefits or to explain the importance of life expectancy.

- How Washington can help: Boost staff training and improve written educational materials, which the GAO found lacking. More funding for customer service may be a tough ask. But, notes Cristina Martin Firvida, director of financial security at AARP, "we know that members of Congress in both parties are very aware of constituents' concerns about the reliability and timeliness of services from the Social Security Administration and want to see improvements."

9. Let Consumers Know of Data Breaches Faster

- Why it's needed: In 2016 there were almost 1,000 data breaches, compromising 35 million personal records, according to the Identity Theft Resource Center. (Businesses suffer too, losing an average of $7 million per breach, according to IBM and the Ponemon Institute.) Trouble is, consumers often don't hear that sensitive financial information might have been exposed until months later.

- How Washington can help: Hackers are tough to stop, but Congress could establish national standards for data security, as well as rules for when and how consumers need to be notified of a hack. A 2015 bipartisan bill would have done that but was opposed by some business groups and went nowhere. Will a new administration take up the cause? "During the transition, we've definitely heard rumblings from potential officials that cybersecurity is on the agenda," says Lee Tien, a senior staff attorney at the Electronic Frontier Foundation.