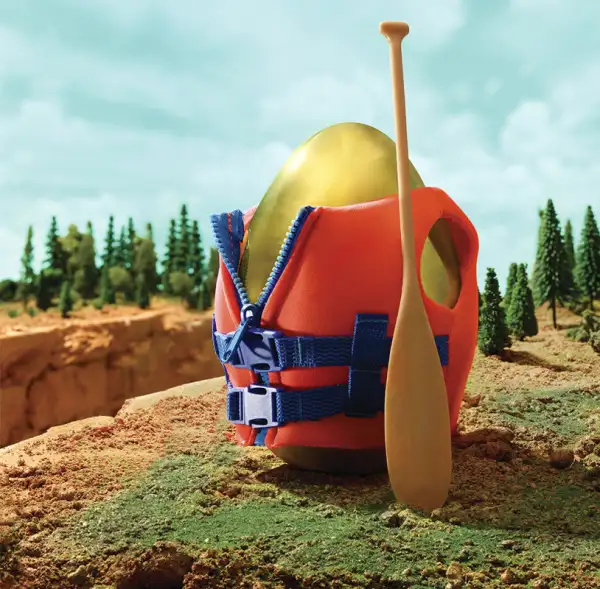

The Two Things You Must Do to Keep Your Nest Egg Safe

This is the second in a three-part series on strategies for a worry-free retirement. Read the first part here.

When the 2008 financial crisis hit, Smiley El-Abd, a mechnaical engineer from Kensington, Md., was only about a decade away from his planned retirement. He says he looked at his own 100%-stock portfolio and decided, "I had to get a lot more conservative." Now he has has a portfolio that's half bonds and half stocks. That certainly brings El-Abd a lot more in line with the typical advice of financial planners. But how do you know, when deciding to sell stocks in order build a safer portfolio, that it's really the right call?

Here are two key moves to ensure you have an asset mix you can really live with:

MOVE #1: Perform this stress test after a big market spill

Sharp stock drops like the one that hit in August are no reason to sell—indeed, by early October, stocks had climbed 7.5% from their low. But use your reaction to them as a way to gauge your true tolerance for risk. Try this test: Did you hang on to your stocks as the S&P 500 fell by 12% from mid-July? If you did, great—but now recall how many times you checked your 401(k) balance during that period. More than once or twice? Consider scaling back. Did your cursor hover over the “Trade” button as you pondered a sale? Definitely scale back.

Should you pass that test, next try to imagine how you’d feel if the 12% drop was followed by another one, for a loss of over 20%. The investment management firm Gerstein Fisher says stocks lose about that much once every two years and three months on average. If that would tempt you to sell, it’s okay to get less aggressive. A portfolio with only 60% in stocks, and the rest in bonds, has historically delivered 82% of the return of an all-stock bet.

During the summer market drop, El-Abd noticed the difference in volatility—he lost only about 4%. "It could have been a lot worse if I didn't have those bonds," he says.

The cost of a too-scary mix. Putting yourself in a position where you might sell heavily near the bottom can mean losing a significant chunk of return. According to Morningstar, the average investor in stock funds earns 1.3 percentage points less a year than the funds themselves, as a result of badly timed selling and buying. That may sound tiny, but on a $100,000 investment earning 6% over 20 years, it shaves $320,000 down to $250,000.

Pick funds that feel less volatile. One way to get an asset allocation you can live with is to outsource the job. Balanced funds typically hold a fixed mix of 60% stocks and 40% bonds. Alternatively, target-date funds (offered in about 80% of 401(k) plans) start heavy in stocks and shift to bonds as you age. A psychological advantage of both kinds of funds is that you don’t see the moving parts: When the stocks within the fund drop, the overall fund falls less. For example, iShares Core Growth Allocation (AOR), a balanced exchange-traded fund, fell 7% when the S&P fell 12%.

If you are picking a target-date fund, remember it’s not all about your age. The Money 50 recommended Vanguard Target Retirement 2035 (VTTHX), aimed at someone 20 years from retirement, is about 80% in stocks. If that feels too risky, move to the fund for someone older. The Vanguard 2025 (VTTVX) fund is about 65% equities.

MOVE #2: Revise your game plan after 50

If you haven't tweaked your asset mix since you set up your 401(k) in your thirties, you’d better take a hard look now. According to recent data from Fidelity, 11% of investors ages 50 to 54 had 100% of their assets in stocks. Among those ages 55 to 59, about 10% were all in equities.

Such stock-heavy allocation can do serious damage if a bear market hits in the years leading up to your retirement, or just after. That’s because you have less time to ride out losses or replenish savings with earnings, explains New Providence, N.J., financial planner Diahann Lassus. Instead, you may be selling investments to cover living expenses, so you benefit less if stocks later rebound. If nothing else, you may feel painfully constrained in the first years after quitting.

Why a bear can maul your income. Assume you have a $1 million stock portfolio. From that, you might plan an income of $40,000, rising each year with inflation, using the common 4% withdrawal rule of thumb for making your money last. (With today’s low yields, some experts think you should take out less—about 3%.) Now imagine again a double dose of the midyear downturn just as you retire—a 20% loss. You’d want to slash your income to $32,000 or less to feel safe. Ouch.

And that’s hardly a worst case. The graphic below shows the impact of a 40% loss, which wasn’t uncommon in the 2008 downturn.

Prepare for a safer segue. Reduce your risk by gradually moving into safer assets. In your late fifties, think 40% to 65% in stocks, with the rest in bonds and cash.

Then when you switch over into retirement you’ll be ready to use a so-called bucket strategy to manage volatility. In the first “bucket” you keep an account with enough cash and short-term bonds for one to two years of spending. The other buckets hold the bonds and stocks; as the cash bucket runs out, you move money from the other buckets.

Research by financial planner Harold Evensky finds that buckets can preserve cash flow and maintain growth. Much of the value is psychological, adds planner Jonathan Guyton of Edina, Minn. Knowing you have cash makes you less likely to panic during a slump. To account for the cash you’ve held back, investments outside your first bucket should be accordingly more aggresssive.

Ed Bilger, 72, a retired engineer in Raleigh, N.C., says his cash bucket kept him comfortable during the recent stock swoon. “I haven’t made any moves in the market,” says Bilger.

Tomorrow: Three Strategies for Making Your Money Last Through Retirement.

Donna Rosato and Alexandra Mondalek contributed reporting to this story.