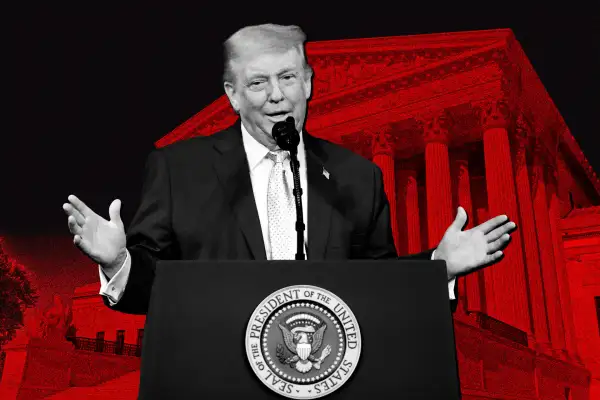

Will You Get a Tariff Refund After the Supreme Court Ruling?

Importers hope to recoup billions of dollars now that the Supreme Court has rejected President Donald Trump's sweeping tariffs. Whether this will lead to lower prices or refunds for U.S. shoppers, however, is up in the air.

There's certainly demand for it. Following the ruling, Sen. Elizabeth Warren, D-Mass., wrote on X, "The American people paid for these tariffs and the American people should get their money back."

But that's not going to be easy.

Speculation had been intense about whether the high court would uphold the president's use of a 1977 law called the International Emergency Economic Powers Act, or IEEPA, to impose sweeping tariffs on global trading partners. On Friday, the court issued a 6-3 decision determining that IEEPA does not give Trump broad power to impose tariffs, invalidating them.

For American businesses, a question of nearly equal urgency was whether or not the court would order the Trump administration to refund more than $175 billion in tariff revenue. Retailers like Costco and Crocs filed lawsuits against the administration in the hope of securing refunds should the Supreme Court overturn the tariffs, and they've got plenty of company: Over 700 companies have initiated tariff refund lawsuits at the Court of International Trade, according to Ashley Akers, an attorney at Holland & Knight.

So what happens now? Here's what we know.

Will companies get tariff refunds after the SCOTUS ruling?

The court's ruling is likely to keep those lawyers busy for quite some time. In a dissenting opinion, Justice Brett Kavanaugh noted that "the Court says nothing today about whether, and if so how, the Government should go about returning the billions of dollars that it has collected from importers."

The National Retail Federation, a trade group, cheered the ruling and urged the government to provide a smooth process for refunding importers. Refunds “will serve as an economic boost and allow companies to reinvest in their operations, their employees and their customers,” David French, the group’s executive vice president of government relations, said in a statement.

But those hoping for a clear path forward — or a quick resolution — are likely to be disappointed.

In a news conference Friday afternoon, the president vowed to continue his tariff agenda, announcing a 10% global tariff under a different trade clause, Section 122 of the Trade Act of 1974. Trump also said the White House would pursue other means of levying tariffs. These include investigations into other countries’ trade practices that could form the basis for sanctions under Section 301 of the Trade Act, as well as tariffs implemented on national-security grounds under Section 232 of the Trade Expansion Act of 1962.

Trump has used both Section 301 and Section 232 to establish numerous tariffs, beginning in his first term.

When asked by a reporter if the government would refund companies that had paid tariffs under the invalidated IEEPA framework, Trump pivoted to criticizing the court for not addressing the topic of if or how refunds should be distributed in its decision. His reply also implied that businesses might have a long road ahead of them before seeing any reimbursement.

“We’ll end up being in court for the next five years,” he said.

Even the court itself acknowledged that sorting out refunds would be a headache. During oral arguments in November, Justice Amy Coney Barrett bluntly asked the lawyer representing the groups opposing tariffs: "If you win, tell me how the reimbursement process would work. Would it be a complete mess?"

Some companies that have sued the administration are concerned about tariff payments that are becoming "liquidated," or finalized, by Customs and Border Protection. Remedies for importers are typically more limited after that liquidation date, which usually occurs 314 days after payment. Trump announced his first IEEPA tariffs on Feb. 1, 2025 — 384 days ago.

In December, the Court of International Trade tried to calm concerns, confirming that tariff entries could be reliquidated, or returned, if tariffs were deemed unlawful by the Supreme Court.

Customs and Border Protection also announced last month that it was modernizing its refund process to be electronic — another sign that the federal government had begun preparing for the possibility of an unprecedented refund situation.

In one scenario, Customs and Border Protection could create a "streamlined" online refund process, Akers says. Alternatively, businesses seeking refunds could be instructed to submit "post summary corrections" or "protests," which are existing administrative processes for correcting tariff payments, Akers explains.

These are all just hypotheticals, though.

Siddartha Rao, an attorney at Hoguet Newman Regal & Kenney, tells Money one path is for the Supreme Court to "remand it back to the Federal Circuit, which would kick it back down to the Court of International Trade, and it would be up to the trial judges to figure out a process for importers to get their refunds."

Secretary of the Treasury Scott Bessent has said the government has $774 billion on hand, telling Reuters that it "won't be a problem if we have to do" refunds. He also shared his skepticism that companies suing the administration would return money to their clients.

What's more, Bessent has also referenced the administration's backup plan to issue new tariffs on different grounds in response to the Supreme Court striking down Trump's IEEPA tariffs, meaning this saga isn't ending anytime soon.

Will Americans get money back from tariffs?

In any outcome involving refunds, the money would go back to importers who paid duties. Given the complexity of supply chains and the prevalence of imported materials and components in many of the goods Americans buy, experts say it's unlikely that any refunded tariff money would trickle down to consumers.

That's because while American shoppers have paid somewhat higher prices due to tariffs, the potential claim to a refund would lie only with the importer of record that actually paid the tariff.

And no matter what happens, consumers will likely not receive checks from the federal government.

Akers notes that if tariff refunds go through, there's "a chance that a company will do the customer a solid and pass along a refund." But don't count on it.

Even Sen. Warren has acknowledged that this outcome is unlikely.

"There is no legal mechanism for consumers and many small businesses to recoup the money they have already paid,” she said in a statement Friday. “Instead, giant corporations with their armies of lawyers and lobbyists can sue for tariff refunds, then just pocket the money for themselves.”

The good news is that the Supreme Court's ruling striking down tariffs could lead to price relief for consumers in the form of lower prices going forward. Companies, in theory, could no longer need to pass tariff costs along to customers: a win for shoppers and tariff-sensitive businesses.

More from Money:

Why States With No Income Tax Aren't as Affordable as They Seem

Here's How Low Inflation Would Be Without Trump’s Tariffs, According to New Research

From Phones to Jewelry, These 7 Things Are Getting More Expensive in 2026