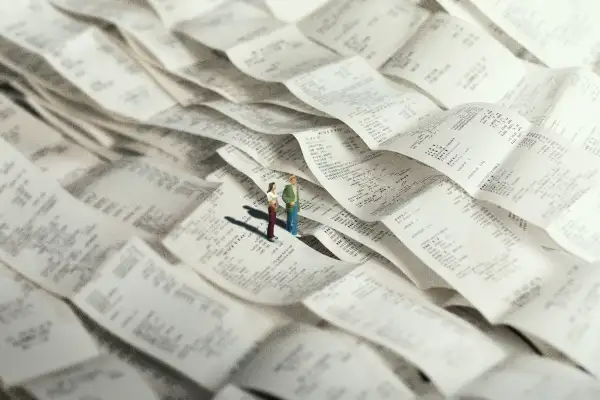

10 Last-Minute Tax Questions and Answers You Need to Know

With days to go until the deadline, millions of Americans still haven't filed their tax returns for 2021.

Admittedly, it's been a turbulent time. Not only is this the third tax season to take place during the COVID-19 pandemic, but it’s also happening as the IRS struggles with a mountain of paperwork. On top of that, the government has changed policies associated with the child tax credit and the third stimulus check, both of which are making people even more eager than usual to receive their tax refunds.

Overwhelmed? Don't worry; we're here to help. Below is a guide to some of the most commonly asked tax questions, along with answers and links to Money stories on each topic.

The federal tax deadline is usually April 15. But this year, April 15 falls on a holiday (Emancipation Day) in Washington, D.C., so Tax Day got moved to April 18 in 2022. That means for most folks, the last day to file taxes is Monday.

However, in Maine and Massachusetts, Monday is also a holiday (Patriots' Day), so for residents of those states, the tax deadline is April 19, aka Tuesday.

If you're also on the hook for state taxes, note that your state's tax deadline may be different than the federal one(s). Taxpayers in states like Delaware and Louisiana, among others, have until May to file taxes.

Should I file my taxes online?

Yes, yes, a thousand times yes. Part of the reason the IRS is such a mess right now is because it’s attempting to process millions of old paper returns — which employees have to do by hand thanks to outdated technology.

To maximize your chances of having your 2021 tax return processed quickly, file online and choose to get your refund by direct deposit.

Something like 7 in 10 taxpayers qualify to get free tax prep through the IRS Free File program, which provides the most benefits to people who earn $73,000 or less. Under that threshold, you can access free guided tax preparation on name-brand sites like TaxAct and TaxSlayer. Over that, you’re limited to using Free File Fillable Forms, which involves a bit more legwork.

Several tax preparers offer their own free versions, too, but be sure to read the fine print to make sure your service of choice is actually free.

Need assistance with your 1040? You may qualify for free tax help through the IRS's Volunteer Income Tax Assistance or Tax Counseling for the Elderly programs.

Do I have to claim the 2021 stimulus check on my taxes?

It depends. The third Economic Impact Payment, or stimulus check, went out last spring. If you got the maximum amount — $1,400 per person — then you don’t have to report it on your tax return.

But if you got less than that or didn't get a check at all, you’ll want to claim the Recovery Rebate Credit. The government might owe you more money, especially if your income dropped or you gained a dependent last year. If so, the IRS will increase your refund or decrease your tax bill by the amount you’re due.

How do I claim the child tax credit?

Last year, the Biden administration expanded the child tax credit and made it so families could receive half of the total value in six monthly installments. If you got those payments, you need to claim the rest of the money on your 2021 tax return. Use the info on Letter 6419, which the IRS should have mailed you this winter, to do this.

If you opted out of those payments — or if you had a baby late last year — you need to claim the entire credit.

Do I need to report crypto on my taxes?

Some 40 million Americans have dabbled in crypto. If you’re among them, you likely have to tell the IRS if you sold crypto for a profit or at a loss, earned income from mining, exchanged crypto, used crypto to pay for something or more.

In fact, Form 1040 has a question that specifically asks about taxpayers' crypto: "At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?" Read our guide to crypto taxes to find out more.

Is there still time to reduce my taxable income?

Yes. If you made certain charitable donations before Dec. 31, you may be eligible to take advantage of a special above-the-line deduction worth up to $300.

Beyond that, you might consider contributing to an individual retirement account, or IRA. There’s a $6,000 limit for people under age 50, and not everyone qualifies to receive a deduction for these contributions, but it can be a tactic for reducing your tax burden. You can technically contribute to your IRA for 2021 until Monday.

Where's my tax refund?

The IRS says that most tax refunds go out within 21 days.

If you're anxious to get your hands on that cash, it's possible to track your refund. The easiest way is to navigate to the IRS’s website, where its Where’s My Refund? tool will allow you to check your refund status. But come prepared: You'll need your Social Security number, tax filing status and exact refund amount in order to use the program.

Also, Where's My Refund? only works if it’s been at least 24 hours since you filed your taxes online or four weeks since you snail-mailed them.

Refunds are, on average, about $300 higher this year due to the aforementioned child tax credit and stimulus check situations.

But if you think your refund is straight-up wrong, as in it doesn’t match the number on your tax return, don’t spend it. Wait for the IRS to contact you.

If you’re simply dissatisfied with the size of your refund, you may want to adjust your withholding by submitting a new W-4 to your employer. The more you withhold throughout the year, the bigger your refund is; the less you withhold, the smaller it is. Be careful, though — as nice as it is to get a big check every spring, overwithholding equates to basically giving Uncle Sam an interest-free loan.

What if I need more time to file my taxes?

File for an extension, which will push back the deadline for you to file your tax return by six months. Although you will still have to pay the IRS any money you owe, you’ll get until Oct. 17 to get your paperwork together.

More from Money:

The 10 Best Tax Software Programs

7 Big Tax Changes That Could Affect Your Return — and the Size of Your Refund