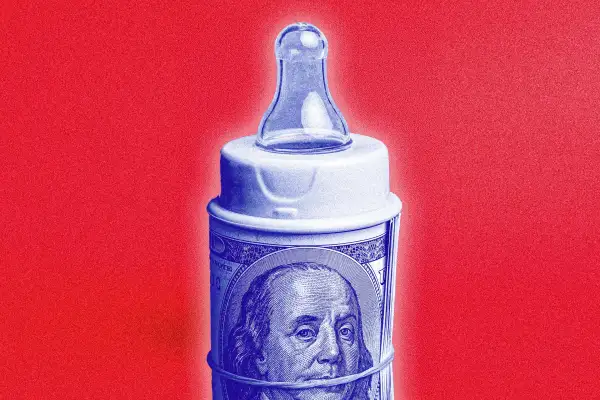

$1,000 Baby Bonus: What to Know About 'Trump Accounts' for Newborns

On Friday, President Donald Trump signed into law his sweeping tax package, dubbed the “big, beautiful” bill, which includes a new savings account for children that comes with a one-time baby bonus.

The new birth-based custodial accounts, often referred to as "Trump Accounts, are designed as long-term investment accounts for newborns. Initially funded by a $1,000 contribution from the federal government, these accounts are tax-preferred and remain tied up until the account holder turns 18.

The goal, according to proponents, is to give young Americans a financial head start and encourage wealth-building from birth. In a press release, the White House said these accounts "will afford a generation of children the chance to experience the miracle of compounded growth and set them on a course for prosperity from the very beginning."

Here’s everything you need to know about the new savings accounts, from who’s eligible to how they stack up against more traditional investment vehicles such as 529 plans.

What is a Trump Account?

The Trump Account is a tax-deferred investment account that the Department of the Treasury will automatically open for every eligible child born between Jan. 1, 2025, and Jan. 1, 2029. Each account will receive a one-time $1,000 deposit from the federal government. Friends and family can also contribute up to $5,000 per year to the account.

Parents can also open a "Trump Account" for any child under 18 who was born before 2025— but they won't receive the $1,000 government contribution.

Funds in the account will grow tax-deferred, meaning gains won't be taxed annually. However, qualified withdrawals — for expenses such as college, a first home or starting a business — will be taxed at the long-term capital gains rate. Non-qualified withdrawals will be taxed as regular income.

Trump accounts will function less like savings accounts and more like brokerage accounts with funds invested and potentially subject to market fluctuations. With that in mind, it's similar to a custodial brokerage account, where a parent or guardian manages investments on behalf of a minor.

Who's eligible for a Trump Account?

Children born between Jan. 1, 2025, and Jan. 1, 2029, will be automatically enrolled in the program by the Department of the Treasury. To qualify, the child must be a U.S. citizen with a Social Security number. (A recent revision to the bill removed the requirement that the child must have at least one parent who is a U.S. citizen).

What can the funds be used for?

Trump Accounts allow tax-preferred withdrawals for qualified expenses, including educational expenses, buying a home and starting a business.

When can the money be accessed?

The funds will be tied up until the account holder turns 18. At that point, the account holder may withdraw up to 50% of the funds for qualified expenses without facing regular income tax.

At age 25, the account holder can withdraw up to 100% of the balance for the same aforementioned qualifications. After age 30, the funds can be withdrawn for any reason.

How long could contributions be made?

Contributions can be made until the account holder turns 18, up to the annual contribution limit of $5,000.

How Trump Accounts stack up

While the so-called Trump Account offers a new way to kickstart savings for the next generation, it's not without trade-offs.

Many financial planners say families may be better off contributing to a 529 plan — especially when saving for education. "For educational purposes, the 529 is the clear winner," Dave Fortin, a chartered financial analyst, told Money. "That said, the traditional education path may not be what all families are targeting."

Unlike 529 plans, which allow tax-free withdrawals for qualified educational expenses, Trump Accounts would still incur taxes on earnings — even for qualified uses that go beyond education, although at the long-term capital gains rate.

Another key difference? Access. Withdrawals from a Trump Account wouldn't be allowed until the child turns 18 — a potential risk, Fortin said.

Although 529 plans are used primarily to pay for college, what counts as a qualified expense has expanded in recent years. Trump's tax bill will extend them even further, raising the annual limit for K-12 expenses from $10,000 to $20,000 starting next year. If you're paying for K-12 tuition, a 529 plan would offer earlier access to funds than a Trump Account, Fortin added.

And while Trump Accounts cap annual contributions at $5,000, the contribution limit for a 529 is much higher. In 2025, you can deposit up to $19,000 per beneficiary (or up to $38,000 for married couples) without triggering the lifetime gift tax exclusion.

The main advantage of the Trump Account? Every baby born between 2025 and 2028 would automatically receive a $1,000 government-funded deposit.

Free money is free money. Still, the $1,000 bonus likely won't significantly change how most families save for college, says Jordan C. Kaufman, a certified financial planner at Green Ridge Wealth Planning. However, it could prompt parents to start thinking about the cost earlier — and that can be valuable.

Are Trump Accounts available yet?

Not quite, but the groundwork is being laid.

Trump Accounts are officially authorized under the "big, beautiful bill" that Trump signed into law on July 4. While the government now has the authority to create these accounts for eligible newborns through 2028, there's no indication that the program is operational yet. The government is likely still finalizing key logistics, which means some details could change before the official rollout begins.

More from Money:

Now That Trump's 'Big, Beautiful' Bill Is Law, Here Are the Major Tax Changes

Better Than a Piggy Bank: 3 Ways to Invest for Your Kid's Future

529 Savings Plans Could Get Even More Flexible Under GOP Tax Bill