Trump’s Economic Advisers Are Dealmakers Just Like Trump

- See How Markets Around the World Reacted to a Trump Victory

- How Donald Trump May Have Avoided Paying Medicare Taxes

- Why Warren Buffett Is Campaigning for Hillary Clinton—And How Much He's Spending To Do It

- Why It Could Be the Perfect Time to Make Your Dream of Working Abroad a Reality

- Is Donald Trump Worth $3 Billion or $10 Billion?

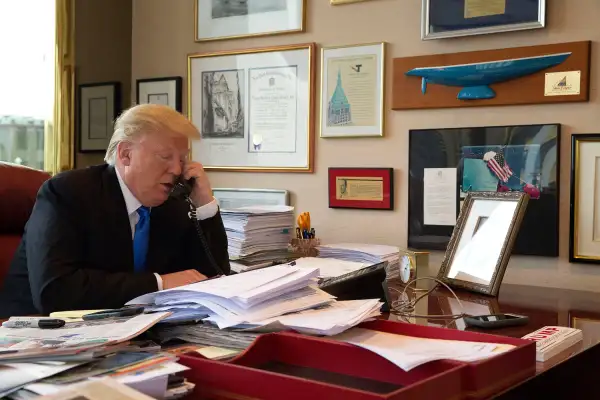

Republican presidential nominee Donald Trump on Monday gave a speech at the Detroit Economic Club to discuss his plans for changing the direction of the U.S. economy. Who's helping him shape those plans? A group of 14 economic advisers who are unconventional picks.

Revealed on Friday, the team is exclusively composed of white men (assuming you don't count Trump's daughter, Ivanka), and hardly any fit the bill as a traditional GOP economist or adviser. Oh, and several of them are also Trump's biggest donors and friends.

Still, aside from sharing Trump's views on matters such as trade, this group is noted for the large numbers of dealmakers, who the author of The Art of the Deal must find appealing. Trump has stated that he can make better deals with U.S. trade partners and adversaries than Hillary Clinton. Many of them are self-made men who amassed fortunes by undertaking risky ventures.

Trump has said he wants to run America like he has run his businesses. While his record doing that is the subject of debate, there is no denying that his billionaire-heavy economics panel has met success creating thriving enterprises. Whether this equips them to forge economic policy is a controversial question.

Justin Wolfers, professor of public policy and economics at the University of Michigan, notes that Trump's picks are all from the private sector, and also overwhelmingly from real estate, finance, and oil.

"If you think about what sectors you'd like to see represented, you'd think about tech guys, those who work in research and development, maybe biotech or services," Wolfers says. "If I were the populist candidate, I would want people who understand the middle-class condition and what middle-class life actually means."

So what's the big deal if Trump threw together a group of enormously wealthy men to advise him on national economic policy? Wolfers says economic advisers should be well-versed in things like monetary and fiscal policy, income distribution, unemployment, the gender pay gap, and work-family balance. Trump's team, he says, is not.

"I have no doubt John Paulson can pick a derivative better than me, but can he tell the likely effects of lowering or raising the minimum wage?"

Take a look for yourself at Trump's team as it gears up to deliver more policy details.

Steven Roth

Founder and chairman of Vornado Realty Trust, Roth has an MBA from the Tuck School of Business and is worth about $1 billion.

Referred to as the "strip mall king from the suburbs," Roth swept into the New York real estate in the 1990s. He and Trump have been both partners and rivals. The two competed in 1995 for the ownership of Alexander's department store chain — and its valuable real estate.

Roth has also sat on the board for retailer JC Penney.

Harold Hamm

Hamm is the CEO of Continental Resources, an oil and natural gas producer in Oklahoma City. Without anything more than a high school diploma, the businessman has amassed a net worth of roughly $5 billion.

Despite making his wealth in oil, Hamm lately hasn't been the greatest predictor of the commodity's price. In 2014, he predicted oil would bounce back to $100 from around $80. Today, oil sits around $42. (He also said he expects oil to rebound by the end of 2016.)

Hamm was Mitt Romney's energy adviser in 2012, and his positions on energy issues are conservative: He's pro-fracking, and thinks global warming is a hoax.

Howard Lorber

Another real-estate mogul on Trump's economic team is Lorber, who's the president and CEO of holding company the Vector Group. One subsidiary is Douglas Elliman, the largest residential real estate firm in the New York City area, which he chairs.

Lorber is also the executive chairman of the Nathan's Hot Dog company, owning a 22% stake in the firm that last year brought him an estimated $25 million of a special dividend payout. His compensation from Douglas Elliman was $42.5 million in 2015.

In a New York Times piece, Trump says one of his best friends is Lorber.

Steven Mnuchin

After he put in 17 years and built a fortune worth a reported $46 million from Goldman Sachs, Mnuchin left to work in the hedge fund business. He's currently the chairman and CEO of Dune Capital, which has funded a number of hit movies, such as Avatar.

Mnuchin made out with $3 million in Madoff money from his late mother’s account, or so was the claim in a lawsuit that was eventually dismissed. Turns out, notorious money manager Bernie Madoff had handled Mnuchin’s mother’s accounts—before Madoff’s ponzi scheme was uncovered.

Interestingly, like Trump, Mnuchin has donated money to Democrats as well as Republicans over the years.

Tom Barrack

Founder and executive chairman at Colony Capital, Barrack is also a top Trump fundraiser, holding events for the pro-Trump Rebuilding America Now Super PAC.

Barrack works in private equity and real estate, and attended the University of Southern California and the University of San Diego's law school. Now, he also owns Michael Jackson's Neverland Ranch and a California winery. Barrack correctly predicted the housing bubble, saying he thought prices were sky-high and properties overvalued in 2005.

Of Barrack, who competed with Trump over various real estate deals over the years, the GOP nominee says: “Amazing vision…no one can match.”

Stephen Calk

Calk is the chairman and CEO of the Federal Savings Bank, a veteran-owned bank focused on Veterans Administration and Federal Housing Authority loans for military and first-time home buyers. It is one of the largest bank home lenders. His primary experience is in residential real estate financing and home loans.

A graduate of the University of Illinois Urbana-Champaign and the Kellogg School of Management, Northwestern University, where he earned an MBA, he was an Army helicopter pilot on active duty and as a reservist.

John Paulson

John Paulson is the president and CEO of investment firm Paulson & Co., which runs hedge funds. Paulson, a former investment banker at Bear Sterns, was one biggest winners from the mortgage crisis: Long before others, he foresaw the dangers of loose housing lending standards and subprime mortgages. He won billions betting against mortgages, using instruments called credit default swaps.

The hedge fund manager is worth about $9.7 billion. In 2012, he donated money to Mitt Romney's presidential campaign.

Andy Beal

A soured casino deal in 2009 didn't stop Trump from naming Beal, a banker and well-known poker player, to his economic team. Beal is another friend of Trump, and the two tried to work out a deal to save Trump's casino company from bankruptcy in 2009, opposing a group of bondholders who wanted to win control the business. At the last minute, though, Trump sided with the bondholders and cut Beal out of the deal.

Beal's $9.4 billion fortune is, in part, made from—you guessed it—real estate. He started in the 1980s as a vulture investor, scooping up distressed properties and turning them around. Once, he played high-stakes poker in Las Vegas with a minimum bet of $100,000.

Steve Feinberg

Running a powerful private equity firm, Cerberus Capital Management, and worth about $1.1 billion, Steve Feinberg nevertheless likes to stay out of the spotlight. Because the Princeton-educated money man is so incredibly private, it's tough to say what his advice to Trump would be.

He is no stranger to risk taking, though. Feinberg's Cerberus took over Chrysler in 2007, thinking the ailing automaker could be turned around. No such luck. The Great Recession scotched those ambitions, and Cerberus booked a big loss. Chrysler tumbled into bankruptcy and Cerberus lost control of the company. Feinberg himself pleaded with lawmakers to bail out the U.S. auto industry, an uncharacteristic move for a free-market enthusiast and Republican.

David Malpass

Malpass has got one of the longer political resumes on the Trump economic bench. In 2010, he lost a primary for a U.S. Senate seat from New York. Malpass, who is the founder and president of economic research and consulting firm Encima Global, also served as the deputy assistant Treasury secretary to President Ronald Reagan and deputy assistant secretary of state to President George H.W. Bush. He also was chief economist at Bear Stearns, which went bust in the Great Recession.

Malpass takes a pretty clear economic position against quantitative easing and "helicopter money," a way of describing how the Federal Reserve and other central banks pushed money into their economies to spur growth. Instead, he said, "central bankers should be forcefully urging their governments to pursue practical growth-oriented solutions that encourage private investment and hiring."

In May, Malpass warned the House Financial Services Committee that the Fed's economic stimulus policy of buying bonds was counterproductive.

Stephen Moore

Economist Moore—notably one of the only economists on Trump's team—is a strong conservative voice advocating free-market policies and supply-side economics. A one-time congressional aide and Wall Street Journal editorial board member, he has engaged in intellectual combat with, among others, New York Times op-ed columnist and Nobel-prize winning liberal economist Paul Krugman.

Moore served as president of the Club for Growth, an advocacy group that argues for tax cuts, from 1999 to 2004, and is now a fellow at the Heritage Foundation, a noted conservative think tank.

Dan DiMicco

DiMicco is the former CEO of Nucor, an American steel company. This is a fitting addition to the Trump team after the GOP nominee's speech on Monday pledging that "American steel will send new skyscrapers soaring."

The steel exec has views that line up with Trump's, such as support for rebuilding America's infrastructure and dismay over the U.S.'s foreign trade policies, which he feels give China and other foreign competitors an advantage.

Peter Navarro

Peter Navarro is a professor at the University of California at Irvine, and the only member of Trump's economic advising team who has an actual doctorate in economics.

Navarro is often focused on how trade with China is no good for the U.S. The economist wrote a book, and put together a corresponding documentary, called Death by China, which chronicles how the U.S.- Chinese trade deficit has harmed the American economy.

Navarro has also published papers on energy policy, including ones on electricity deregulation and the costs of nuclear power.

Wilbur Ross

Ross built his $2.9 billion fortune by investing in distressed assets, notably companies in the throes of bankruptcy. Lately, his focus has been on floundering banks. During the European banking crisis, he invested in the troubled Bank of Ireland, and made back his money threefold.

In 1998, Fortune called him “the king of bankruptcy.” A consummate dealmaker, which must endear him to Trump, Ross has restructured ailing companies in steel, textiles, coal, and auto parts.