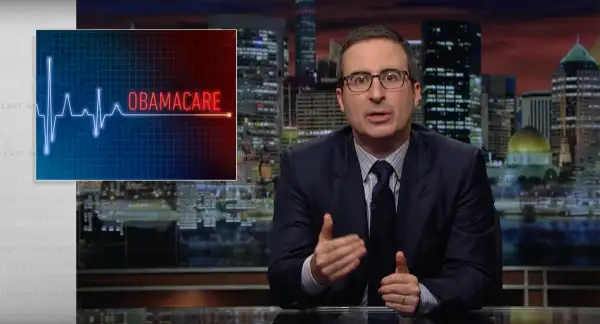

Watch John Oliver Explain Everything Wrong With the Plan to Repeal Obamacare

Republicans don't have a replacement plan for Obamacare yet, but, as 2016 Money Champion John Oliver explains, if they adopt the House plan that's currently circulating, low income and middle class Americans may lose out.

On yesterday's Last Week Tonight, Oliver breaks down the main points of the GOP outline, noting that one of the biggest differences between it and the current law is the promotion of health savings accounts. HSAs are tax-advantaged savings accounts (you put pre-tax dollars in and get tax-free distributions for qualifying medical expenses) that are tied to qualifying high-deductible health plans.

The GOP plan, if based on House Speak Paul Ryan's "Better Way" plan, would effectively double the contribution limit, raising it to $6,550 from $3,400 for an individual, and to $13,100 from $6,750 for a family.

"The key problem with HSAs should be obvious here—they're great for rich people, they're basically a tax shelter," Oliver says. "But if you're too poor to save or you get sick enough to blow through what you save, you're not going to be covered."

Indeed, HSAs are a great deal for the wealthy, who are in higher tax brackets than lower earners and therefore receive a bigger tax break by putting money into the accounts. For example, a wealthy tax payer in the highest federal bracket would save $39.60 for every $100 put away in an HSA, while someone in a the lowest bracket would save $10.

As Oliver alludes to, increasing the HSA contribution limit assumes that people will have extra money to save, a stretch considering nearly six in 10 Americans report not having $500 to $1,000 on hand for an emergency, according to a recent Bankrate survey.