From Deliveries to Gift Cards, Here's What Small Businesses Are Doing to Cope with Coronavirus

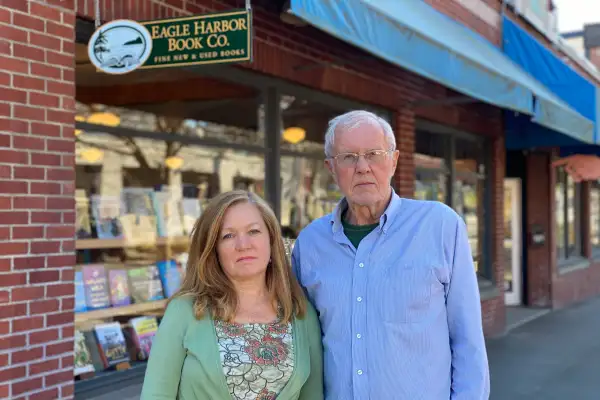

On a typical March day, Jane and Dave Danielson can count on around 100 customers at their bookstore, Eagle Harbor Book Co., on an island just across Puget Sound from Seattle.

That was before fear of coronavirus gripped Washington State — so far one of the worst-hit areas in the U.S. On Tuesday, the couple rung up just 10 shoppers. Meanwhile, orders are down 60%. Book clubs that frequently come to meet have gone on hiatus.

“Fewer and fewer people are coming in,” says Jane Danileson, 60, who has started to worry about the business — not to mention her family’s financial situation and her 16 employees. “Every day is a little bit worse than the one before,” she adds.

The Danielsons run just one of nearly 30 million small businesses in the U.S.. These firms, defined as those with fewer than 500 workers, employ 57 million people, according to 2019 data from the Small Business Administration.

No one knows exactly what the coronavirus’s effect on small business will ultimately be. Firms whose employees can work remotely from home, such as software companies, will likely come out better than those whose businesses involve physical goods and services, and where the business model involves meeting in person.

“It’s tough to answer all the questions, because we don’t have the answers,” says financial planner Mike Hennessey, founder of Harbor Crest Wealth Advisors in Fort Lauderdale, Fla. “I can’t tell business clients, “If you just do this, we’ll all come out like roses.’”

Although there’s no set prescription for successfully weathering the pandemic, there are strategies, such as moving work away from other people, protecting cash flow, and planning for the long term, that may help small businesses stay afloat while minimizing losses, say financial planners and business owners.

Expect that the virus’s economic effect may last as long as 18 months

In Blaine, Minn., Robin Green owns Angelique’s, a shop that sells bridal gowns and dresses for bridesmaids, proms, and other special occasions. “In January and February, we were on track for a record year, but all of that has come to a screeching halt,” Green says. “I have about three months of financial reserves, and I don’t know how we’re going to make it through.”

Cancelled and postponed weddings translate into lost sales, which is Green’s immediate problem. But Green also sees trouble in her supply chain and thinks the virus’s total effect on her business will last six months to a year or more. “Right now, I’m supposed to be at a market in Chicago to buy dresses for the fall,” she says. “But the market was cancelled and I don’t have money to buy dresses.”

Even if she did have the money she needs to restock for the autumn, Green points out that dresses are made in many places, but virtually all fabric comes from China — and if Chinese mills aren’t making fabric, dresses will be hard to come by for a while. “I think the wedding industry will be in a harder place in a year,” she says.

If you can, work in ways that maintain social distance

Eagle Harbor Books has begun delivering purchases to its customers’ homes. “There’s nowhere on the island that’s more than 15 minutes from here,” Danielson says. The shop also offers direct shipping from the distributor on anything it has to order.

Selling books happens in person, but some bookstore tasks can be done from home or in the store’s back office. “By working from home, someone could do web site upgrades and social media posts, or buy books and gift items that are new to us,” Danielson says. Restocking has to happen on the store’s computer system, but could be handled in a back office, away from other people.

Divide expenses into “must have” and “nice to have”

Theater Latte Da, an independent theater in Minneapolis, plans to spend some of its cash reserve. It’s also sorting its expenses into “must pay” and “would like to pay” categories. “We’ve implemented a spending freeze on everything that isn’t a fixed expense,” says Michelle Wooster, Latte Da’s managing director. Fixed expenses include mortgage payments, utilities, insurance, and payroll. “We’re not taking donors out for coffee, not spending money on next season, and reducing cleaners while there are fewer people in the building,” she says.

At the bookstore, Danielson says that a staff member is leaving in April, and she probably won’t be replaced immediately.

Helen Ngo, founder and financial planner at Capital Benchmark Partners in Atlanta, is also holding off on hiring. “I was going to hire a part-time public relations and marketing person, but I’m not going to do that anymore. I don’t want to dry up my funds,” Ngo says. She adds that she’s advising clients who own small businesses not to hire right now, either. “I’m expecting that unemployment will rise for this quarter,” she says.

Expect to use some savings

Business owners with emergency funds should expect to use them. Kelley Raye, a wedding and special-event photographer with bases in Los Angeles and Atlanta, says that she had four postponements and one cancellation on a single day in mid-March.

The clients who have cancelled their wedding celebrations have asked for a full refund. Raye’s contract stipulates that her fees are not refundable. In this instance, though, she says she will reach into her personal savings and refund the couple in full. “I’m going to bite the bullet,” she says. “I won’t be the only vendor they’re asking for a refund.” Moving forward, she says, is more valuable to her than arguing.

Take whatever help you can

According to the U.S. Chamber of Commerce, small businesses affected by the coronavirus have a variety of resources. The Small Business Administration is offering disaster assistance loans of up to $2 million. States and cities are working to assist small businesses. For example, Washington State is offering no-interest loans for firms with cash-flow problems. The New York City Department of Small Business Services says it will provide loans and grants.

The federal government is also rushing to fill the breach. Among the various plans, the Trump Administration has proposed offering firms with 500 or fewer employees loans to cover six weeks of payroll, up to $1,540 per worker, as long as they keep paying their employees for eight weeks after receiving the loan, according to The New York Times.

In addition, some banks and credit card companies have indicated a willingness to help customers who hit difficulties, and some have offered to waive service fees. A number of states are allowing unemployment claims from people who can’t work because of the corona virus.

Danielson says that Eagle Harbor is getting help from customers, too. “Some community members have ordered very large gift cards because they want us to have some income,” she says. “We’re having lots of requests for books home delivered. We are fairing about as well as can be expected, although who knows what the next week or month will bring.”

More from Money:

Coronavirus Continues to Tank the Stock Market. Here's Why — and What To Do About It

Can't Pay Your Credit Card Bill Because of Coronavirus? Here's What to Do

Mortgage Rates Are Near Record Lows. Here's How to Figure Out If You Should Refinance