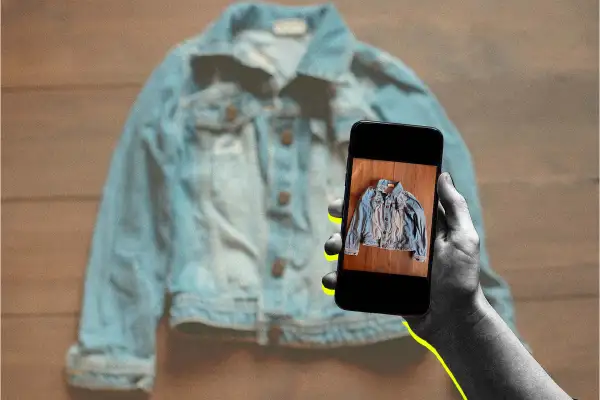

Is Shopping Secondhand the Perfect Tariff Loophole?

Your next pair of sneakers might cost 40% more — unless you’re willing to buy them secondhand.

The Trump administration's latest round of trade measures is set to push the price of apparel and footwear higher. Yale University’s Budget Lab estimates that both shoes and clothing could see price increases of roughly 40%.

Although an appeals court struck down the president’s tariffs on Aug. 29, the affected tariffs will remain in place through at least Oct. 14.

For consumers already wrestling with the effects of inflation, these price hikes are nudging more shoppers to consider secondhand options. And this isn’t just a short-term reaction — resale had been gaining momentum even before tariffs entered the picture.

Over the past seven years, the U.S. retail resale market has nearly doubled in size from approximately $23 billion in 2018 to $43 billion in 2023. It is projected to reach $74 billion by 2029, according to ThredUp’s annual resale report.

TikTok thrift hauls — the hashtag #thrifthaul has garnered more than 93 million results on the app — along with sustainability influencers and eco-conscious shoppers, have fueled the trend. But the resale boom isn’t just about what’s trending online.

Younger consumers, especially members of Generation Z, or people born between 1997 and 2012, are driving the shift.

Approximately 83% of Gen Z have either purchased or are interested in secondhand apparel — about 11% higher than the average across all other age groups, according to a Capital One Shopping survey. Shoppers aged 25 to 34 now make up the largest share of the secondhand market, while older consumers remain less likely to buy used clothing.

David Eagles, chief operating officer of Goodwill Industries, says that the shifting attitudes toward resale have been transformative. “It’s young people driving the trend,” he explains.

“Their willingness to shop secondhand means the stigma is largely gone. I think they see the environmental benefit. They see the uniqueness of what we bring. And that was not necessarily the case 10, 20 or 30 years ago.”

The pandemic gave that shift even more momentum. For instance, Eagles notes that Goodwill’s network today is 50% larger than it was pre-COVID, reflecting an influx of both donations and shoppers.

Now, tariffs could accelerate it, turning what was becoming a lifestyle choice back into more of an economic necessity.

“When Gen Z consumers see the price go up for regular clothing, they’re more interested in purchasing secondhand clothing,” says Sheng Lu, a professor of fashion and apparel studies at the University of Delaware. Their influence, combined with broader economic pressures, has helped transform resale from a niche choice into a mainstream habit.

Non-profit thrift stores and digital resale platforms are already noticing the ripple effects, though experiences vary. Some report booming donations and higher foot traffic, while others say shoppers are browsing as much as ever but buying slightly less, likely because rising prices on everyday essentials are forcing people to tighten spending on non-necessities.

Overall, experts remain optimistic because retail resale inventory comes from donations rather than new imports, meaning the market is largely insulated from tariffs.

That resilience, combined with growing interest from younger consumers, suggests secondhand could continue serving as a buffer against rising retail prices — even if the long-term picture is still unfolding.

A market insulated — but not immune

One reason resale remains largely insulated from tariffs is that secondhand clothing has already been purchased once — it isn’t coming directly from overseas. This buffer keeps prices lower than retail, but it’s not foolproof.

That means donated items can move through the secondhand market without incurring import duties, giving shoppers a more affordable alternative when retail prices rise.

“When retail clothing prices rise, secondhand apparel becomes a natural buffer for consumers,” says Lisa Rusyniak, president and chief executive officer of Goodwill Industries of the Chesapeake.

“We’ve seen time and again that shoppers turn to Goodwill during times of economic uncertainty because they can stretch their budgets further without sacrificing quality.”

But the surge in interest is putting pressure on stores in different ways. As more shoppers turn to resale, many are becoming increasingly price-conscious, carefully weighing each purchase rather than impulsively buying.

“We have noticed the uptick in customer demand on the shopping end as well as the consigning and selling end,” says Jennifer Johnson, founder of True Fashionistas, a Florida-based consignment shop.

“However, customers are looking for [a] deal. Last year, they may have purchased more items or purchased slightly more expensive items, and this year, the average price per item is down, not a lot, but nonetheless, it is down.”

Another pressure resale stores face comes from the supply side. Rusyniak explains that if tariffs make new clothing more expensive, demand for secondhand clothing rises, which could strain supply.

Additionally, disruptions in the broader retail market could lead consumers to hold onto items longer, reducing donations. Competition could also intensify as more players see resale as a solution.

Bargains under pressure

In addition to shoppers' strained budgets and supply pressures, thrift shops and secondhand stores are feeling the effects of rising demand on certain items, which is putting upward pressure on prices.

“Even for secondhand clothing, consumers are facing higher prices,” says Lu. “The most in-demand items are these relatively few good-quality and branded items.” So, as more consumers seek out these popular items, their prices will increase.

It’s a classic case of Econ 101: Price depends on supply and demand. As Lu notes, the supply of secondhand clothing ultimately depends on new purchases — if fewer consumers buy new, fewer items will trickle into the resale market.

Shannon Erickson, manager at Delivering Dreams of Arizona, a non-profit organization based in Phoenix, says her store is feeling the pressure as well. “Our donations have doubled,” she says.

“We’ve been working hard just to keep up with the amount, [but] I’ve noticed that some volunteers have had to go back to work to keep up with rising costs, which puts us in need of more volunteers to keep the store running smoothly.”

While resale remains largely insulated from tariffs, the market is navigating a unique and unpredictable environment. Ken Murphy, chief innovation officer at OfferUp, a digital marketplace, points out that the current environment is unlike anything the resale market has seen before.

“Impacts are not symmetrical, with different goods categories affected to differing degrees,” says Murphy, including non-garment items. For instance, OfferUp saw searches for e-bikes surge into the platform’s top three trending queries after tariffs were announced in March.

By May, baby and kids’ products began climbing into the top 25 as price increases hit that category. Those real-time shifts, he notes, suggest consumers are turning to secondhand as a smart alternative when new goods suddenly get more expensive.

“No one knows for sure how this will impact the resale market, but past experience suggests that supply chain disruptions are likely to have a more pronounced impact on resale markets than overall price increases,” Murphy notes.

For example, he points to early COVID trends on OfferUp, when resale prices for home office furniture fluctuated as supply and demand shifted, illustrating the uneven effects of supply shocks.

Looking forward

While it’s too early to know exactly how tariffs will reshape the resale landscape, experts agree that maintaining a steady flow of quality donations and inventory will be key. “While tariffs don’t hit us head-on, their impact could be felt in donations, demand and competition,” says Rusyniak.

Despite these pressures, resale remains a standout option, offering both a budget-friendly and sustainable option. “The tariff situation creates a phenomenal opportunity for the resale industry,” says Johnson. “It’s our time to step up and show the world the value of shopping resale.”

For consumers, the takeaway is that secondhand shopping remains a practical alternative to rising retail prices. However, the availability of sought-after items, sizes and categories may fluctuate — but that’s the nature of shopping secondhand.

Still, shoppers can stretch their dollars further by planning ahead — shopping off-season, participating in clothing swaps, buying only what’s needed, exploring yard sales or browsing online resale platforms. By considering alternatives before buying something new, shoppers can find bargains even as tariffs push up retail prices.

More from Money

How Tariffs Are Affecting Your Favorite Small Businesses

Trump's Tariffs Are Likely Headed to the Supreme Court. What Now?

'No Place to Hide': Where and When Trump's Tariffs Will Hit Your Wallet