The Stock Market Just Had Its Best Month of 2021. What's Next?

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

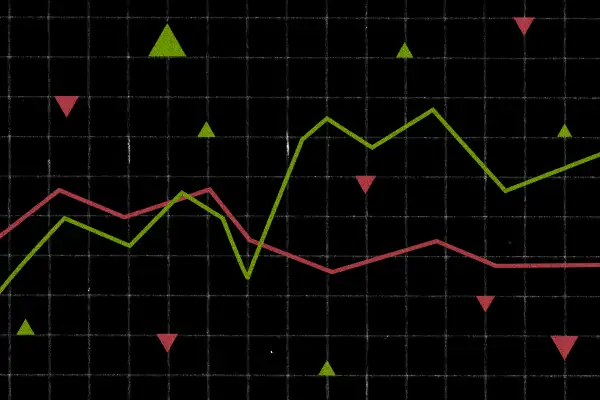

The stock market had a very good October this year.

The S&P 500 — a benchmark commonly used to measure the strength of the overall stock market — gained 6.9% last month, the biggest monthly gain so far for 2021.

The Dow and the Nasdaq were also up 5.8% and 7.3%, respectively, in October. It was the S&P 500 and the Nasdaq's best monthly performances since last November, and was especially noteworthy because October is known for being particularly volatile for Wall Street.

Stocks were buoyed last month in part by strong corporate earnings despite concern about global supply chain issues that have led to shortages and higher prices. Earnings reports from major companies like Alphabet (Google's parent company) and Microsoft exceeded Wall Street's expectations in October. The S&P 500 is reporting the third highest year-over-year growth in earnings since the second quarter of 2010, according to data from FactSet.

Though there's plenty of uncertainty — and many experts see a correction in the near future — the market's strong October performance bodes well for the rest of the year.

What to expect from the stock market in November

As we've learned time and time again, it's impossible to predict the future of the stock market. But history shows that the rest of 2021 may have a positive outlook.

On October 21, the S&P 500 recovered from the 5.2% pullback it suffered in September. In the month after recovering from the prior 60 declines of 5% to 10% since World War II, the S&P 500 rose an average of 3.3%, according to Sam Stovall, chief investment strategist at CFRA Research. And in the 20 times since WWII that the S&P 500 set an all-time high in October, the S&P 500 gained an average 3.2% in price in November, he adds.

Meanwhile, strong earnings are expected to continue into the rest of the year: analysts expect earnings growth of more than 20% in the fourth quarter and more than 40% for the full year, according to FactSet.

Plus, the holiday season tends to be a sweet spot for the stock market, thanks to healthy consumer spending and companies enjoying the profits of our gift-buying.

So, what should everyday investors do?

"They should just go with the flow,” Stovall says. "If they’ve been thinking about adding to holdings, go ahead and do so with well-researched investments. And if they have a good exposure to equities, just ride it out.”

Remember: it's always best to come up with an investing plan that meets your risk tolerance and goals and will help you maintain a diversified portfolio. Then, stick to it and regularly rebalance your portfolio (something you can add to your end-of-year to-do list).

More from Money:

The Best Money Moves for November 2021

You're Not Actually Saving Any Money by Holiday Shopping Early (Sorry)

This Simple Chart Shows When to Expect the Next Stock Market Correction