Student Loan Borrowers Just Received Another Month of Relief. Here's Why It Could Be Much Longer

The Education Department gave millions of Americans a brief reprieve Friday when it extended a payment pause for federal student loans for an additional month. Ultimately, borrowers may be able to avoid making payments until much later in 2021, experts say.

Relief for student borrowers had been scheduled to expire at the end of the year. The announcement from the Education Department officially extends the relief through Jan. 31, and it helps to avoid a chaotic situation in which borrowers may have been required to make one payment in January before then being put back into forbearance.

Several experts told Money in interviews around the election that there was a very high likelihood an incoming Biden administration would continue a policy started under the CARES Act by leaving interest at 0% and allowing federal borrowers to avoid making payments for at least a few months into 2021, if not longer.

“There’s generally recognition that it needs to be extended across the board, given that we’re still in the thick of the reason for doing it in the first place,” Michele Streeter, a senior policy analyst at The Institute for College Access and Success, said at the time.

Consumer advocates have been warning for months that flipping a switch to resume payments for all borrowers in January would cause many to fall behind. A poll by Pew Charitable Trusts earlier this year found that nearly six in 10 borrowers would find it somewhat or very difficult to begin paying back their student loans again.

Here are three things borrowers need to know.

Extended Relief Will Happen Automatically

If you have qualifying student loans, you will continue to have 0% interest through the end of January. The additional month of administrative forbearance will also continue to count toward the number of payments required under an income-driven repayment plan, a loan rehabilitation agreement, or the Public Service Loan Forgiveness program. Payments aren't required, but if you are able to pay between now and the end of January, all of the money will go toward your principal balance, which will help you pay off your debt quicker.

The extension will be automatic; you don’t need to do anything to take advantage of it.

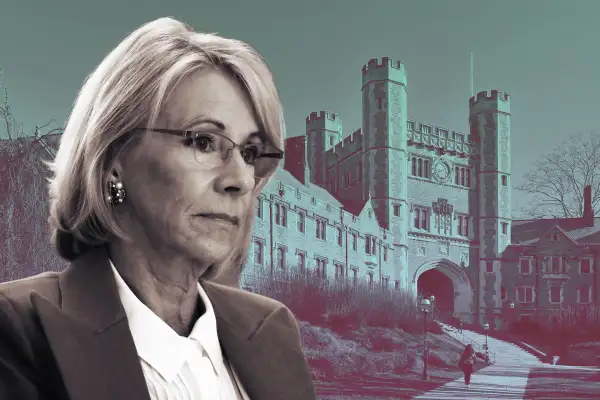

Education Secretary Betsy DeVos said in a statement that the extension gives Congress additional time to “do its job and determine what measures it believes are necessary and appropriate.”

Mixed Messaging Might Continue

In recent weeks, the companies that manage loan repayment for the government had already begun notifying borrowers that payments would resume in January. Now those loan servicers have to reverse course and tell borrowers that the current relief measures will continue.

What's more, it’s likely you may see similar mixed messaging next month unless Congress acts to pass a stimulus bill before then. An incoming Biden administration won’t be able to extend the forbearance period until after the inauguration on Jan. 20. But like they did this time, the loan servicers will have to begin informing borrowers that their payments are set to resume in February because they can’t hold off on the assumption that the Biden administration will act.

Payments May Not Resume Until Next Fall

Extending the relief past the end of January could be done via legislation if Congress agrees on a new pandemic relief package. If not, Biden and his education secretary can continue the relief via executive order, as President Trump did in August.

Biden hasn’t said whether he would extend the payment pause for federal borrowers. But he has said he supports some of the student loan relief measures in the Heroes Act, which includes giving federal borrowers a reprieve from payments until September 2021.

That's also the date proposed by more than 75 organizations in a letter to the Education Department earlier this year. And in November, the leaders of three prominent higher education organizations recommended that student loan payments be paused until Sept. 30, 2021 or until the unemployment rate has fallen below 8% for three consecutive months.

Robert Kelchen, an associate professor of higher education at Seton Hall University in New Jersey, told Money in November that he expected a Biden administration would extend the interest-free payment pause period through next September, and he repeated that prediction in a tweet after the Education Department's announcement.

Other experts also said they expected the policy to last beyond January, though they offered more conservative predictions of March or June of next year.

If the September timeline sticks, that means more than 40 million borrowers would have 0% interest for 18 months. For those who can still afford to pay their monthly payments, that could add up to significant savings for some borrowers. Graduate degree holders with debts around $50,000, for example, would normally be accruing roughly $250 in interest each month.

More from Money:

The 3 Current Student Loan Forgiveness Proposals: Who Would Qualify?

What Can Student Loan Borrowers Expect Under a Biden Presidency?

Student Loan Strategies: How to Borrow Smartly (and Maybe, Less) for College