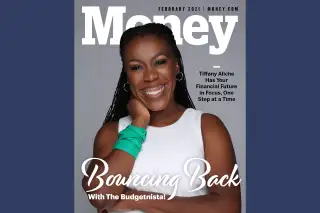

5 Lessons About Money (and Life) From the Budgetnista, the Financial Educator America Needs Right Now

Tiffany Aliche isn’t interested in being your financial guru.

As The Budgetnista, she wants to be your best friend. Your confidante. A self-described Harriet Tubman pathfinder with warm Mr. Rogers vibes. Above all, she wants to be your teacher.

“Having educators is great. You’ll have teachers your whole life. But making people your guru, your god, I think that is dangerous,” she says.

The New Jersey-based Aliche calls herself “America's favorite financial educator” for a reason, and it’s not only because she’s taught millions to live richer with a growing empire that includes online money challenges, a membership-only academy, a podcast, eight self-published books and a huge social media presence. It’s because in her eyes, the very concept of the guru is a lie. One person can’t be an expert in everything. Anyone who claims to know it all is pretending.

Aliche certainly doesn’t. Roughly a decade ago, in the thick of the Great Recession, she lost her job as a preschool teacher and landed so deep in debt she had to move in with her parents. She spent years going back to basics, studying up and climbing out of the hole.

Now at 41, she’s come a long way. Aliche is quick to make fun of her 2008 self, imitating Past Tiffany’s thought process in a high-pitched voice as Present Tiffany points out errors. She gushes about how her businesses were incredibly profitable last year. She talks excitedly about how she’s written a bill to stop racial discrimination in home appraisals as well as a new book, Get Good with Money, set to come out in March.

Despite the laundry list of accomplishments, Aliche insists she’s a teacher at heart. And she’s committed to that approach, especially as the pandemic drags on and people continue to flock to her for advice.

“My job as a teacher is to create a safe space for you to learn and grow. It is not for me to tell you credit cards are the devil,” she says. “I’m here to give you the best information possible so you can decide how to make the best choices for yourself.”

Trying to recover from job loss, an eviction or just the incredibly hard year that was 2020? Here are five key tips from The Budgetnista to help you bounce back. Pay attention closely, and you might learn something.

1. When in debt, forgive yourself

Aliche likes to say she was “financially perfect” until age 26. The daughter of a CFO and a nurse who’d stop in grocery store aisles to explain why it’s better to buy in bulk, Aliche grew up constantly learning about money. In college, she coached her roommate through phone calls with debt collectors. She bought a car in cash. By age 25, she had saved up $40,000 and purchased a condo.

But then a run-in with an investment scam led to reckless spending. She racked up $35,000 in credit card debt. Her gold-star streak was over. At 29, Aliche moved home, following a midnight curfew and sleeping on the twin mattress she’d used in middle school. It was a dark time.

“I didn’t speak to anyone,” she says. “I wasn’t calling my friends because my identity was Tiffany, the friend that was good with her money. And now I wasn’t her anymore.”

Eventually, a gal pal finally tracked her down. All it took was one “How are you?” for Aliche to start bawling down the phone line. Her problems came tumbling out: the scam, the debt, the embarrassment. Her friend’s nonchalant reply — “Oh, that’s it?” — sparked an “aha” moment Aliche carries with her still today.

“You have to forgive yourself, because if you’re carrying around the shame that means you’re shielding yourself from the solution,” she says. “It’s OK. You’re not a terrible person. You don’t kick puppies; you used your credit card. It happens.”

In retrospect, Aliche realizes the shame had been preventing her from moving forward. Now, she advocates for people to stop beating themselves up for their money mistakes. You went overboard on Uber Eats last month? Fine. Recognize it and move on. Guilt will get you nowhere.

2. Tackle your money problems one at a time

It’s easy to dispense money-saving advice like “cut your cable” or “forgo your daily latte,” but Aliche knows from experience that those surface-level tips don’t always suffice. When she was broke, she used to wait until her parents went to church and sneak into their deep freezer to swipe meals because she couldn’t afford food.

Those memories resurfaced last spring, when 20.5 million Americans lost their jobs like she did during the last economic downturn.

“This pandemic had me reach back to Tiffany from 10 years ago and say, what missteps did I make? What did I wish I would have heard when I lost everything?” she adds. “And it wasn’t a matter of cutting cable.”

Aliche praises the value of prioritizing — adopting different budgets based on the severity of your current crisis. The bare minimum is what she calls a health and safety budget: spending whatever’s necessary to protect your health and safety. A bump up from there is your noodle budget: the guidelines you follow when you’re so strapped for cash that you’re eating cheap ramen noodles for every meal. That means no Netflix or salon visits.

These budgets have simple names and clear directives on purpose. Aliche knows mastering money can feel like an overwhelming prospect, especially when you're backed into a corner. So in her new book, she breaks down the 10 steps to financial wholeness, including budgeting, investing and estate planning.

“Me being a teacher, it’s not just enough to say, ‘You need a budget. You need credit,’” she says. “It’s why you need these things, and here’s a step-by-step to exactly how you achieve these things.”

The book is a fun read, studded with personal anecdotes, references to Oprah Winfrey and unexpected tips like to light a scented candle while you budget or to plug your TV into a power strip to save on energy. At the same time, though, it patiently walks you through the actions to take to get yourself situated financially. Think: Baby steps.

3. Combine mechanics with mindset

Not every task in Aliche’s book requires a lengthy journey of self-discovery to complete. One simple exercise is to automate your paycheck. Ask the human resources department at work if it can split your wages before you get them. Ideally, you’d have each paycheck divided among four accounts: one for bills, one for everyday spending, one for an emergency fund and one for long-term savings.

Automation can be an amazing tool because it’s quick to set and forget. Aliche likes to say that “automation is the new discipline” — to an extent.

After all, it’s only one incremental action. Nailing the mechanics is good, but deeper understanding is great.

Otherwise, you could lose your momentum. Say you later change jobs to a place where they refuse to split paychecks. Without an attitude adjustment, you’ll likely find yourself right back in the same spot of struggling to save.

“Automation is only as good as the instructions you give it. This is where mindset and a clear understanding of your financial goals come in,” Aliche says. “You are the brains and heart, and automation is the hand.”

Personal finance is full of topics like this. Take building your credit score, for example. Aliche says one way to do this is by starting with a secured credit card. It’ll require you to put down a deposit, and that will be your spending limit. If you use your secured card responsibly for six months, your bank may upgrade you to an unsecured card (and return your money).

The tool — the card itself — is a nice way for beginners to hack the system. But if you don’t actually learn how to use the tool responsibly you’re never going to grow.

It’s important to appreciate how it’s all connected.

“We all need to know our ‘why’ and ‘how’ when it comes to our money,” she says.

4. Find a community to support you and provide accountability

Growing up with four sisters meant Aliche always had a strong community. As The Budgetnista, she formed the Dream Catchers. (Think Beyoncé’s Beyhive, but for money.)

A support group of women reaching for their financial goals, the Dream Catchers started small and grew quickly. There are now 465,000 members in the Dream Catchers Facebook group, plus about 20 official chapters of the organization. The group has a presence in more than 100 countries; it's collectively saved more than $200 million.

Aliche may technically be the leader, but she credits the community itself for much of that success. Dream Catchers are mostly Black women, which provides a natural starting place for members to relate to each other. They provide both empathy and inspiration. It’s reminiscent of Aliche’s classroom days when she’d pair off students so they would pick up good habits from each other.

“If you’re struggling, and you’ve got three kids, and your husband’s out of work, and you see someone else who’s struggling, and they’ve got three kids and their husband’s out of work … they’ve normalized that,” she says. “ It’s hard for you?’ ‘Me, too.’ ‘You’re struggling?’ ‘Me, too.’”

Because the Dream Catchers communicate largely via social media, it also reminds people they’re not alone. Aliche hosted a live video recently where she asked the 5,000 viewers to write “I did” in the comments if they lost their job, saw a reduction in income or had trouble paying their bills in 2020.

“For two minutes, all you saw was ‘I did,’ ‘I did,’ ‘I did,’” she says.

Even if it’s not the Dream Catchers, Aliche recommends you find a community — your sister, mom, colleague, whomever — and seek out accountability. Tell them your goals. Ask them to help you stay the course when it gets tough. And don’t forget to share the (eventual) wealth.

5. Speak up about injustices

You can’t follow Aliche on social media without noticing her frequent posts about politics and racial justice. There’s a saying that money is green, not black or white, but that’s not true for her.

“For me, my gender and my race play a role,” she says. “I don’t have the privilege as a Black woman to stay quiet.”

Aliche explains that she uses frustrating injustices as motivation in her mission to educate people about money. Statistics like the fact that Black women get paid 63% of what white men have become fuel for The Budgetnista.

“If you are not being paid fairly at work because you're a Black woman, at least I can teach you how to take that money and make more of it elsewhere,” she says. “The stock market does not know your color, does not know your gender. Investment properties do not know your color and gender.”

Relatedly, last year, she and her husband had their home appraised so they could refinance. Aliche later discovered the appraiser undervalued the newly renovated house by $30,000. Incensed, she tweeted about appraisal discrimination. A legislator friend saw Aliche’s post and reached out; now the two have proposed a state bill laying out consequences for appraisers who value homes based on the owners’ color, creed, nationality or race.

If passed, it will actually be Aliche’s second New Jersey law. In 2019, she helped author The Budgetnista Law, which makes it mandatory for middle schools to teach financial literacy.

So if you’re not happy with the way things are, speak up. Change things. Seek out knowledge, encouragement, and community. Learn from The Budgetnista — as a teacher, not a guru — and do the work to get back on the right track.

“I’m not here to save you,” she says. “I’m here to give you the tools and the lessons you need so you can save yourself.”

Class dismissed.