Trump Plans to Move Student Loan Portfolio to SBA. Here's What Borrowers Need to Know

The Trump administration is moving forward with the idea to transfer the government’s $1.6 trillion student loan portfolio to another government agency.

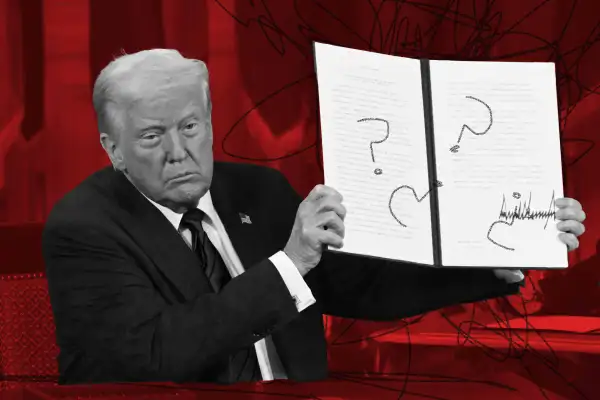

President Donald Trump said Friday that management of federal student loans would move from the Education Department to the Small Business Authority, or SBA, "immediately." It's likely the move will face legal pushback.

The announcement comes after a chaotic period at the Education Department, which oversees student loan repayment for more than 40 million borrowers. On Thursday, the White House issued an executive order aimed at dismantling the department, and last week the department announced layoffs that will cut the agency's staff in half.

Higher education groups and student advocates had already expressed deep concerns about the plan for redistributing the Education Department's responsibilities before Trump made his comments about transferring the student loan portfolio — which was a departure from what White House Press Secretary Karoline Leavitt said less than 24 hours prior.

Jessica Thompson, senior vice president of The Institute of College Access & Success, said in a statement Friday that the administration has "decimated staffing and oversight capabilities" at both the Education Department and Small Business Authority and has "no clear strategy."

"This can only result in borrowers experiencing erratic and inconsistent management of their federal student loans. Errors will prove costly to borrowers and ultimately, to taxpayers," she said.

There’s still a lot we don’t know about what could happen, but it’s important for borrowers to remember that even if a the portfolio is transferred, the terms and interest rates on their loans will not be changing. The most important thing borrowers can do right now is keep detailed records. Here’s what else we do (and don’t) know:

When will student loans be moved from the Education Department?

That’s not clear right now. In speaking to reporters Friday, Trump said it would happen “immediately.” But legal challenges could pause any possible changes.

“I know he said immediate but nothing is going to be immediate," says Betsy Mayotte, president of The Institute of Student Loan Advisors, which offers free advice to borrowers on paying back their loans.

The White House hasn’t provided any details about how such a transition would work, including whether staffers at the Education Department who have knowledge of the student loan system would move to the SBA to continue working on it.

In its executive order, the administration suggested that the Education Department, and in particular the Federal Student Aid office, was too small to manage such a large portfolio. It noted that the size of the student loan portfolio is roughly the size of some of the nation's largest banks — although the office has a far smaller staff than those banks do.

But the SBA is also a relatively small agency. It currently has a staff of about 6,500, and it announced Friday morning that it would cut its workforce by 43%.

Do I still need to keep paying my loans?

Yes — transferring the loans to another agency does not equate to canceling them.

"I can’t emphasize enough that this is not the time to be making any panicked financial decisions," Mayotte says.

To whom do I pay my loans?

You should continue making payments to your servicer until you hear differently.

Most of the work on managing repayment is done by loan servicers and third-party vendors, not the department itself. It's possible that even if a move to the SBA happens, borrowers will still deal with the same servicers and databases and that the day-to-day experience won't change, Mayotte says.

What does this mean for income-driven repayment and Public Service Loan Forgiveness?

Income-driven repayment plans and Public Service Loan Forgiveness, or PSLF, are written into law. That doesn’t mean there will not be changes to those programs — Trump has already messaged with a previous executive order that he'd like to limit the jobs that qualify for PSLF , and the Education Department has paused all applications to income-driven plans in response to a court injunction.

It’s likely borrowers will see changes to these programs coming down the line. But the possible shift of the portfolio to SBA, on its own, does not affect them.

What else should I know or do right now?

Log into your servicer account and into your account with Federal Student Aid to document what you owe and where you are in your repayments.

Assuming Trump is able to follow through and the loan portfolio is in fact transferred to the SBA, you should remain vigilant throughout the period of transition. Take a screenshot of every payment you make, and download documents that track your payment history. It's a good idea for all borrowers to take these steps, but it’s especially critical for those who are working toward forgiveness via income-driven repayment or PSLF.

Sarah Sattelmeyer, the project director for education, opportunity and mobility on the higher education team at New America said in an email Friday that she has a lot of unanswered questions. But at a minimum, “a move of this magnitude will be extremely messy and inefficient for everyone — including borrowers who depend on loan relief, contractors who administer the programs and staff who manage the programs and provide oversight — and runs the risk of breaking the system in the process.”

More from Money:

What Will Happen to Financial Aid if Trump Closes the Education Department?

Could Trump's DOGE Cuts Delay Social Security Payments?

Social Security Is Ending Phone Applications. Millions of Americans May Now Need to Apply in Person