My Son Was Accepted to a College He Can't Afford. Now What?

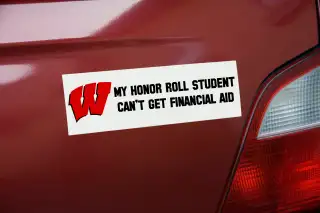

In early April, my son Dan arrived home from the University of Wisconsin’s Admitted Students Day holding a Wisconsin windshield sticker—and immediately affixed it to our car above his older brother’s University of North Carolina sticker, with a smile I can only describe as vengeful younger-brother joy.

He, too, was going away to a prestigious public university in a storied college town and with a cult-like alumni following.

A couple days earlier I’d photographed him, lanky and beaming, at Bascom Hill, and posted to Facebook: “On Wisconsin! Dan’s a Badger.” Congratulations poured in: 58 “Likes” and 17 comments. He performed the teenage equivalent, recording Snap Stories for his buddies.

All along, he had been clear that he didn’t want to attend a private school because of the price tag: “$70,000 a year! That just makes me angry!” And then he’d laugh at the ridiculousness of those costs. Above average but not a rock star student, he labored through five Advanced Placement classes, including calculus, biology, and statistics; and earned a weighted grade point average well north of 4.0, as well as a very high ACT score.

He'll graduate next month from a public high school in a New Jersey suburb, one of those places where 98% of the class attends a four-year college. Some go to Ivies or near Ivies, many to prestigious liberal arts colleges, and another group to public research universities. That’s my kids’ peer group. So Dan and I exulted our way through April.

Then, two weeks after we put down the deposit for Wisconsin, we got the financial aid package. We were stunned when he got zero—nada—in aid. Unless you count the $5,500 in federal loans we were offered.

“This must be a mistake,” I thought.

Out-of-state tuition, room, board, and fees for Wisconsin run more than $48,000 this year. Even with the money I’d saved in his 529 fund, there is no way I can afford to send him there, particularly on top of the cost of my elder son’s education. (A rising college junior at UNC, he got a decent financial aid package but will graduate with debt—which worries me, but that was his choice.) Their father and I are journalists, not hedge fund managers.

I wrote to a few people in the financial aid office at Wisconsin. They wrote back immediately, running the numbers again to be sure. No mistake.

You may know that public universities are feeling the effects of state funding cuts. According to a recent report by the American Academy of Arts and Sciences, between 2008 and 2013 states reduced financial support to top public research universities by nearly 30%. That’s one of the main reasons for increased college tuition at these universities. As a result, state universities are admitting more and more out-of-state and foreign students who will pay full freight—sometimes three times the tuition rate of state residents.

I guess they thought we would magically come up with that full freight, as did the other big universities where Dan was admitted, all of which charge between $46,000 and $51,000 for tuition, room, board, and fees for out-of-state students. We’d been aware of the Wisconsin budget drama, but somehow thought this would not affect us so harshly.

What to do? I recognize that sending my sons to out-of-state universities is a luxury, not a given. But it doesn’t feel like a luxury to my kids, who have grown up in an affluent community among competitive kids.

I, on the other hand, attended high school with the children of farmers, mechanics, and teachers in rural Pennsylvania. I graduated from a liberal arts college in my home state only because I received scholarships, federal loans, and a 50% tuition break given to the children of ministers. With a manageable debt load, I started my career at a low-paying job as a local newspaper reporter. I was able to do meaningful, often joyful work and excel at it because I wasn’t burdened with a lot of debt.

In emergency mode after the news from Wisconsin, I got in the car with Dan two Saturday nights ago and drove the 40 minutes to Rutgers University, New Jersey’s flagship state university, where he’d also been accepted. The total cost for in-state students: $26,000. (For out of state, it’s $42,000.)

Sure, it’s a good school. But it’s only 35 miles from home. And where was that ineffable Wisconsin magic? My son and I came home deflated.

I went to Facebook, once again, and wrote the following: “Crowdsourcing a heartfelt situation. We have discovered that Dan's financial package at Wisconsin is nearly nil, and costs have increased by a lot….Dan so wants to go away for school. Yet the costs.….What, dear Facebook friends, would you do?”

The reaction was immediate and enormous—and the reason I am writing this essay. No fewer than 43 people replied with opinions, and counter-opinions, and counter-counter opinions.

First up was a New Yorker with this advice: “Wisconsin,” debt be damned. Then came this: “Rutgers is a great school. Is massive debt worth it these days for students?...If he doesn’t like it he can transfer later.”

Then this: “I’ve been putting off replying for a while because I’ve been having this argument with my boyfriend about how to balance the unknowable value that access to power/wealth provides vs. the more practical money value (keeping in mind my boyfriend went to Rutgers). I vote against his recommendation of Rutgers, but his arguments are just as legitimate.”

And this: “I will say a few things, mom to mom. I’ve seen other kids go through this and once they start, wherever they start, they come to feel at home. If not, it’s fine to transfer….When they graduate, if they don’t have loans to pay back, they can travel, or do something they love that only pays room and board, or can better afford graduate school. So it’s not just ‘we can’t afford it,’ but ‘here’s an opportunity.’”

A few people weighed in for Rutgers “for not only financial reasons but the fact that he is one train ticket away from NYC and the internship opportunities. Wisconsin is more the ‘college’ experience but Rutgers might provide more a ‘life’ experience.”

But this comment really got my attention: “I consider my decision to take on debt as one of my biggest life regrets….I’m not kidding when I say that by the time I finish paying it off, my one-year-old twins will be starting college.”

From this outpouring of sympathy, support, and personal stories, I saw the only clear option, and so did my son. Dan put the deposit down on Rutgers and made plans to room with one of his high school buddies.

This past Saturday, for the second time in a week, we got in the car and drove down the highway to Rutgers, this time listening to Killer Mike and Biggie Smalls. (You can imagine the mood in the car.)

We drove and walked the campus, admiring the gorgeous new business school building and winding our way through the streets surrounding the university. Dan bought a $20 T-shirt. But no back-of-the-car sticker.

As we were leaving, we spotted a couple of girls, one of them wearing a skirt so tight and short that when she crossed the street she had to pull it down to avoid baring her entire back end. “Oh dear Lord,” I thought. “He’ll turn into a meathead and date one of those girls.” I burst into tears, with my son yelling at me to “stop crying!”

When I texted this exchange to my husband his response was: “He’s not going to marry Snooki.”

Afterward, I did more research, discovering just how well-regarded my state’s flagship public university is. Over the next couple days, Dan reported that more and more of his classmates were choosing Rutgers, including one who’d been admitted to Johns Hopkins and Carnegie Mellon, all because they can’t afford to take on debt—from public or private schools alike.

Dan began to feel proud of himself for making a wise financial choice. I’ve come to realize how many students like Dan nationally are grappling with these kinds of decisions.

On Monday morning, he wore the Rutgers T-shirt for his school’s Decision Day festivities. The Wisconsin sticker is still on the car’s back windshield, above his brother’s University of North Carolina sticker.

I don’t know when he’ll peel it off. I don’t know if he’ll grow to love Rutgers. I don’t know if he’ll transfer. The only thing I know is that he is avoiding a crushing debt burden. For now, that’s good enough.