How to Decide the 'Best' Way to Use Your Stimulus Check

Welcome to Dollar Scholar, a personal finance newsletter written by a 28-year-old who’s still figuring it out: me.

Every week, I talk to experts about a money question I have, whether that’s “What if I don't have a 401(k)? or “How many credit cards do I need?” As I learn, I share simple ways to improve your financial life… and post cute dog photos.

This is (part of) the 39th issue. Check it out below, then subscribe to get future editions of Dollar Scholar every Wednesday.

Do you remember that children’s book If You Give a Mouse a Cookie?

The gist is that there’s a boy who — as you might guess from the title — gives a mouse a cookie. It sets off a whole chain of events. The mouse eats the cookie, which makes him want a glass of milk, which makes him want a straw, which makes him want a mirror to check his milk mustache, and so on. (Needy mouse, huh?)

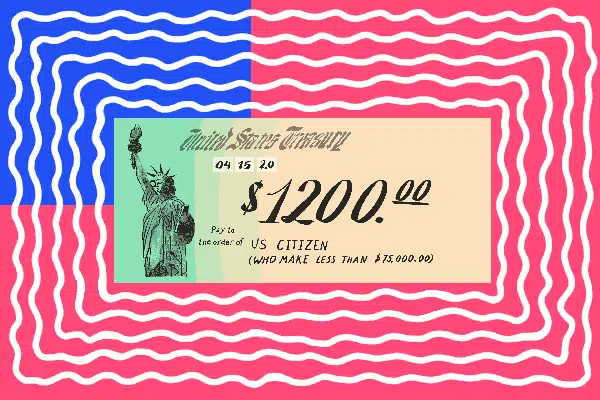

It’s similar to how I feel about the coronavirus stimulus checks. If you tell taxpayers they’re getting a rebate, they’re going to want to know how much it’s worth. Once they know how much it’s worth, they’re going to want to know when they’re getting the payment. And once they get the payment, they’re going to want to know the best way to use it.

At least, that’s my situation. Although most of my logistical questions have been answered, I haven’t quite figured out what to do with my relief money. I’m smart enough to know I probably shouldn’t run out and buy an inflatable T-rex costume, but I’m otherwise torn.

What should I do with my stimulus check?

I asked the experts, and it seems like there are three major paths I could go down with my $1,200. Each one has an If You Give a Mouse a Cookie-style corollary, so that’s how I’m going to lay this out.

If I want to use it, I’m going to want to prioritize the essentials.

First and foremost, I should use the stimulus money to meet any immediate needs I have, like food, shelter or rent. From there, I should consider putting it into an emergency fund, according to Scott Ward, a CFP Board Ambassador in Birmingham, Ala.

“There’s so many things we can’t control, but for the things we can, it’s a very good time to be strategic,” he says. “60% of Americans can’t afford a $1,000 emergency, so if you receive a $1,200 check, you can cover that right away. Or begin building up a more robust emergency savings fund that covers between six and 12 months of fixed expenses.”

Next, if I want to save it, I’m going to want to consider the big picture.

If I don’t need the money to pay bills right now because, say, my student loan payments are suspended, I might want to figure out a way to use it to help achieve my medium- and long-term goals, said Rhian Horgan, the founder and CEO of financial wellness platform Kindur.

If I’m trying to buy a house in the next couple of years, for example, I could put my $1,200 into an asset management account or a brokerage account.

If I’m planning for retirement in a few decades, I could put the money in a Roth IRA. Because it compounds tax-free, Horgan said a Roth IRA “would probably be the smartest place to put your money if you don’t need access to it.” It's not hard to set up an IRA online with companies like Betterment. Assuming a 5% rate of return, my $1,200 stimulus check could easily turn into $5,000 in the next 30 years.

“It’s always good to put something aside for the future,” she adds.

Finally, if I want to spend it, I’m going to want to support my local economy.

This is the whole point of a stimulus check, after all: to provide consumers with some extra spending money and hope like hell that it jumpstarts the economy.

Niagara University economist Tenpao Lee told me that global supply chains have broken as a result of the coronavirus. He explained that the whole world’s process for creating and buying goods from each other is screwed up. To repair them, we have to start small.

“It will be easier to rebuild the global supply chains piece by piece, as global is based on local,” Lee says. “So, if consumers have choices, they should buy from local retailers, then national retailers.”

Basically, I should shop my favorite Brooklyn book store instead of Amazon. Can do.

Bottom line? There are several things I can do with my stimulus money: cover basic expenses, build up my emergency fund, save it for a big goal or shop local. (I could also donate it, as I learned in Issue #37.)

As I decide, I shouldn’t feel like I’m forced to put all my cash in one place. If I want to put some in my emergency fund, some in a Roth IRA and blow $300 on this deluxe Harry Potter book, that’s OK.

“Oftentimes, when you try to make a decision that’s 100%, it’s hard to get comfortable,” Horgan says. “Make sure you’re in a good spot, and then think about what are the priorities?”

More from Money:

Coronavirus and Charity: How Can I Make the Most Impact with My (Kinda Small) Donation?

You're Probably Already Saving Money During Quarantine. Here's How to Take it a Step Further