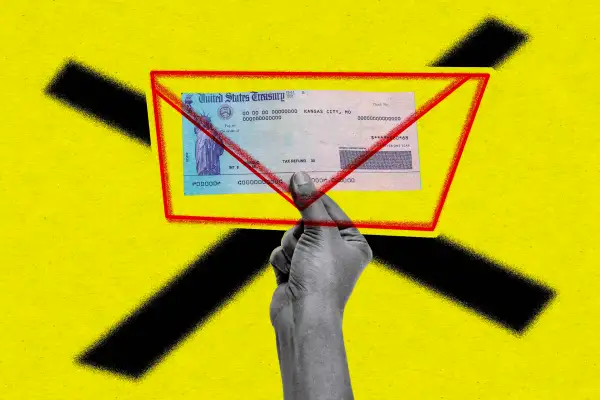

Watch Out for This Letter About Tax Refunds 'From the IRS' — It's a Scam

Scammers are sending out letters and other messages to taxpayers trying to trick them with misleading information about tax refunds, officials warned earlier this week.

The letters claim to be from the IRS and arrive in a cardboard envelope from a delivery service. Using an official-looking IRS masthead, the scammers ask recipients to volunteer their personal information in order to receive their alleged refund.

The fraud operation is well-timed: You may have tax refunds on the brain if you’re one of the millions of Americans who are legitimately owed a refund by the IRS right now. The agency is holding nearly $1.5 billion of unclaimed refund money because roughly 1.5 million taxpayers didn’t file their 2019 taxes. If you're one of them, you have until July 17 to manually file back taxes for that tax year to claim your money.

But don’t get confused. If you get the aforementioned IRS letter about a refund, it’s most likely a scam.

How to spot an IRS scam

There are a few obvious signs that will alert you right away to whether someone is trying to scam you.

The first revolves around the method of communication. The IRS will never try to reach out to you via email, phone call or text message regarding a bill or tax refund, nor will it ask you to send sensitive information this way.

The second sign shows up in the actual copy. Scams masquerading as communications from a government agency will usually have misspellings, awkward phrasing and other glaring mistakes. This particular IRS mail scam claims taxpayers must provide “filing information” to receive the tax refund and requests "A Clear Phone of Your Driver's License That Clearly Displays All Four (4) Angles, Taken in a Place with Good Lighting."

That's not the way a federal agency would capitalize an official message.

The IRS says the letters also have strange punctuation and mismatched fonts, as well as incorrect information about tax filing deadlines. For instance, while the letters say the deadline for filing tax refunds is Oct. 17, the deadline for people on extension for their 2022 tax returns is actually Oct. 16. And taxpayers owed refunds from last year actually have time beyond that date.

After telling recipients to include information like their cell number, bank routing information and Social Security number, the letter also incorrectly states that "You'll Need to Get This to Get Your Refunds After Filing. These Must Be Given to a Filing Agent Who Will Help You Submit Your Unclaimed Property Claim.”

The IRS says it doesn’t handle “unclaimed property.” If you receive a fraudulent communication in the form of an email — also known as phishing — there may be links included, which you should not click on.

What to do if you get a scam message

Taxpayers shouldn’t respond to scam messages or try to take action themselves.

Instead, you can report tax-related scams by sending the email or a copy of a letter or text message as an attachment to phishing@irs.gov. Be sure to include any information the sender provided, like an email or phone number, as well as the date and time.

You can also report scams via the Internet Crime Complaint Center or the Treasury Inspector General for Tax Administration. See the IRS's Dirty Dozen list for information on specific scams, or visit the agency's phishing and online scams page for more information about protecting your information from security threats.

Don't forget: If you're not sure whether a communication from the IRS is real, you can always directly contact the agency on your own and ask. The IRS phone number for individuals is 800-829-1040.

More from Money:

The Best 3 Money Moves to Make This July

7 Ways to Cut Your Electric Bill and Still Stay Cool This Summer