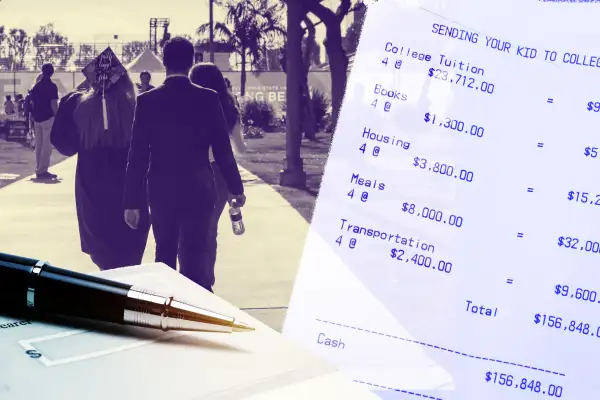

How Much Should Parents Really Pay for College? An Expert Explains in a New Book

Here’s a scary math problem. If you wanted to prepare for the full cost of a private college for your future child, how much would you need to start socking away each month?

At least $1,000, assuming the sticker prices of the most selective private colleges remain steady, for a grand total of $300,000 in today's dollars.

That mind-boggling figure has a starring role in The Price You Pay for College: An Entirely New Road Map for the Biggest Financial Decision Your Family Will Ever Make, a new book from Ron Lieber, personal finance columnist at The New York Times.

Of course, very few families ever end up paying that $300,000-plus bill in full. That’s one of the first things you learn in Lieber’s book. But even when attending a state school or receiving scholarships to discount the cost of a private college, you’re still likely looking at six-figure bill. What are you actually paying for? And when is it worth paying more for one college than another?

That’s what Lieber set out to learn and now, teach you. Part self-help book, normalizing what an emotional process this can be for parents, and part step-by-step guide, the book will leave you with a (long) list of questions. The goal is to help you determine what price is right for you and your child. Money talked with Lieber about college savings, merit aid and how to talk to your teen about what you can afford.

This conversation has been edited and condensed for clarity.

The first part of the book focuses on explaining the ins and outs of college pricing and financial aid. What's the the biggest piece parents need to understand as they start thinking about the college application process?

The most important thing, money aside, is how is it that you are defining college anyway? What is college for? And this is not an existential question. It is not a rhetorical one either. It’s a pretty serious endeavor, because until you know what it is that you are trying to buy, it’s hard to know what to spend. And only when you have the spending parameters in mind can you make a plan.

I realized early on (in working on the book) that I didn’t have a good definition of what college is. And I certainly didn’t want to impose one on people, so I just started asking. Conversation after conversation yielded three responses. People go to college for the education. People go to college for the kinship, and they go to college for the credential. There’s no right answer to that question. The only wrong answer is to not have considered it. Because if you’re going to college for the credential and the credential only, and you couldn't care less about whether you acquire a bunch of new friends or a mentor, or you couldn't care less about having your mind disassembled and reassembled by an expert philosophy instructor, that’s fine. If that is your goal, you can go and get your degree without spending a big pile of money. But if your goal is to work for McKinsey or to get into one of the best Ph.D programs in marine biology, then that’s a different undergraduate goal, which may require spending more.

One of the most common phrases, throughout the book chapters, is some version of 'How, or whether, the college responds to your questions should tell you something.' What do you mean by that?

What I’m asking people to do — or what I’m trying to give people the courage to do, because it’s much easier for a reporter to show up to these places with a head of steam and ask 37 inconvenient questions — is start thinking of themselves as shoppers. More than anything, I’m trying to raise an army of people who are not confrontational exactly but who just feel entitled to ask better questions.

Once we do that, the schools are going to have to answer in a more thorough way, with more data and more proof about their value. And if they won’t or if they don’t, it doesn’t necessarily mean that they have something to hide. But it probably means that they are not trying hard enough to prove their worth. And there may be some residual institutional arrogance, especially at the more selective institutions, who feel like, 'Well we’re rejecting three-quarters of our applicants. We don’t have to answer to you.' And my response to that is, 'If I am writing you a check for up to $325,000, I deserve some answers.'

A lot of families don't actually end up paying that full $300,000, as you explain in the book. Even more affluent families can get big discounts through something known as merit aid. Do enough families know about this going in?

No, the answer to that is a firm, hard no. Part of the reason I wrote the book is I was just amazed at the number of people who were, quite literally, crying into my inbox talking about the fact that they had gotten to the end of their child’s senior year and had not realized how things work.

Nobody had ever educated them about, ok here's the subset of super selective schools that do not offer any merit aid. And here is the next chunk of pretty selective schools that are uniformly excellent institutions and that do discount for people who do not have any financial need. And then farther down the food chain, here are the schools who use merit aid to try to make people feel good about themselves even though they offer merit aid to everybody. (Lieber walks parents through some of that here.)

There are people who get to the end of the process and they do not even understand what merit aid is or how it works. And it’s because it’s incredibly complicated and partially hidden. So, yes, people need to know a lot more and part of what I was trying to do in the book was pull the curtain back. so they could see the wizardry operating behind the scenes.

You give families a few guidelines in the book about how, and how much, to save for college, but there isn’t one strict formula. Why not?

I’d argue that there is an actual formula, but it involves feelings and not actual numbers. The formula is: you have to sit down with your spouse, if you have one, 20 years or so before the kid is going to go to college. That may seem kind of insane, but one way to manage a long-term goal that includes a six-figure number is to start early, as we know. Because hopefully your savings, if you can create them, benefit from compounding over time.

So you sit down with your spouse, and you ask yourself some questions about the past: What was it that happened to us between the ages 17 and 23, if we went to college, that involved money and how that money was used to buy us an education or to borrow to get us one. How did that feel then? How does that feel now? Is there anything about that experience that we'd like to repeat for our own kid and what would we like to change dramatically? You have to get real with each other about the feelings that those memories drudge up. And then you have to come to an agreement about what the goal is going to be for your own child. If you’re going solo on this, go and find somebody that you really trust who can ask you these questions. Once you do that, then you’ll have a better senses of what your financial goals might be, and then you can apply one of the more general savings formulas that I outline in the book.

Another important money conversation is the one parents should have with their kids, but I imagine that, too, can be awkward. How can parents make sure they’re on the same page as their teenager when it comes to paying for college?

It is only an awkward conversation if you have not been talking with your teenager all along, starting at the age of four or five, about money and how you spend it and how you save it. If you’ve been doing that, the point at which you have the conversation with your 8th grader, they should not be surprised, and if they are — it probably means they didn’t learn enough all along about your family’s financial situation. Then when you have a conversation with your 8th grader, you say, 'we just want you to know as you start high school, we’re getting ready for the next step after that. This is what we have saved.' And don’t apologize if it's a small number or if it’s $0. You say, 'This is what we think we’ll be able to spend. This is what we might be willing to borrow. So we just want you to know that those are the constraints. And then you can talk about the implications.

One of the things that I found interesting is that the book is called The Price You Pay for College, and price is normally a very quantitative, calculable thing. But the majority of the pages focus on much more subjective decisions.

I had this dream in mind when I first conceived of this book that I would be able to create some magic algorithm, where families could input fact and feelings and it would tell them, ‘ok your family should pay $48,000 for Grinnell College in Iowa but no more than that.'

I wanted to be able to do that, but because everybody’s facts and feelings are different, there’s no magic machine that spits out an answer for the right price. The only thing there is a long list of much better questions. (Editors note: Lieber does indeed provide a very long list of questions for parents.) Many of the questions won’t apply to your family, but some of them will be vital.

What struck me as I was reading is just how much work all of this is — researching online, visiting campuses, following up with questions for professors and administrators. How can any normal working parent really do this level of due diligence?

I think that’s a totally reasonable question. A good look into that is an interview I did on Marketplace this week with somebody from the book, Lara Mordenti Perrault. She’s the one whose kid applied to 32 schools and wrote 90 essays and got a full-ride at Tulane. This became a part-time job for her for like 9 months, but it ended with $200,000 (in scholarship money) tax-free. So, you know, that’s a pretty good wage for 9 months of part-time work.

But the larger question, and the more important question, is — how on earth does somebody who doesn’t have a ton a of privilege, who doesn't have a ton of time on their hands to manage this on top of everything else, how do they get it done? I have no good answer for you. It is not how this should be. It should not take a year of some parent's life spending 10 hours a week to crack the code on this thing. I wish I had the ability in some 300 pages to make the system go away or to make it better, but the best I can do for now is just to tell people how things work and how to navigate within it.

You're the parent of a high schooler. Did you learn anything in writing this book that is going to change the way you personally approach the process?

Yes, I tried to visit a whole bunch of places that I’d never seen before. What I realized is that it is so easy, depending on the milieu that you choose, to talk yourself into the fact that there are only, you know, 22 institutions that are somehow acceptable, right? That’s just wrong.

I’d never seen the landscape of small liberal arts colleges in Ohio, or Minnesota, or North Carolina. I saw places of great beauty with intensely focused and determined administrators and teachers, where I know that my older daughter could thrive. I found that not just comforting; I found it hopeful. College is about the possibility that nearly anything could happen to any given undergraduate. Any of the 500 most selective colleges in the country has the ability to do that, if a student cares enough to extract everything they possibly can from all the resources that are on offer for those four years. I felt like this is going to be OK, that we, collectively, are going to figure this out. But we have to start a little earlier than expected and we need to know a fair bit more, because that’s just how the system works now.

More from Money:

9 Mistakes to Avoid When Applying for Federal Financial Aid

Best Life Insurance Companies of 2021

The Biggest Mistake Parents Make When Paying for College, According to a Financial Planning Expert