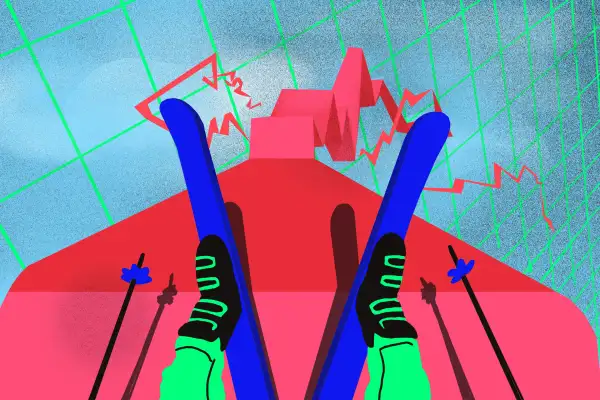

The Dow Is Taking a Nosedive. What Does That Actually Mean for Me?

Welcome to Dollar Scholar, a personal finance newsletter written by a 27-year-old who’s still figuring it out: me.

Every week, I talk to experts about a money question I have, whether that’s “What if I don't have a 401(k)? or “How many credit cards do I need?” As I learn, I share simple ways to improve your financial life… and post cute dog photos.

This is (part of) the 34th issue. Check it out below, then subscribe to get future editions of Dollar Scholar every Wednesday.

On a scale of 1 to 10, how freaked out are we about the coronavirus pandemic? Personally, I would put myself at a Naomi Campbell.

I’m writing this from the kitchen table in my Brooklyn apartment because the mayor advised us to skip the subway and work from home until further notice. I can’t pull myself away from Twitter, even though the constant flow of updates is bad for my anxiety, and I keep stress-eating cheese.

Like, a LOT of cheese.

To make matters worse, my iPhone lights up every couple of minutes with news alerts about how the Dow is tanking. Because I have no clue what that actually means, it’s just causing me more stress. Cue infinite scream.

Knowledge is power, and we clearly could use some power right now. So I'm going to dedicate the next couple of Dollar Scholar issues to the coronavirus and our money. We'll work through this mess together.

First up: The Dow is imploding — how worried should I be?

A quick Google search informed me the Dow is shorthand for the Dow Jones Industrial Average, an index measuring how 30 major companies are performing in the stock market. Apple, Boeing, Coca-Cola, Nike, Visa and Disney are all currently included, though the lineup has changed over time.

The reason everyone’s always talking about the Dow is that it’s viewed as a proxy for how the overall market is doing. In fact, Robert Kiyosaki, the author of Rich Dad Poor Dad, told me he checks the Dow every morning.

“Watching the Dow is like tuning into the weather report,” he says. “To me, the ups and downs indicate the mood of the markets, much like a weather report is about changes in the weather, warning of hurricanes, tornadoes and storm fronts.”

The Dow is what’s called a point-weighted index, which means companies are weighted based on what their price per share is. It rises and falls by points that are calculated in a very complicated way. Basically, the bigger the swing in points, the more drastic it is.

That’s why people lost their minds when the Dow closed at 23,553.22 points on March 11, triggering the end of the bull market. And on Monday, when it decreased by 2,997.10 points — its largest one-day point drop to date.

Though I don’t own any stocks outright, I have a 401(k) that is partially invested in stocks, which means these movements do technically affect me.

Nevertheless, Morningstar’s director of personal finance, Christine Benz, advised me not to panic about my Dow-related iPhone notifications. At 27, I’m far enough out from retirement that I can afford to largely overlook most fluctuations. I could even use this as an opportunity to buy discounted stocks.

“Try not to plug into what’s going on in terms of day-to-day swings in the market,” she says. “Even though stocks can be really volatile over the short period of time, as an investor, you get paid to wait.”

If I must pay close attention, Benz told me to measure the Dow’s movement in percentage changes. They’re more meaningful. While I might not be able to wrap my head around whether a 300-point swing is big or small, I do understand if my investment gains 3%. It’s easier mental math.

In addition, Benz likes tracking the S&P 500, which not only includes way more companies but also is capitalization weighted. Kiyosaki said he watches bond interest rates, the price of gold and the price of oil.

“The Dow means different things to different people,” he adds. “The important lesson for young people is that you can make money regardless of whether the Dow is going up or down.”

Bottom line: The Dow is a way to generally gauge how the stock market is doing. I should care about it, but only to a degree — like using a decrease as a chance to increase my stock allocations. Otherwise, I should ride it out and keep an eye on other indicators.

“Markets can move around for lots of different reasons that aren’t necessarily reflective of where the economy may go in the long term or even intermediate term,” Benz says. “I wouldn’t try to overthink it in terms of making major life decisions.”

More from Money:

Stocks Just Entered a Bear Market for the First Time in 11 Years. Your Questions, Answered

5 Smart Money Moves to Make While You Self-Quarantine During Coronavirus