Will Overdraft Fees Increase Under Trump? Here's What 7 Banks Told Us

Many Americans celebrated last year when government officials announced a restriction on $35 bank overdraft fees for checking accounts. But with the change in leadership in D.C., it's now unclear whether this will happen.

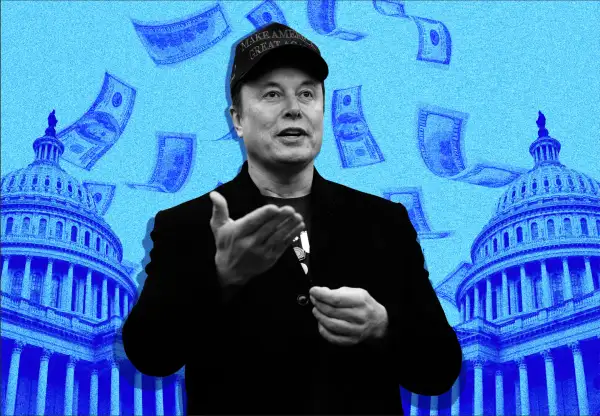

President Donald Trump and Tesla CEO Elon Musk want to dramatically reduce — if not kill — the regulatory authority of the Consumer Financial Protection Bureau, the 14-year-old agency behind the rule limiting overdraft fees. This could mean that high overdraft fees, which can be a significant financial burden for folks tight on funds, are here to stay after all.

Some banks, like Citi and Capital One, have fully eliminated overdraft fees and told Money they're committed to their policies — no matter what happens at the federal level.

However, other major banks have yet to offer the same relief to customers. Banks including JPMorgan Chase, Wells Fargo, U.S. Bank and PNC still charge overdraft fees of $34 to $36, collecting hundreds of millions per year off them. These banks are likely hoping that the Trump administration and the GOP-controlled Congress can reverse the Biden-era regulations.

Trump admin looks to undo 'midnight' rule on overdraft fees

In December, the CFPB announced a final rule that would end "excessive" overdraft fees effective Oct. 1, 2025, capping the charges — which typically run around $35 — at $5. Alternatively, banks could charge an overdraft amount just high enough to cover their costs or losses. Or they could offer overdraft loans (if the terms and interest rates for these credit lines were disclosed).

While many consumers were excited about this change, the regulation is now in jeopardy. An effort in Congress spearheaded by Rep. French Hill, R-Ark., and Sen. Tim Scott, R-S.C., aims to repeal the CFPB rule before it takes effect this fall.

Meanwhile, the banking industry hasn't given up fighting it in court.

A spokesperson for the Consumer Bankers Association, a group that represents retail banks, tells Money that the rule "is an illegal and harmful overreach that threatens millions of Americans' access to liquidity." Banks also argue that overdraft fees support their ability to let customers pay for some transactions with negative balances, which can help people access necessities like food and utilities — just at a very high cost.

What the CFPB shakeup means for overdraft fees

CFPB Interim Director Russell Vought said in a post on X that he is "grateful" for the legislation aimed at rolling back the Biden administration's "midnight rule" limiting overdraft fees, adding that the repeal attempt aligns with Trump's "deregulatory agenda."

Earlier this month, the president picked Vought to lead the bureau after firing Rohit Chopra, the agency's director under former President Joe Biden. Chopra's CFPB had estimated the overdraft rule would save Americans a collective $5 billion per year.

The Trump administration appears to be still determining exactly what it wants to do with the CFPB — an agency that figures including Musk have indicated they want to "delete." Musk's Department of Government Efficiency, or DOGE, has already fired dozens of CFPB staffers.

But as the Trump administration eases back on bank regulation and halts CFPB activity, consumer advocates say bank customers are the ones who will suffer.

Lauren Saunders, associate director of the National Consumer Law Center, argued in a Feb. 13 news release that "Republican leadership is siding with Wells Fargo and other big banks over working families hurt by abusive overdraft fee practices." (The NCLC is part of a group that has filed a lawsuit trying to stop the Trump administration's efforts to "dismantle" the CFPB.)

Right now, the fate of the rule is still up in the air, and there's also uncertainty around what would happen to overdraft fees if it were to go into effect. But while the situation unfolds, here's what seven banks are saying about their policies:

Wells Fargo

- Overdraft fee: $35

- Overdraft fee revenue: $937 million

In 2022, the CFPB took action against Wells Fargo over certain overdraft charges, ordering the bank to pay $205 million in redress. The bank still took $937 million in overdraft/non-sufficient funds fee revenue in 2023, according to an April CFPB report. When contacted by Money, a spokesperson for the bank said they did not wish to comment on future plans for overdraft fees.

JPMorgan Chase

- Overdraft fee: $34

- Overdraft fee revenue: $1.1 billion

Chase customers can be charged a $34 fee if their account is overdrawn by more than $50. The bank did not respond to Money's request for comment about any possible plans to lower that fee.

Bank of America

- Overdraft fee: $10

- Overdraft fee revenue: $140 million

Bank of America reduced its overdraft fee from $35 to $10 in 2022 and also eliminated its non-sufficient funds fee, which applied when certain transactions were denied. A spokesperson for the bank declined to comment on future plans.

U.S. Bank

- Overdraft fee: $36

- Overdraft fee revenue: $214 million

The overdraft fee charged by U.S. Bank is among the highest. The bank did not respond to Money's request for comment about any possible plans to change that fee.

Citi

- Overdraft fee: None

- Overdraft fee revenue: N/A

Citi became the largest major bank to remove overdraft fees in 2022. "The recent overdraft fee rule had no bearing on our decision one way or another," spokesperson Colin Wright tells Money.

PNC

- Overdraft fee: $36

- Overdraft fee revenue: $258 million

PNC charges a high overdraft fee but touts that customers can only be charged once a day. PNC did not respond to Money's request for comment about any possible plans to change the fee.

Capital One

- Overdraft fee: None

- Overdraft fee revenue: N/A

A spokesperson tells Money that Capital One "proactively" decided to fully eliminate overdraft and non-sufficient funds fees in 2021.

"We will not be making any changes to our policy regardless of how the effort to roll-back the overdraft rule unfolds. No-Fee Overdraft has been a centerpiece of our mission to provide best-in-class, no fee and no minimum products and services to our millions of customers," the spokesperson adds.

More from Money:

Best Banks and Credit Unions in New York for 2025

Dollar Scholar Asks: Should I Share a Bank Account With My Best Friend?