Here's Why the IRS and President Trump Are Sending You a Letter About Your Stimulus Check

No one wants to get a letter from the IRS. And it's fairly unheard of for personalized letters to be sent to everyday taxpayers from the White House, with the president's signature. But there's no reason to freak out if you've gotten just such a letter in the mail.

As of April 17, roughly 90 million Americans had received stimulus checks worth up to $1,200 per adult, the IRS says.

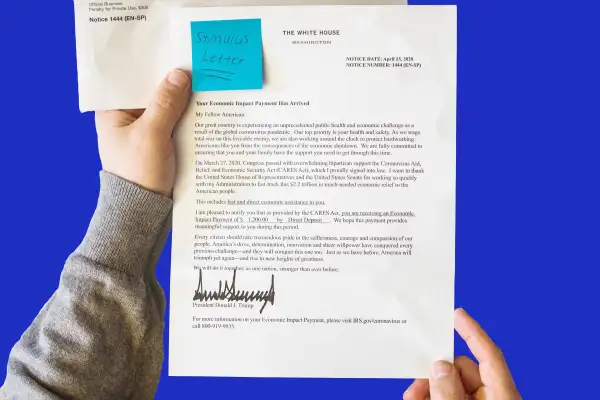

Two weeks after the payment is processed, everyone issued a stimulus check — or "Economic Impact Payment," in IRS lingo — is supposed to get a letter in the mail. The envelope comes with a return address from the Department of Treasury, Internal Revenue Service. Inside, though, the note comes with a "WHITE HOUSE, WASHINGTON" letterhead, and it's bears the signature of President Donald J. Trump.

The letter comes written in English on one side, and Spanish on the other. It explains how and why the CARES Act is paying out up to $1,200 per eligible adult and $500 per child under age 17, as a way to provide relief to Americans during the coronavirus pandemic.

The letter also includes personalized information about your stimulus check — specifically, how much money you received, and what form the payment came in. (Most people are getting direct deposit stimulus payments, though some recipients are paid via paper check.)

Why Did I Get a Letter From Donald Trump About Stimulus Checks?

The IRS says it is sending letters to stimulus check recipients "for security reasons." Specifically, the IRS FAQ page states:

For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.

Presumably, the letters are being sent to alert people that their stimulus checks have been sent and verify the details of the payment. If there's a problem — say, the payment was issued to the wrong bank, or your check came in the wrong amount — the letter will serve as a call to take action and try to address the mistake. The arrival of the letter might also possibly alert you about a scam involving stimulus checks.

Why the letter about stimulus checks comes from the White House and features President Donald Trump's signature is a more complicated political matter. Likewise for how and why paper stimulus checks bear Trump's signature.

Treasury Secretary Steve Mnuchin has said it was his idea to put President Trump's name on paper stimulus checks, and that the signature would be "a terrific symbol to the American public."

Critics say that the addition of Trump's signature on the checks and the letter mailed from the IRS, as well as language in the letter referencing Trump's "Make America Great Again" campaign slogan, was politically motivated and wrong. "This will harm the IRS and its ability to appear nonpolitical and nonpartisan,” Nina Olson, executive director of the Center for Taxpayer Rights, said of the letter to USA Today. "If I were there, I would be strongly advocating against this.”

C. Eugene Steuerle, from the nonprofit Tax Policy Center, wrote this week that paper stimulus check payments were delayed by the addition of Trump's signature because Treasury Department workers "had to redesign the basic check, mock up the display of the president’s name, and rejigger computer software needed to produce the checks." He also said that "it’s demeaning to ask career professionals in places like IRS to devote their time and attention to promoting the president’s reelection."

Can You Call the IRS About Stimulus Checks?

At the bottom of the stimulus check letter, below President Trump's signature, a phone number is listed if you want to get more information about your Economic Impact Payment. "Visit irs.gov/coronarivus or call 800-919-9835," the letter says.

However, at least for the time being, you cannot speak to a live person when you call the IRS. Due to staffing reductions related to the coronavirus pandemic, "IRS phone lines supported by customer service representatives for both taxpayers and tax professionals are not staffed at this time," the IRS says.

As of Monday, May 4, if you call the 800-919-9835 Economic Impact Payment information line or the main IRS phone number (800-829-1954), the only assistance available is via automated messages.

If there is a problem with your stimulus check, or you're trying to track your payment or register for a payment, use the IRS portal, which includes the Get My Payment app and the form where non-tax filers can sign up for their checks.

If you think a mistake's been made with your stimulus check, take a look at our stories about what to do if the payment went to the wrong bank, or you were paid the wrong amount.

More From Money:

Will You Get a Second Stimulus Check for Coronavirus?

The IRS's Get My Payment App Is Live So You Can Track Your Stimulus Check